$0 commission at Hong Kong's best broker1

HSBC Trade25 is designed especially for the next generation of stock traders aged 18-25. For just HKD25 a month, join and you'll get:

- $0 commission on HK, US and China A shares

- $0 platform fees

- Free access to our Trade25 Academy to level up your stock trading knowledge

Join HSBC Trade25 on your HSBC HK Easy Invest app.

Just the price of one bubble tea, that's all you need

HKD25 per month

You will only be charged this monthly fee when you trade or hold stocks with us.

$0 commission

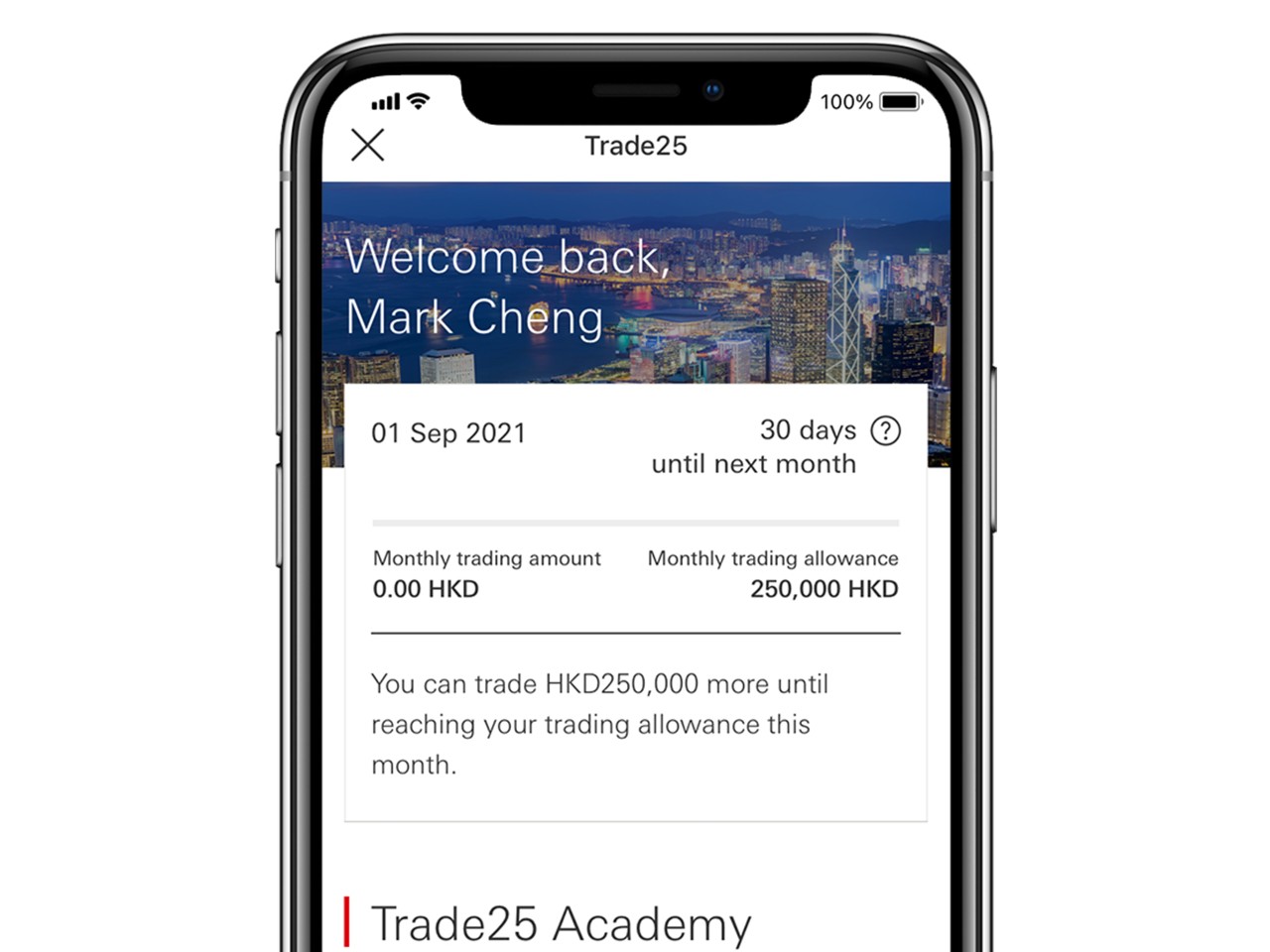

Trade stocks commission-free on up to HKD250,000 monthly trading turnover. No hidden platform fees.

Trade25 Academy

Explore our exclusive Trade25 Academy and get to know your way around stock trading.

| Monthly trading turnover |

Monthly fee2 |

Commission fees for HK stocks |

Commission fees for US stocks |

Commission fees for China A shares |

|---|---|---|---|---|

| Less than HKD250,000 |

HKD25 |

HKD0 |

USD0 |

RMB0 |

| HKD250,000 or above |

HKD25 |

0.25% brokerage fee min HKD100 |

USD18 for first 1,000 share USD18 + USD0.015 per share (above 1,000 shares) |

0.25% brokerage fee min RMB100 |

| Monthly trading turnover |

Less than HKD250,000 |

|---|---|

| Monthly fee2 |

HKD25 |

| Commission fees for HK stocks |

HKD0 |

| Commission fees for US stocks |

USD0 |

| Commission fees for China A shares |

RMB0 |

| Monthly trading turnover |

HKD250,000 or above |

| Monthly fee2 |

HKD25 |

| Commission fees for HK stocks |

0.25% brokerage fee min HKD100 |

| Commission fees for US stocks |

USD18 for first 1,000 share USD18 + USD0.015 per share (above 1,000 shares) |

| Commission fees for China A shares |

0.25% brokerage fee min RMB100 |

You won't be charged HKD25 if you do not trade or hold stocks with us in the respective month.

Brokerage fees are applied based on the latest monthly trading amount at the time of execution. Please take a look at out HSBC Trade25 conditons and our product factsheets at <https://www.hsbc.com.hk/en-hk/investments/products/stocks/trade25/>

Lower trading costs than other Hong Kong brokers

Trade25 offers $0 commission stock trading, with none of the hidden fees that many other brokers charge. Even if you make multiple trades within the month, all you pay is HKD25 as long as your monthly trading turnover does not exceed HKD250,000. However, please note other regulatory fees apply2 as well.

Breaking it down

| HSBC Trade25 | Broker 1 | Broker 2 |

|---|---|---|

|

|

|

| HSBC Trade25 |

|

|---|---|

| Broker 1 |

|

| Broker 2 |

|

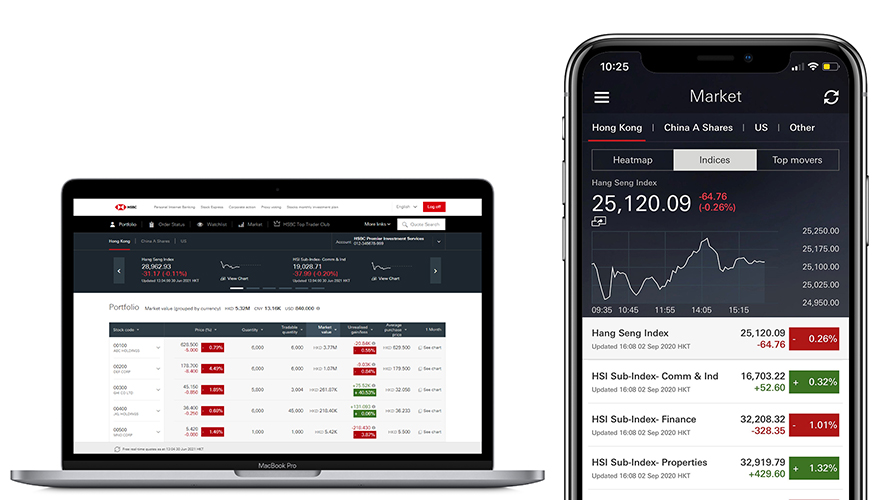

Trade anywhere you go with our dynamic stock trading platform

- Place an order directly from the bid/ask queue or interactive chart

- Receive push notifications when important events happen in the market or to stocks in your portfolio

- Read trend-spotting indicators such as Moving Average Convergence / Divergence (MACD) and Relative Strength Index (RSI)

- Subscribe to an IPO with $0 handling fee

Start trading with $0 commission fees in just 3 simple steps

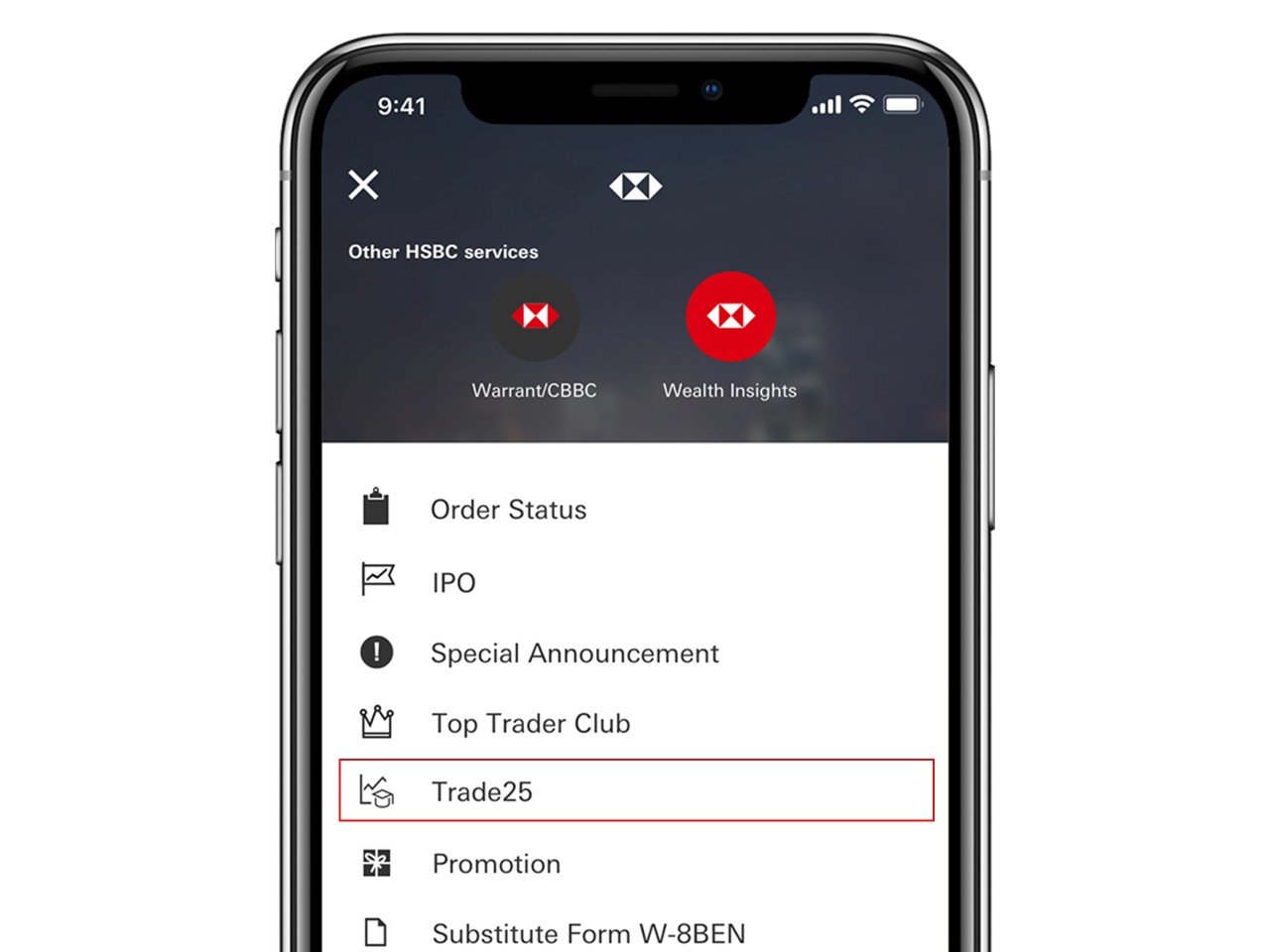

If you're 18 to 25 years old and already have an HSBC investment account, you can sign up for HSBC Trade25 in a matter of minutes:

- Download the HSBC HK Easy Invest app

- Open the app, select 'Menu' and then tap on 'Trade25' to apply

- That's it! Start trading right away, commission free

Open your investment account in just 6 steps:

- Log on to mobile banking and open the 'Investment' tab

- Choose 'Check my eligibility' to see if you can open an account

- Review your details and choose a settlement account to fund your investments

- Submit a valid proof of address, and a consent form if needed

- Take our short questionnaire to determine your financial knowledge

- Review our terms and conditions then submit your application

Got a question about HSBC Trade25? Read our FAQs for more details

Additional information

1 Finance Asia awarded HSBC as "HK Best Broker" in 2019

- HSBC won top prize for Securities Company of the Year at the Bloomberg Businessweek - Financial Institution Awards 2020.

- HSBC won top prize for Brokerage Service at the Bloomberg Businessweek - Financial Institution Awards 2020 and 2021 for two consecutive years.