How to get started?

3 simple steps to place your Deposit Plus:

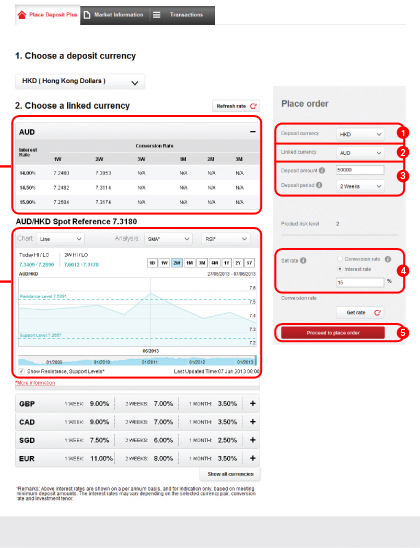

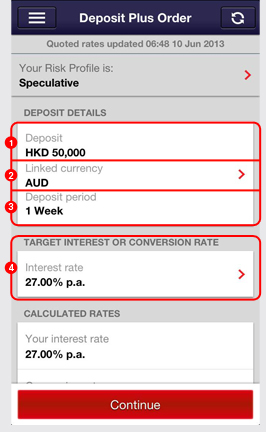

- Choose your

Deposit currency

Linked currency

11 currencies including AUD, CAD, CHF, CNY, EUR, GBP, HKD, JPY, NZD, SGD and USD - Enter deposit amount

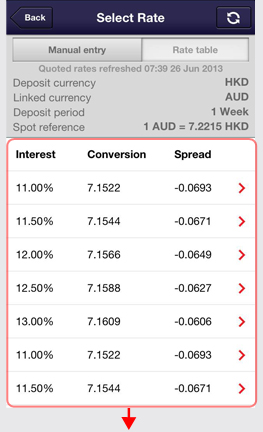

Choose deposit period (1 week to 3 months) - Set your desired conversion rate or interest rate

At maturity4, receive principal and interest in the deposit currency or convert principal and interest to the linked currency at the predetermined conversion rate5

Act now to capture Deposit Plus opportunities

Set up Deposit Plus through HSBC Internet banking and HSBC HK App.

You can also visit any HSBC branch or call 2233 3733.

- Not a time deposit – Deposit Plus is NOT equivalent to, nor should it be treated as a substitute for, time deposit. It is NOT a protected deposit and is NOT protected by the Deposit Protection Scheme in Hong Kong.

- Derivatives risk – Deposit Plus is embedded with FX option(s). Option transactions involve risks, especially when selling an option. Although the premium received from selling an option is fixed, you may sustain a loss well in excess of such premium amount, and your loss could be substantial.

- Limited potential gain – The maximum potential gain is limited to the interest on the deposit.

- Maximum potential loss – Deposit Plus is not principal protected. You must be prepared to incur loss as a result of depreciation in the value of the currency paid (if the deposit is converted to the linked currency at maturity). Such loss may offset the interest earned on the deposit and may even result in losses in the principal amount of the deposit.

- Not the same as buying the linked currency – Investing in Deposit Plus is not the same as buying the linked currency directly.

- Market risk – The net return of Deposit Plus will depend upon the exchange rate of the deposit currency against the linked currency prevailing at the deposit fixing time on the deposit fixing date. Movements in exchange rates can be unpredictable, sudden and drastic, and affected by complex political and economic factors.

- Liquidity risk – Deposit Plus is designed to be held until maturity. You do not have a right to request early termination of this product before maturity. Under special circumstances, the Bank has the right to accept your early redemption request at its sole discretion and on a case by case basis. The Bank will provide an indication of the redemption price upon such request. Your return upon such early redemption will likely be lower than that if the deposit were held until maturity and may be negative.

- Credit risk of the Bank – Deposit Plus is not secured by any collateral. When you invest in this product, you will be relying on the Bank's creditworthiness. If the Bank becomes insolvent or defaults on its obligations under this product, you can only claim as an unsecured creditor of the Bank. In the worst case, you could suffer a total loss of your deposit amount.

- Currency risk – If the deposit currency and/or linked currency is not your home currency, and you choose to convert it back to your home currency upon maturity, you may make a gain or loss due to exchange rate fluctuations.

- Risks relating to RMB - You should note that the value of RMB against other foreign currencies fluctuates and will be affected by, amongst other things, the PRC government's control (for example, the PRC government regulates conversion between RMB and foreign currencies), which may adversely affect your return under this product. The value of your investment will be subject to the risk of exchange rate fluctuation. In case you receive RMB as Linked Currency at maturity and you choose to convert your maturity proceed to other currencies, you may suffer loss in principal. This product will be denominated (if Deposit Currency being RMB) and settled (when receive RMB at maturity) in RMB deliverable in Hong Kong, which is different from that of RMB deliverable in Mainland China.

Investment invoices risks and past performance is not indicative of future performance. The above information is prepared for general information purposes only. It cannot be construed as an offer or recommendation by the bank and HSBC shall not be held liable for damages arising out of any person's reliance upon this information. Any person considering an investment should seek independent advice on the suitability or otherwise of the particular investment. The bank has prepared this document based on information obtained from sources it reasonably believes to be reliable. However, the bank does not warrant, guarantee or represent, expressly or by implication, the accuracy, validity or completeness of such information.

1. The above interest rates are indicative only. They are not guaranteed and are subject to revision as per prevailing market conditions.

2. Currency pairs in this table are ranked in descending order according to transaction volume as recorded by HSBC in Hong Kong during the specified period.

3. Currency conversion only takes place when the linked currency weakens against the deposit currency as compared to the pre-determined conversion rate on the fixing date, and may suffer loss if currency conversion takes place.

4. Determined by the exchange rate on the fixing date

5. May suffer loss if you convert the proceeds to the deposit currency at the spot rate immediately.

6. Customers can trade from Monday 6 am to Saturday 5 am except for system maintenance periods from 9 pm to 9.30pm and 5.20am to 5.35am Monday to Friday and public holidays in Hong Kong.

7. Currency choices include AUD, CAD, CHF, CNY, EUR, GBP, HKD, JPY, NZD, SGD and USD.

This document does not constitute an offer for the purchase or sale of any investment products. You should carefully consider whether any investment products or services mentioned herein are appropriate for you in view of your investment experience, objectives, financial resources and circumstances.