Exchange currency via Online and Mobile Banking and earn multiple currency exchange rewards

Looking to streamline your currency exchange experience while delighting in an array of rewards? Look no further than HSBC's user-friendly mobile and online currency exchange service anytime on the go, with a series of offers and convenient services for new currency exchange customers. You can enjoy unlimited instant spread discounts of up to 30% after enrolling to 'HSBC Forex Club'. The discount can be enjoyed together with the cash rewards! More convenient services including our Order Watch, Mastercard® Debit Card and Global Transfers services are tailored to your needs to support you all the way! Offers valid until 31 July 2024.

Remark: A new currency exchange customer is a customer who has not made any currency exchange transactions with HSBC from 1 October 2023 to 31 March 2024.

Offer 1: Up to a HKD388 cash reward1

New currency exchange customers can enjoy a HKD100 cash reward for every HKD50,000 (or its equivalent in other currencies) of currency exchange transactions you accumulate, up to HKD300 during the promotion period!

Earn an extra HKD88 cash reward when you join HSBC Forex Club and accumulate a currency exchange amount of HKD50,000, through the HSBC Online and Mobile Banking during the promotion period.

Offer 2: HSBC Forex Club - Enrol now to enjoy unlimited instant discounts on currency exchange spreads of up to 30% off

With the HSBC Forex Club, you can enjoy greater currency exchange spread discounts for all your currency exchange transactions. These include transactions from your account to your self-named HSBC accounts or a third party's personal HSBC accounts in Hong Kong. Achieve benefits based on your accumulated amount of:

1) completed currency exchange transactions over the past 90 days and the current day, and

2) any currency exchange transactions you’re currently making, in all applicable channels^

| Tier | Accumulated eligible transaction amount (HKD#) | Spread Discount |

|---|---|---|

| Green | Below 200,000 | |

Bronze |

200,000 – below 1,000,000 | 5% |

| Silver | 1,000,000 – below 3,000,000 | 10% |

| Gold | 3,000,000 – below 5,000,000 | 15% |

| Platinum | 5,000,000 and above | 30% |

| Tier | Green |

|---|---|

| Accumulated eligible transaction amount (HKD#) | Below 200,000 |

| Spread Discount | |

| Tier |

Bronze |

| Accumulated eligible transaction amount (HKD#) | 200,000 – below 1,000,000 |

| Spread Discount | 5% |

| Tier | Silver |

| Accumulated eligible transaction amount (HKD#) | 1,000,000 – below 3,000,000 |

| Spread Discount | 10% |

| Tier | Gold |

| Accumulated eligible transaction amount (HKD#) | 3,000,000 – below 5,000,000 |

| Spread Discount | 15% |

| Tier | Platinum |

| Accumulated eligible transaction amount (HKD#) | 5,000,000 and above |

| Spread Discount | 30% |

^Transactions via HSBC Online and Mobile Banking / any HSBC branches. Other services and channels, for example, FX Order Watch and transfers overseas, will be excluded unless specified. For details, please refer to terms and conditions.

#HKD or its equivalent in other currencies.

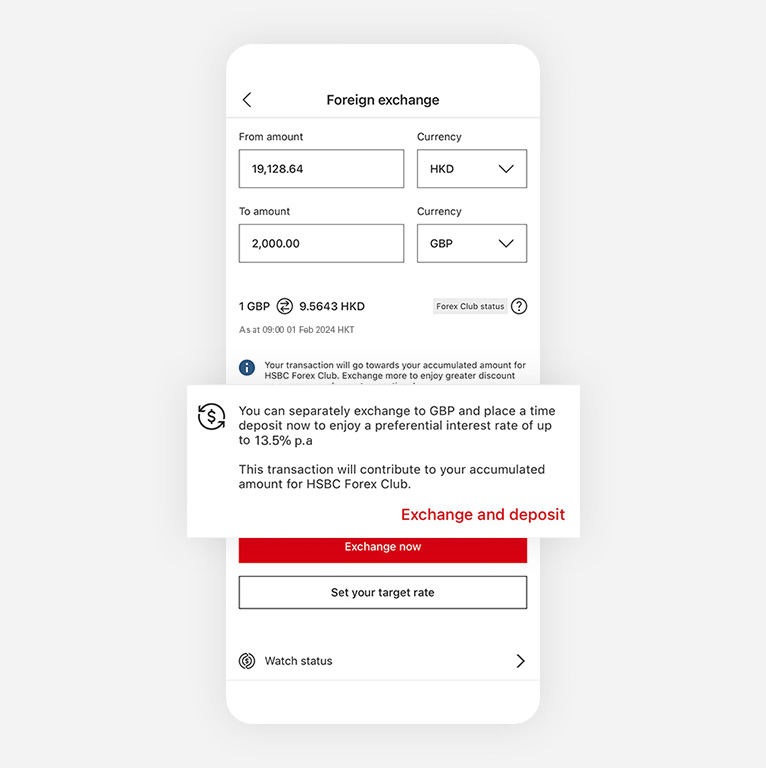

Offer 3: Enjoy a preferential time deposit rate of up to 13.5% p.a.

You can get a bonus rate of +1% p.a. on top of our preferential time deposit rates after currency exchange. This can give you a total time deposit rate of up to 13.5% p.a.2 when you exchange funds in any of the designated currencies and place a 1-week time deposit via the HSBC HK App.

The above interest rates are indicative as of 29 January 2024 and are for reference only. They are not guaranteed and maybe subject to revision, as per prevailing market conditions.

No new funds are required. Click here for more details.

Screen displays and images above are for reference and illustrative purposes only.

Got your currency ready for your next trip? HSBC Mastercard® Debit Card build around 12 major currencies, lets you shop online, make purchase, and withdraw cash at HSBC Group ATMs around the world easier , with zero fees3.

Log on to your HSBC Online and Mobile Banking for an even smoother, faster currency exchange experience and enjoy multiple currency exchange rewards4!

Terms and conditions apply. Offer 3 is applicable to transactions made via the HSBC HK App only.

Remarks

- Exchange transactions involving note exchange, cash deposit, note withdrawal, inward/outward remittance, HSBC Global Transfers, FX Order Watch and Deposit Plus do not constitute Eligible Currency Exchange Transactions and, hence, do not qualify for the cash reward. Any currency exchange occurring within the setting-up of a time deposit does not constitute an Eligible Currency Exchange Transaction.

- The deposit amount should not be less than HKD10,000, RMB10,000, or 2,000 units in other currencies. Each eligible customer can enjoy the offer more than once. This offer is available during Monday to Friday, 08:00 to 19:00 HKT only (excluding public holidays in Hong Kong SAR or time deposit currency regions).

- The above offer of zero charges on overseas withdrawals applies to HSBC Group ATMs worldwide. For details, please visit HSBC HK website > Choose "Banking" > Under "Debit Cards" > Select "Mastercard® Debit Card".

- Please note that:

- Offer 3 cannot be used in conjunction with Offer 1 ;

- Offer 1 can be used in conjunction with Offer 2 HSBC Forex Club Offer;

- Offer 3 cannot be used in conjunction with Offer 2 HSBC Forex Club's spread discount. Currency exchange transactions made through the Foreign Exchange & Time Deposit offer only count towards the accumulated amount for HSBC Forex Club.

Campaign ID: Y24-A0-SGEN01

Note

- Apple, the Apple logo, iPhone, iPad, Touch ID and Face ID are trademarks of Apple Inc., registered in the US and other countries. App Store is a service mark of Apple Inc.

- Google Play and the Google Play logo are trademarks of Google LLC. Android is a trademark of Google LLC.

Risk disclosure

Currency conversion risk - the value of your foreign currency and RMB deposits will be subject to the risk of exchange rate fluctuation. If you choose to convert your foreign currency and RMB deposits to other currencies at an exchange rate that is less favourable than the exchange rate at which you made your original conversion to that foreign currency and RMB, you may suffer a loss in the value of your principal.