1: Can I still log on and authenticate the same way as before?

Unfortunately you may not. Rest assured the changes are to enhance security, so you will need to log on and authenticate using these new instructions on HSBC Online and Mobile Banking.

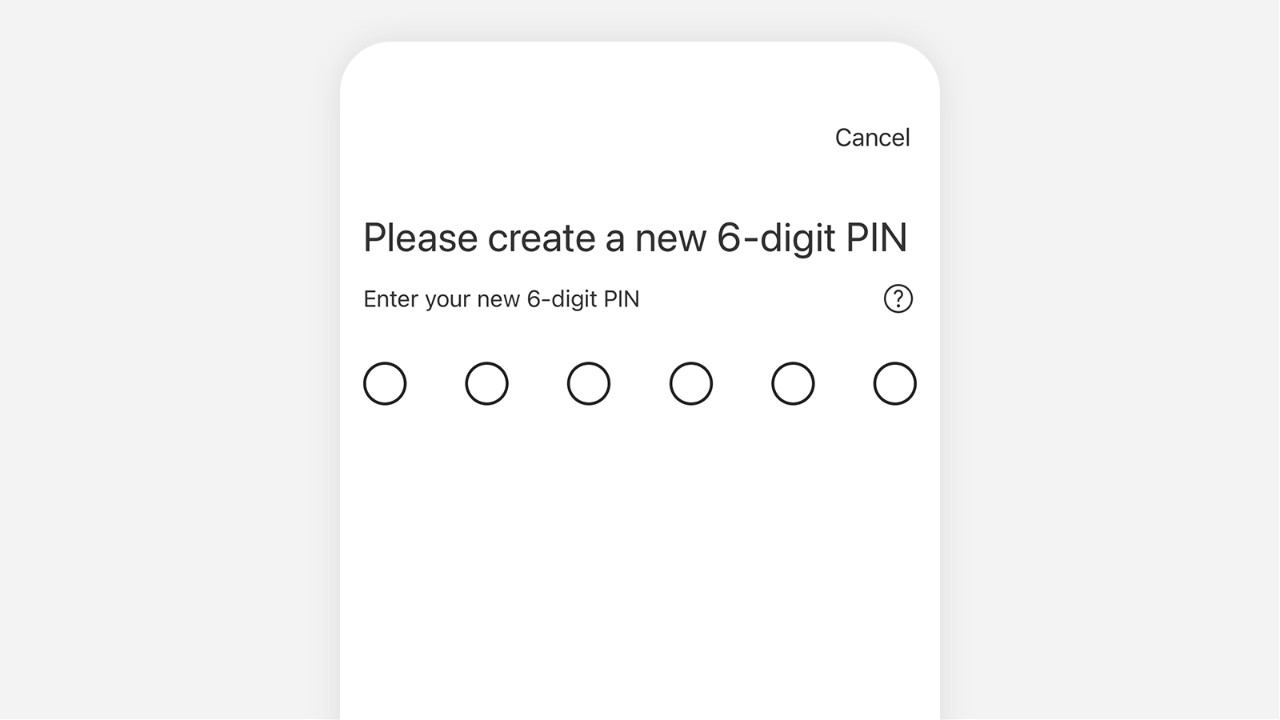

2: What is the format for Mobile Banking PIN for HSBC HK App?

Your Mobile Banking PIN should comprise 6 digits arranged in a unique combination only known to you.

Do update it regularly to protect your bank account.

Your PIN should not include:

- the same number more than once in a row, e.g. 000

- more than three ascending or descending digits, e.g. 1234

- repeating patterns, e.g. 010101

- your birthday or any other significant dates (like anniversaries)

- the same digits in your passcode used to unlock your mobile device

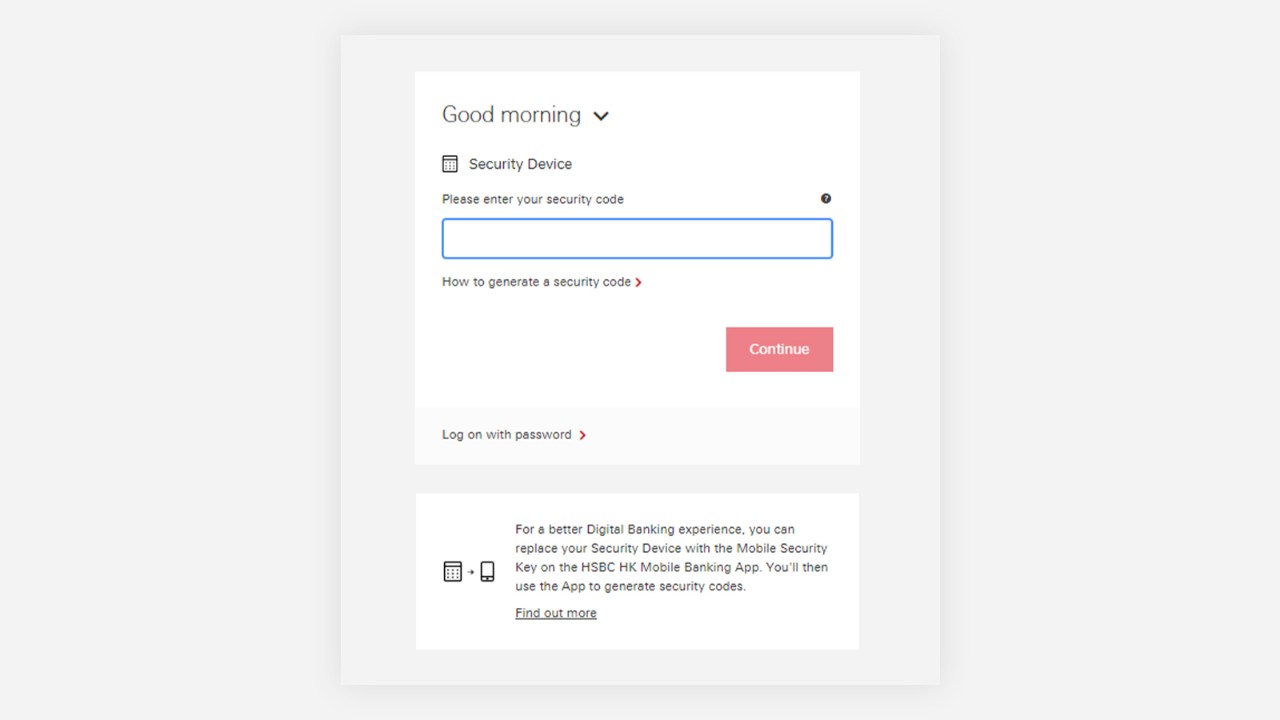

3: Can I continue using my physical Security Device while using the HSBC HK App?

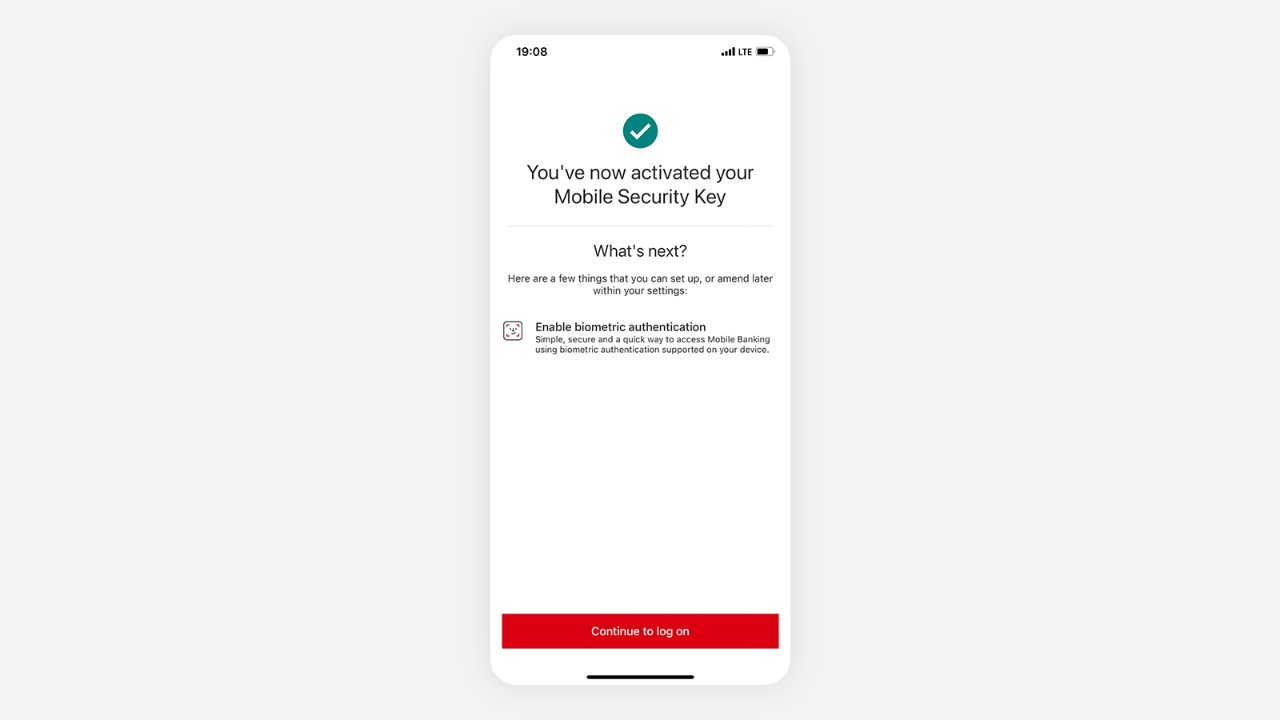

No. You are required to activate Mobile Security Key (by setting up a Mobile Banking PIN) to continue using HSBC HK App. Your physical Security Device will be deactivated once you activate Mobile Security Key.

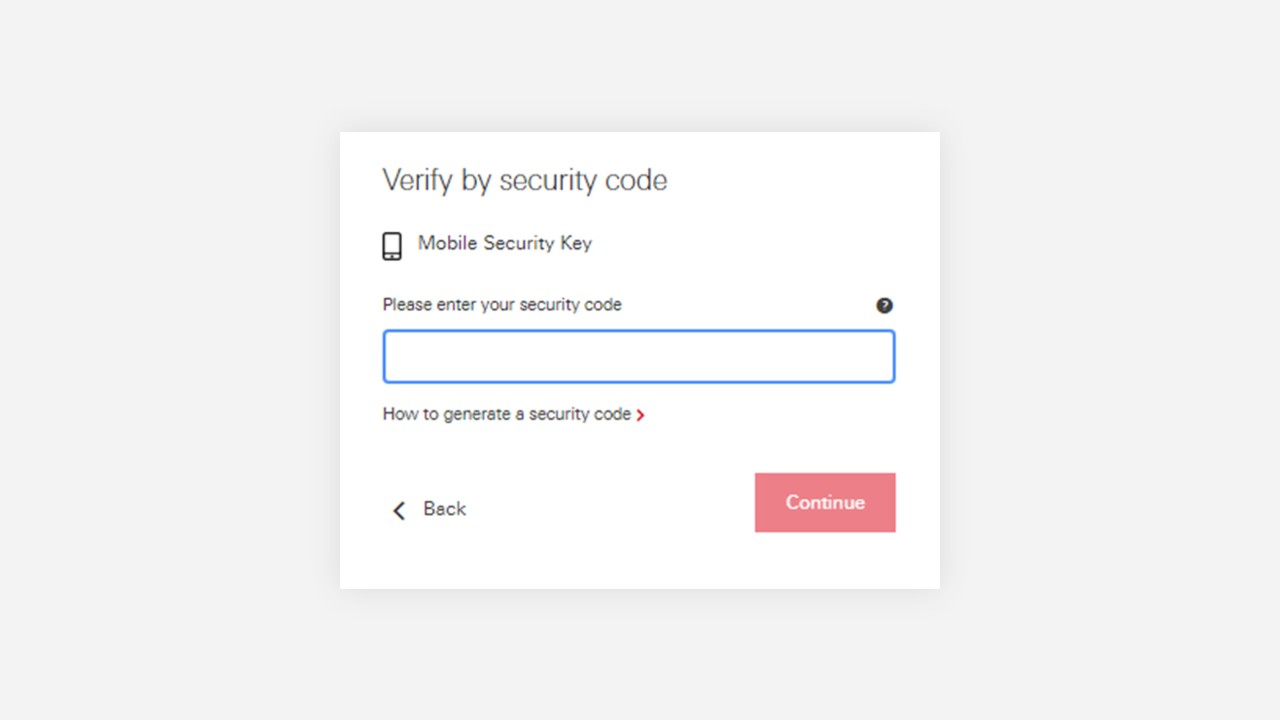

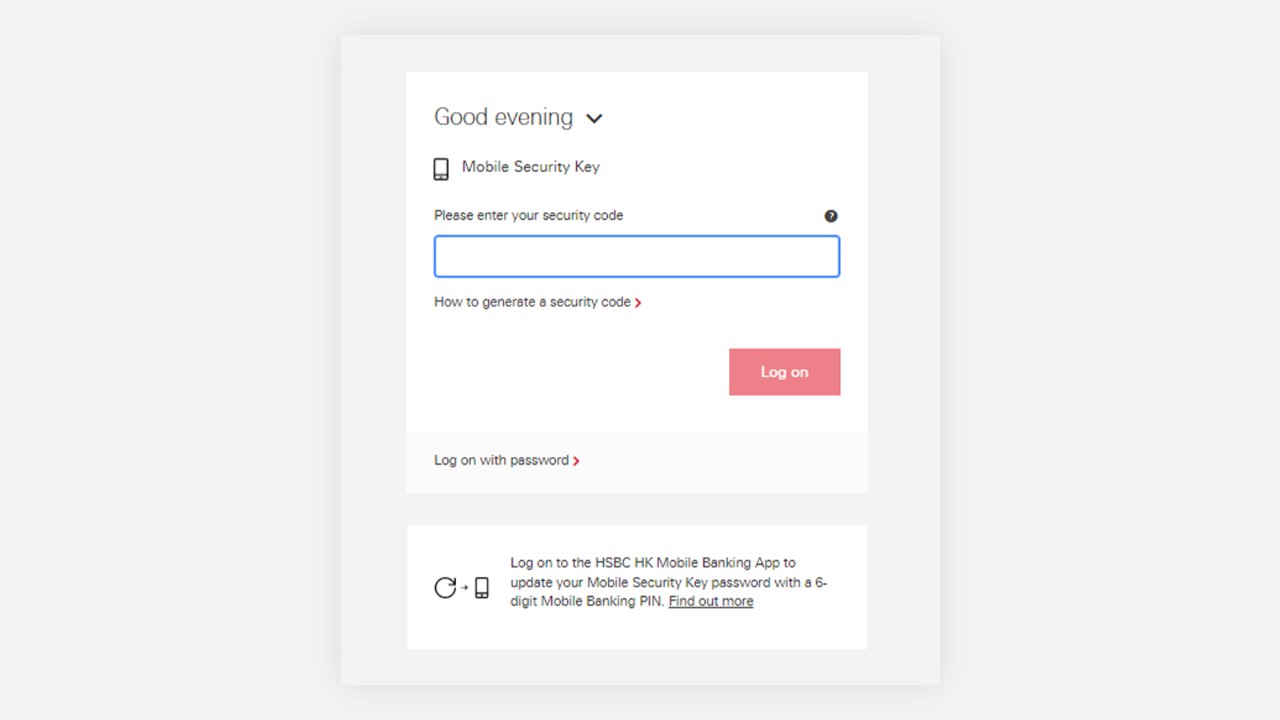

4: I don't use Mobile Security Key. Can I still log on to HSBC Online Banking and the HSBC HK App?

You will not be able to log on to the HSBC HK App without Mobile Security Key.

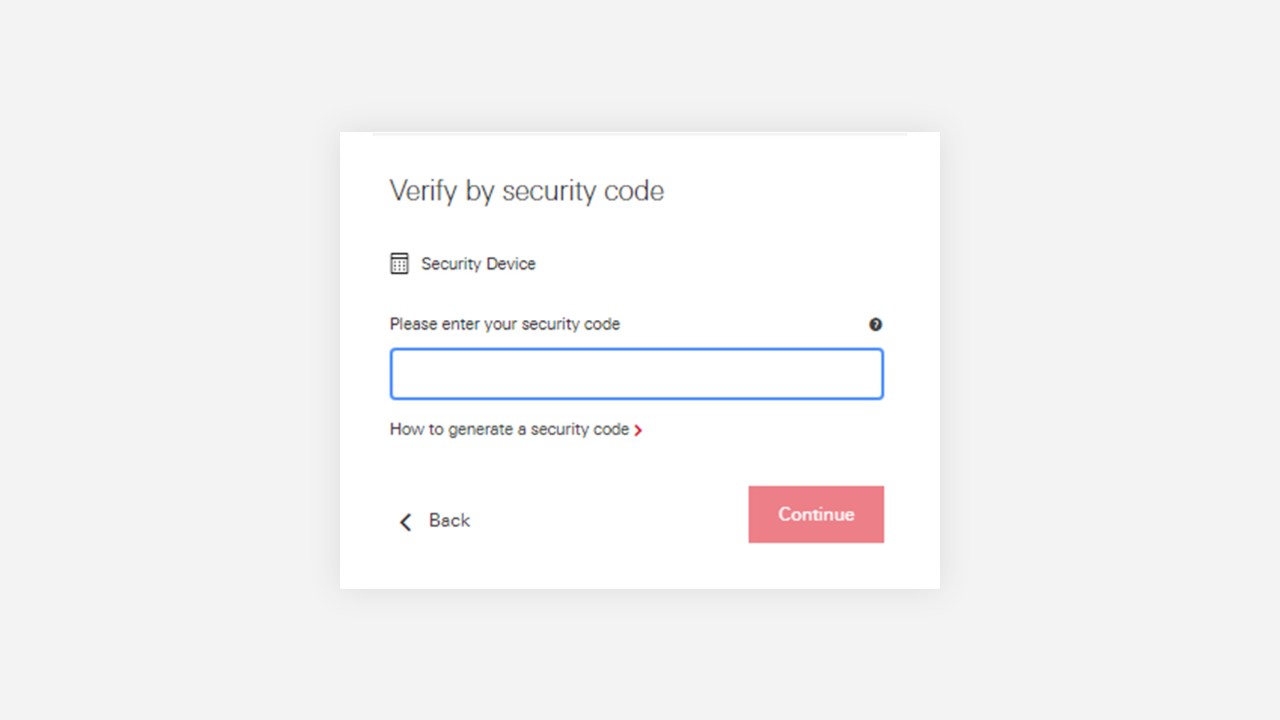

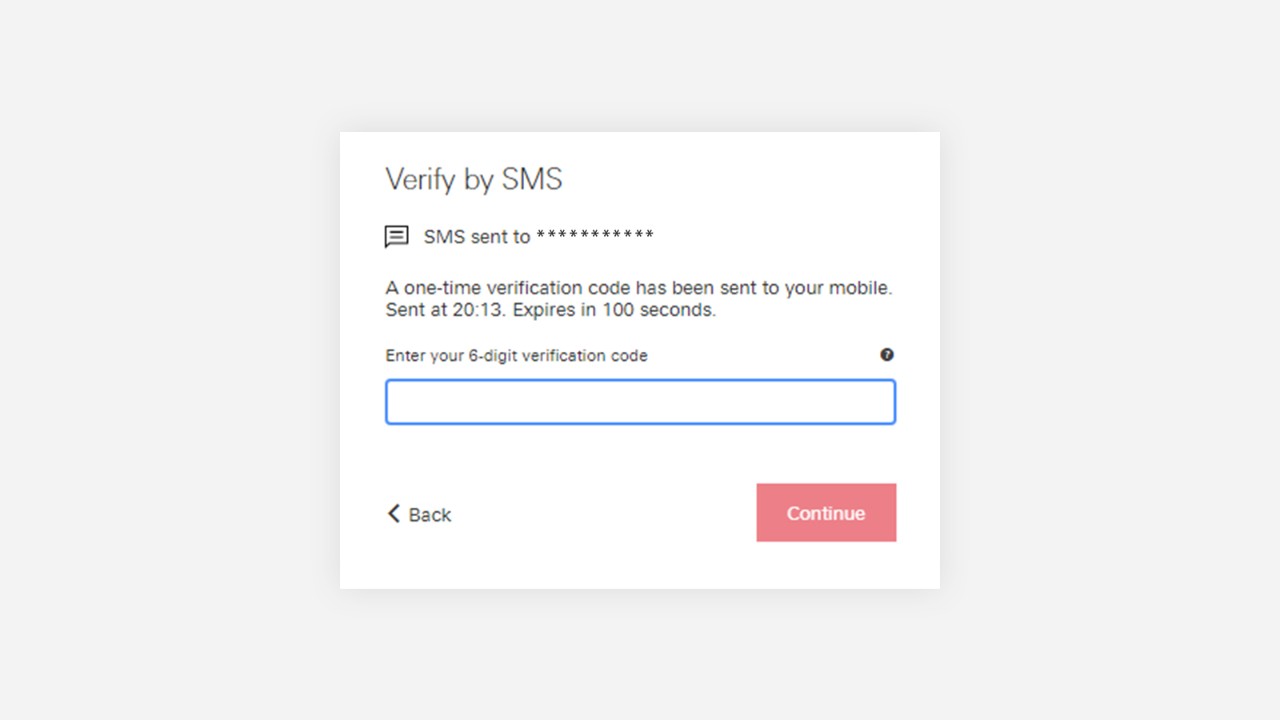

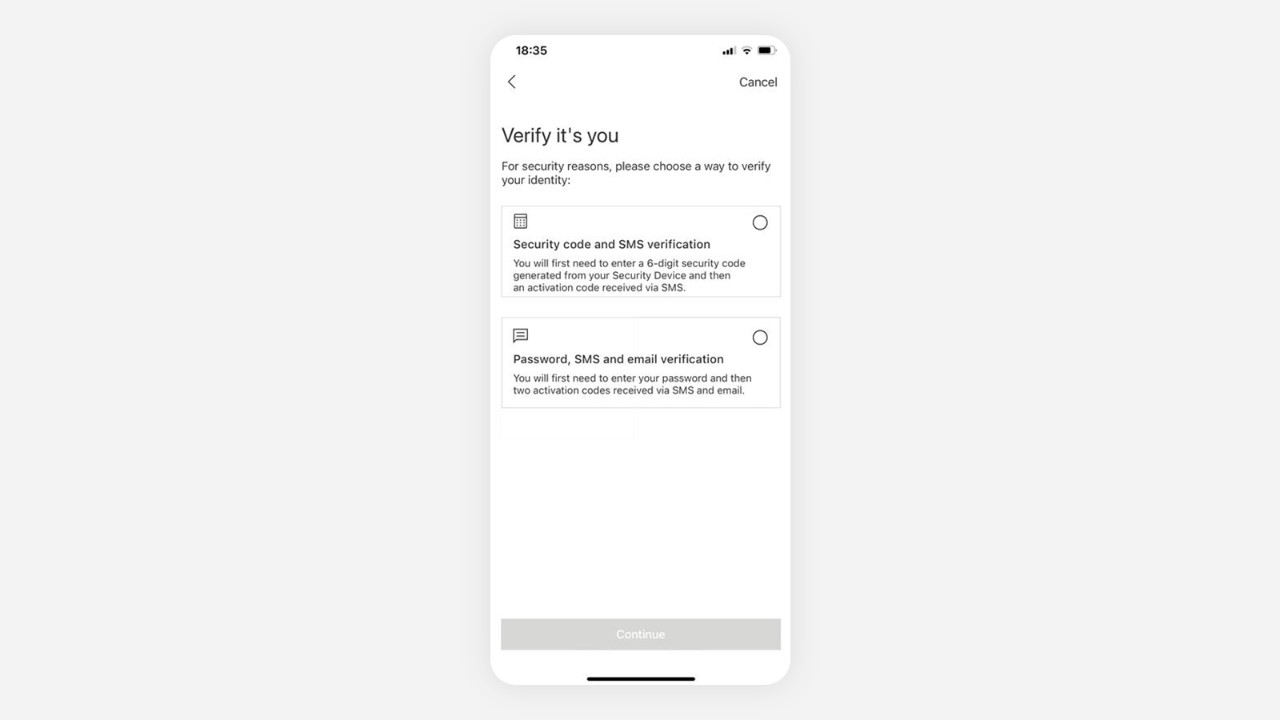

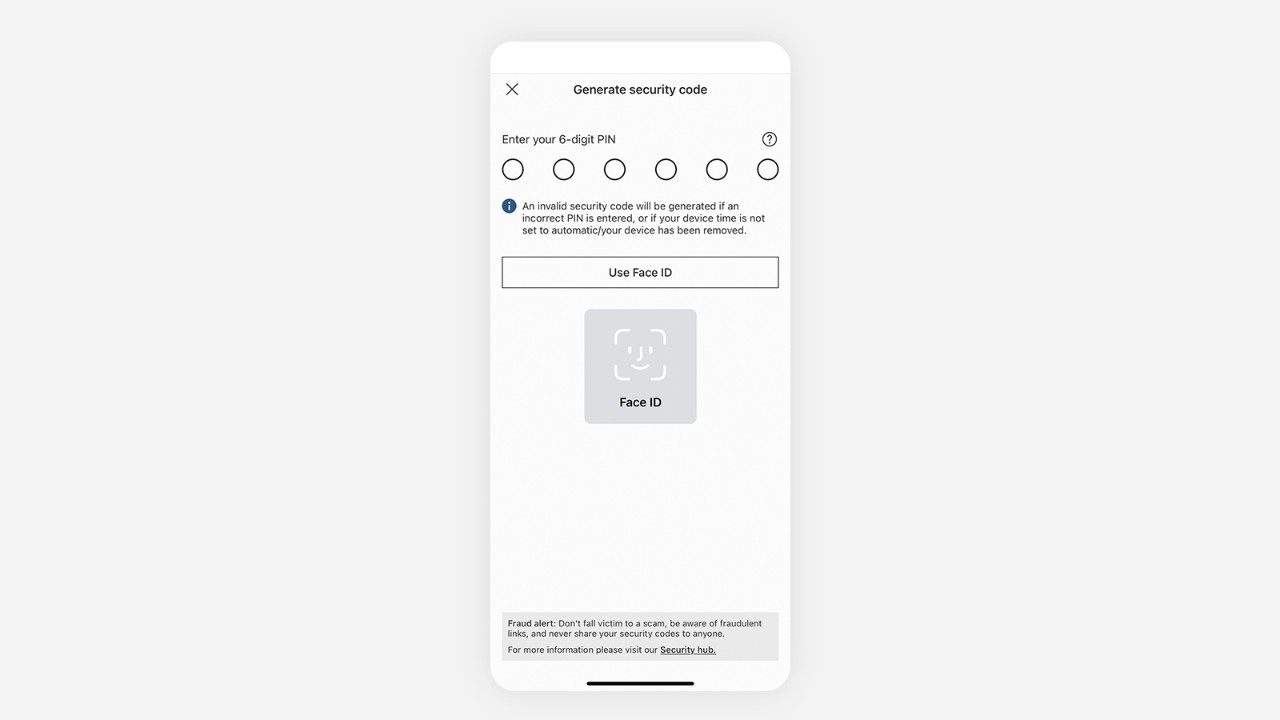

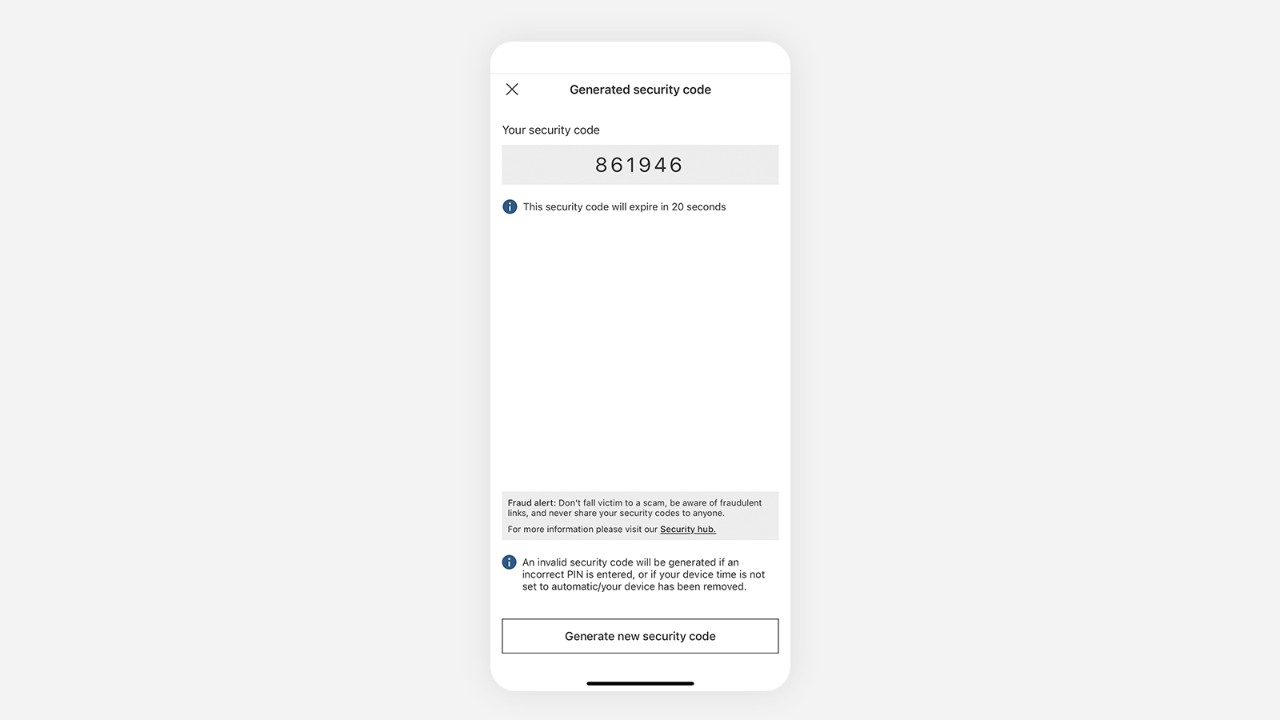

You can still log on to HSBC Online Banking using your Personal Internet Banking username and password. You'll need to generate a security code from your Mobile Security Key or physical Security Device. Or complete SMS verification the first time you log on to HSBC Online Banking after we have enhanced your log on journey.

5: Why do I need to create a new Mobile Banking PIN? Is this secure?

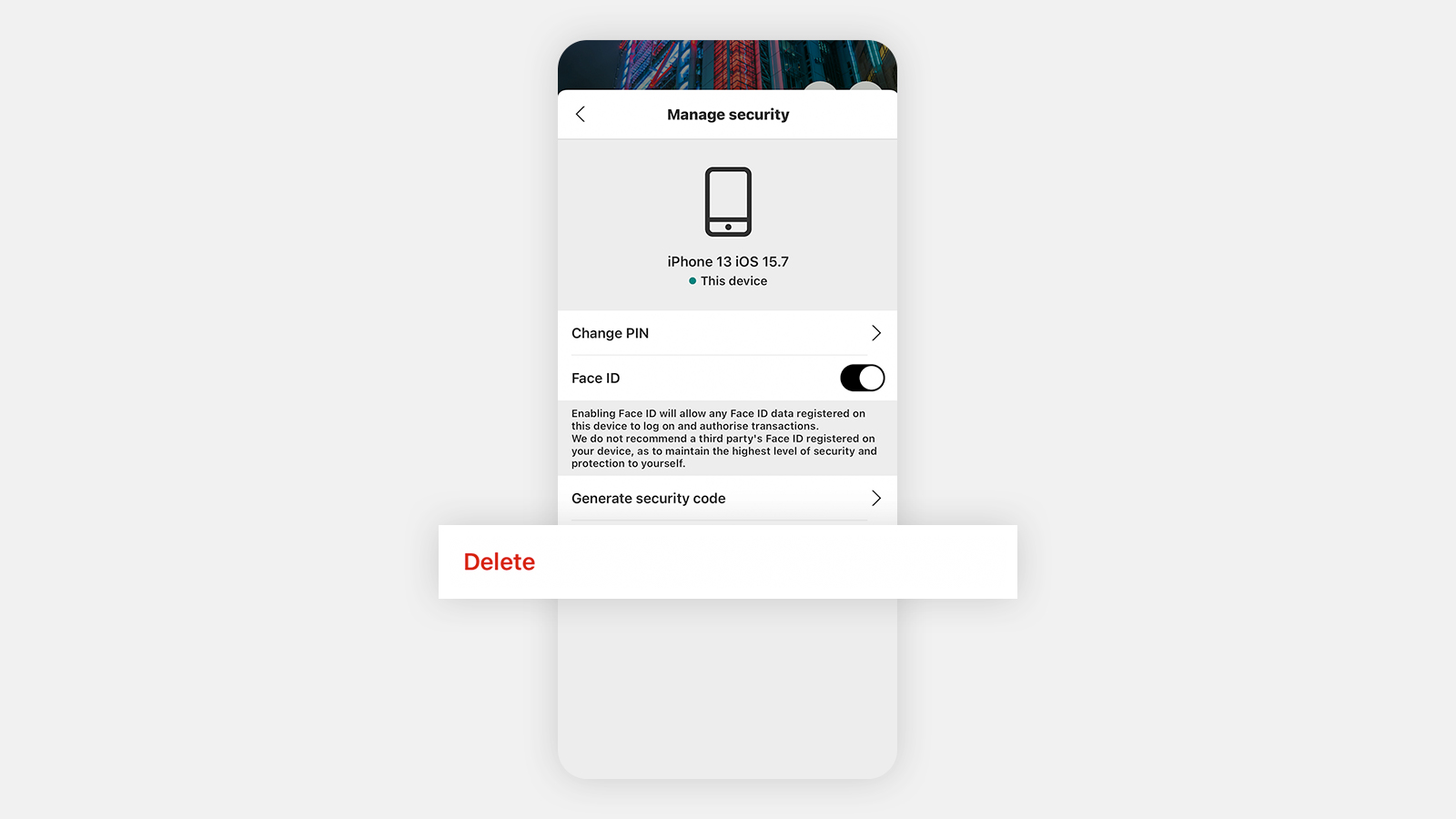

This is part of our enhanced security feature which will give you a single log on solution across HSBC HK App, HSBC Easy Invest and HSBC HK Reward+ apps. The 6-digit Mobile Banking PIN replaces your existing Mobile Security Key password. To log on the HSBC HK App, all you need to do is input your Mobile Banking PIN or use biometric authentication (if enabled).

You can follow our tips in Question 2 to ensure your Mobile Security PIN setup is secure. Keeping your money and personal data safe online is a top priority for us. Our enhanced security features and patches continue to protect you, our website and applications from malicious software and fraud.

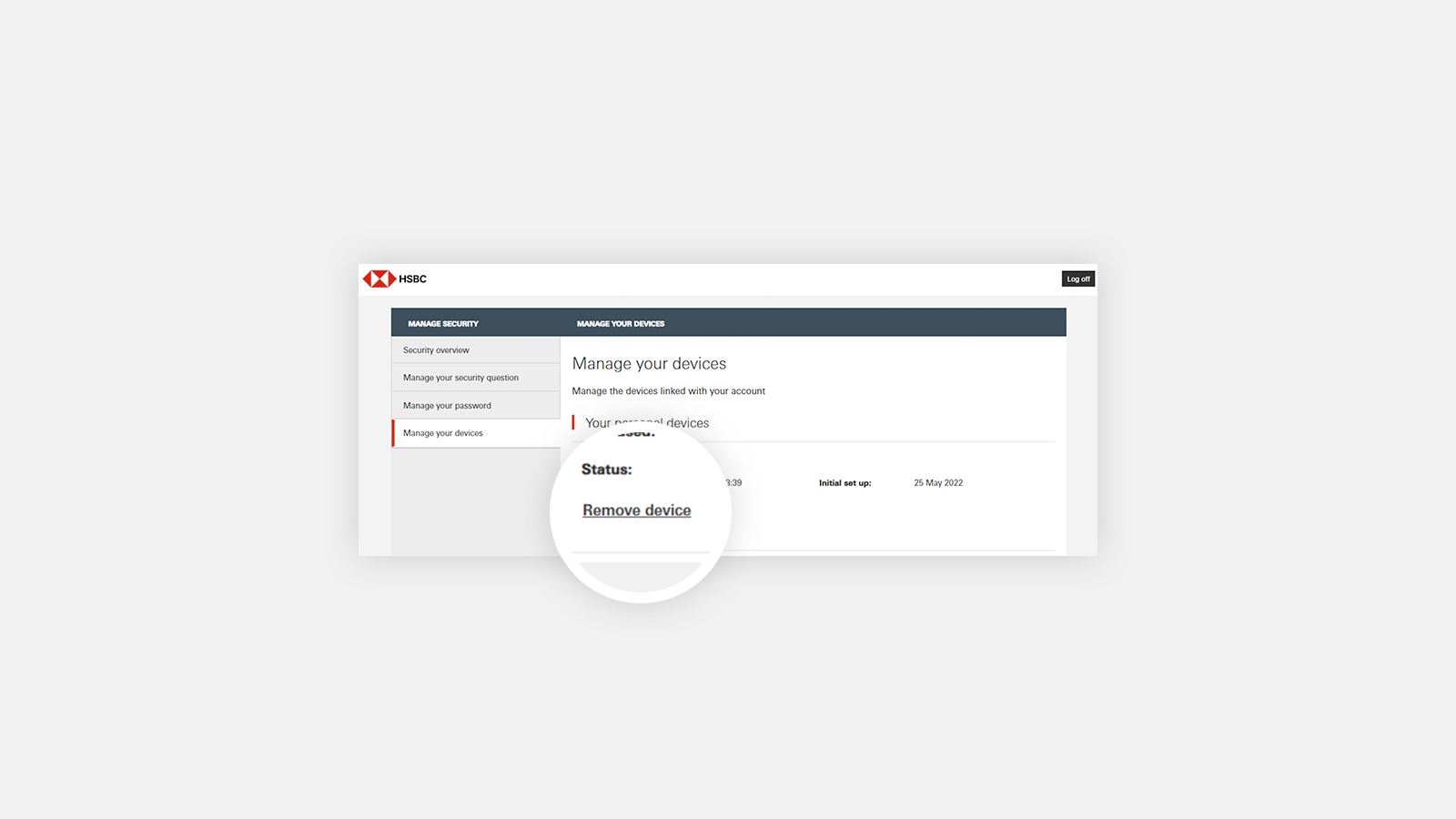

6: Can I activate Mobile Security Key on more than one device?

No, you can only activate Mobile Security Key on one mobile device.

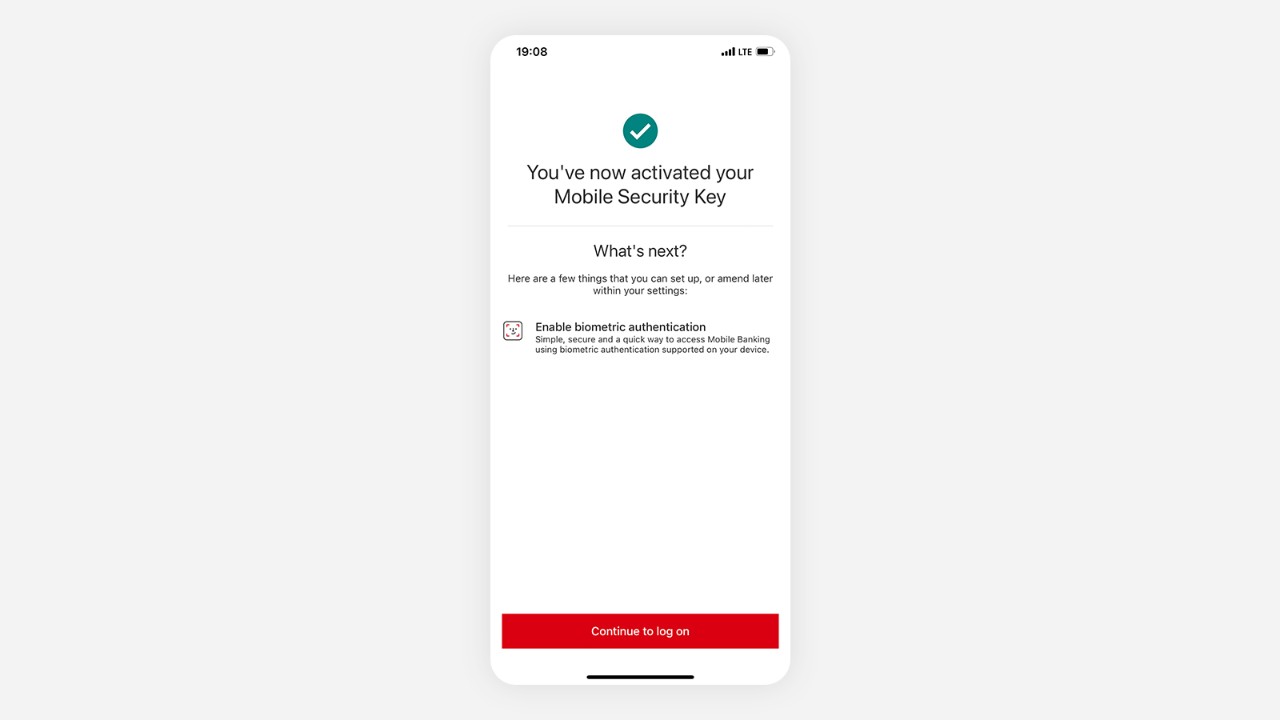

7: How can I activate Mobile Security Key?

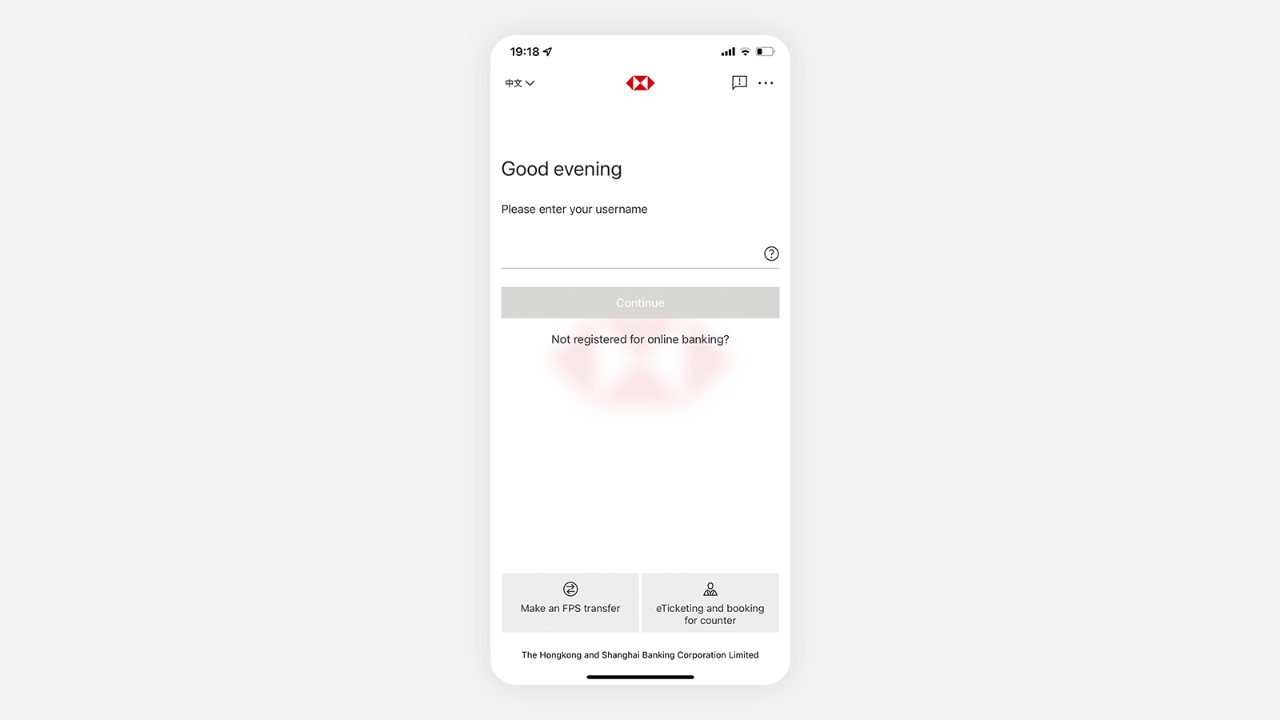

Please download the HSBC HK App and follow the on-screen instructions to activate Mobile Security Key. You may also refer to the quick guides in the ‘What is Mobile Security Key?’ section above for details.

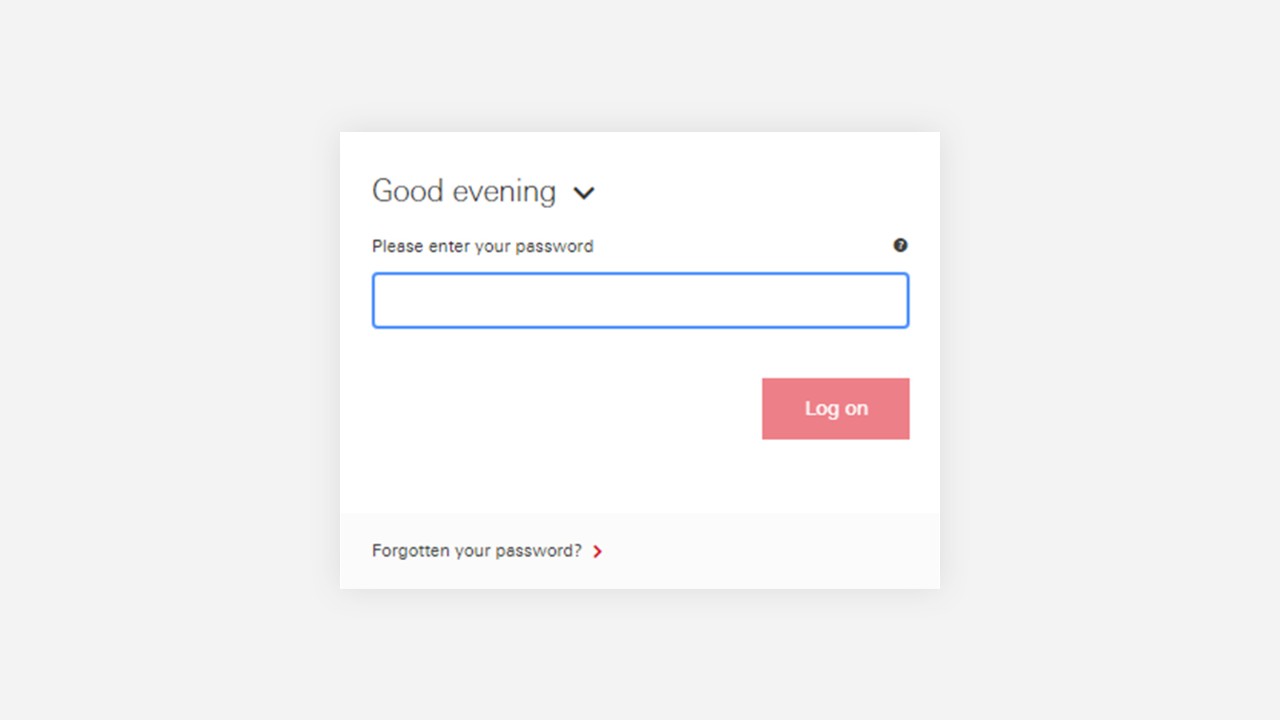

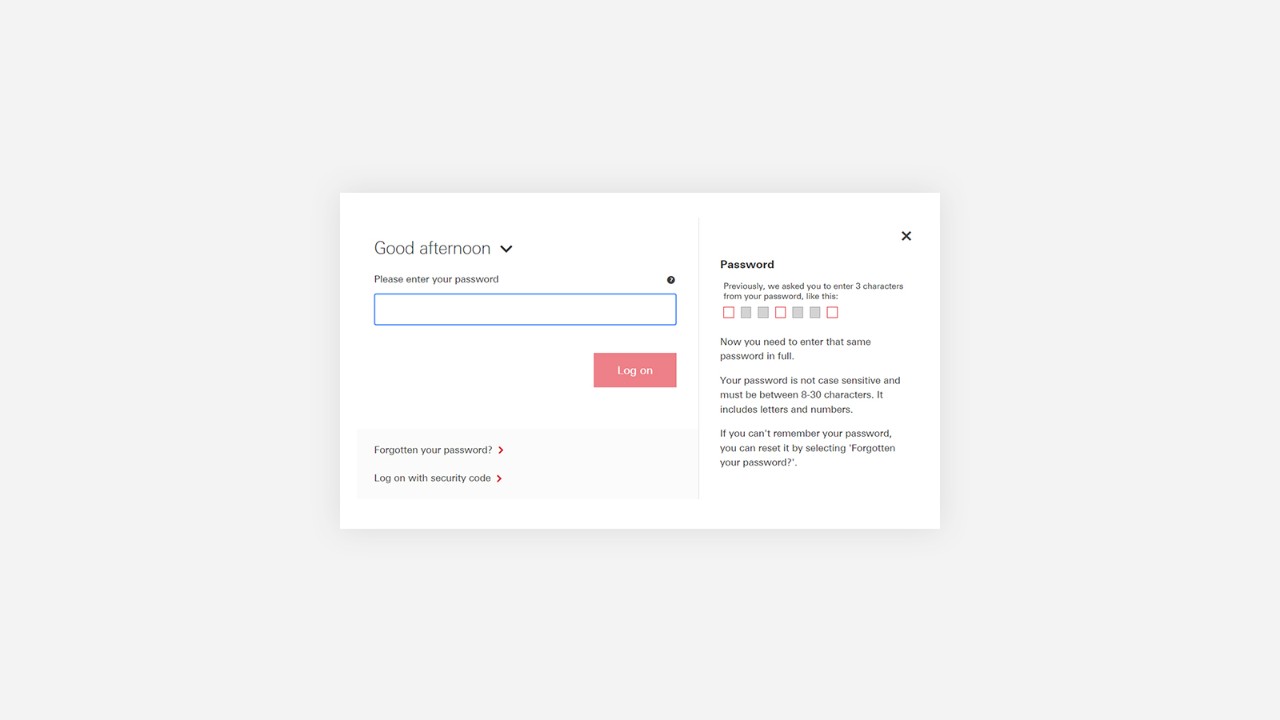

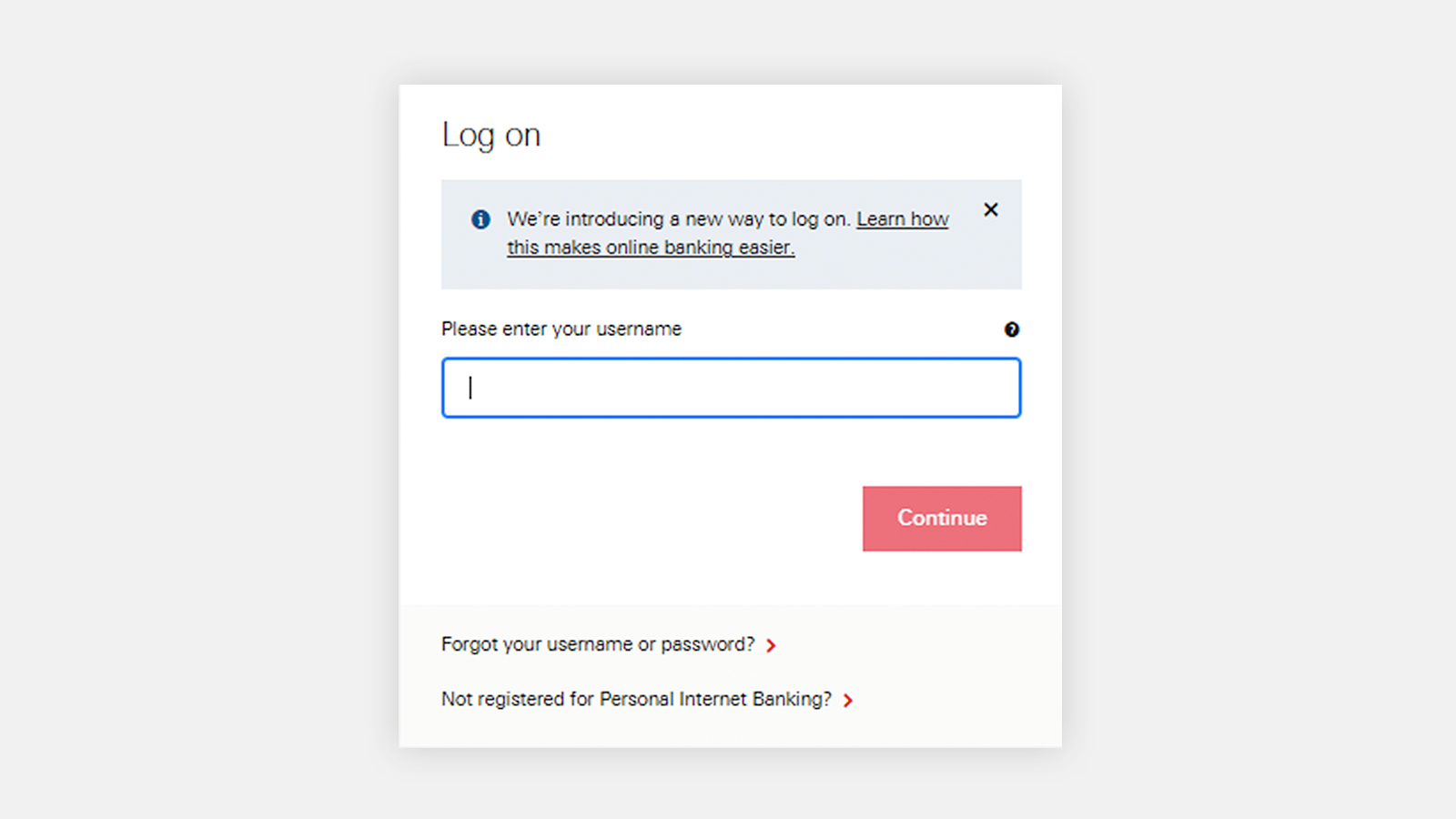

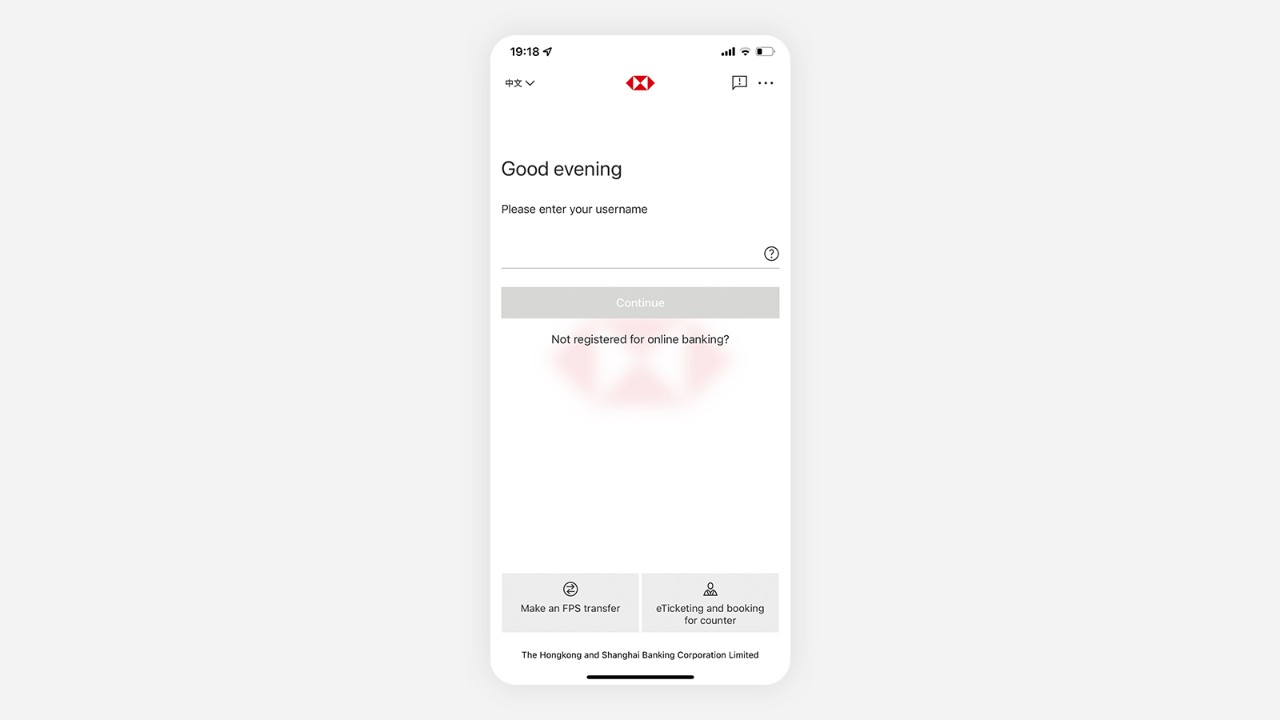

8: Are there any changes to my log on credentials for HSBC Online Banking?

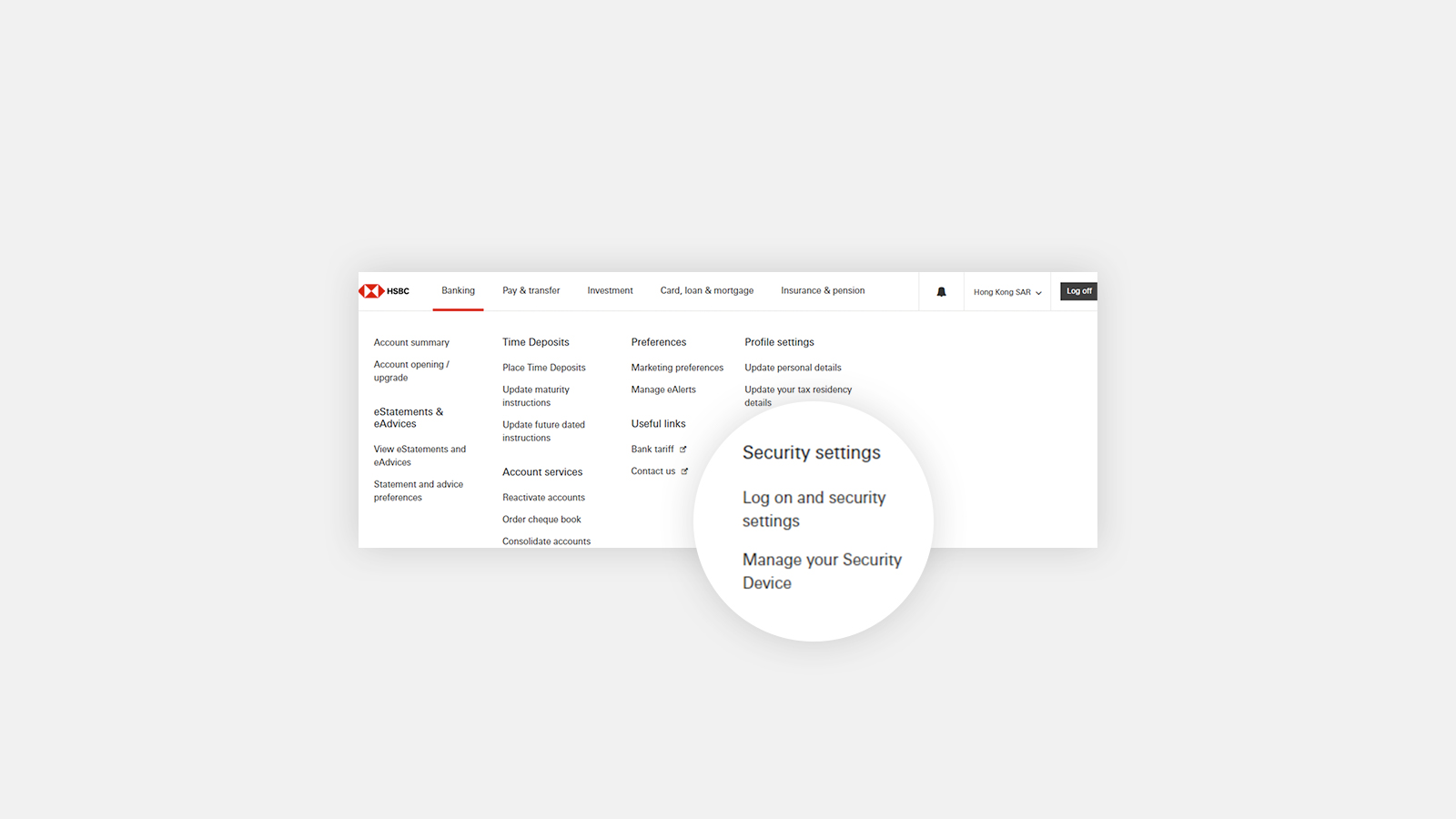

You will no longer need to use your memorable answer to log on to HSBC Online Banking. To access all functions on HSBC Online Banking, log on with your username and security code generated from Mobile Security Key or Security Device. You may also log on with your username and Personal Internet Banking password to access certain functions only.

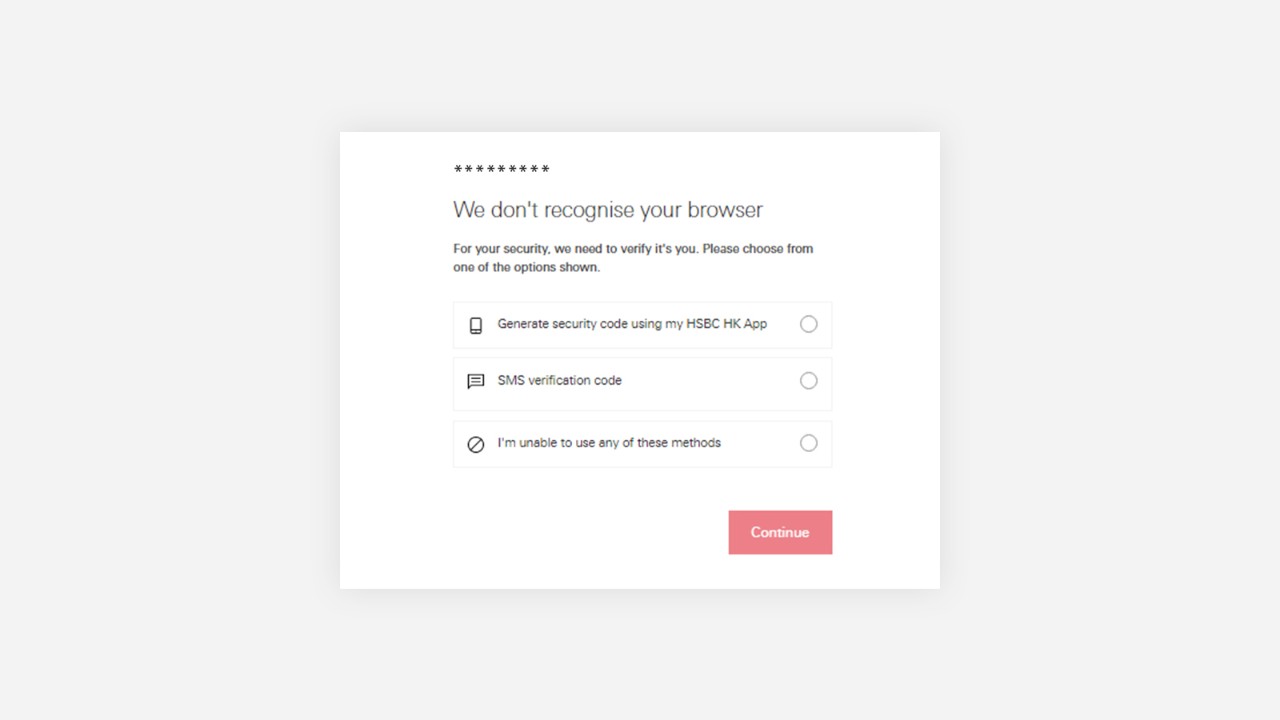

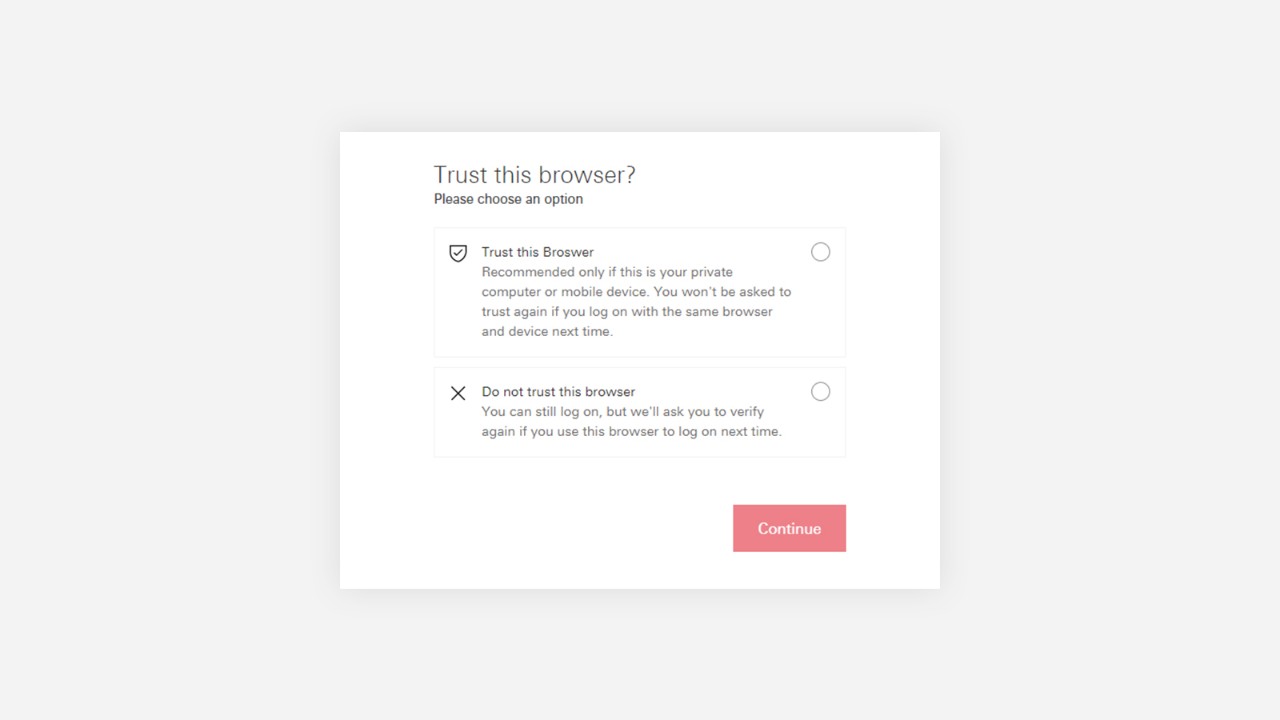

9: Why am I asked to verify my browser when logging on?

This is part of our enhanced security measure to protect our customers from unauthorised access. You will be required to do so only when you log on to HSBC Online Banking on a new or untrusted browser. Once you verify and trust your browser, you will be able to log on seamlessly without additional verification in the future. Please only trust browsers if you're accessing them through a reliable personal device. Avoid doing so on public devices, such as computers in cafes and libraries.

10: I have logged on with the same browser before. Why am I asked to verify it again?

You may not be able to trust your browser if it is in private/incognito mode, you've blocked cookies in browser settings, or use any browser that will clear cookies automatically.

If there are certain changes to your device or browser between your previous log on and your current one, such as a software version update or delete cookies, you will be required to verify your browser again for security reasons.

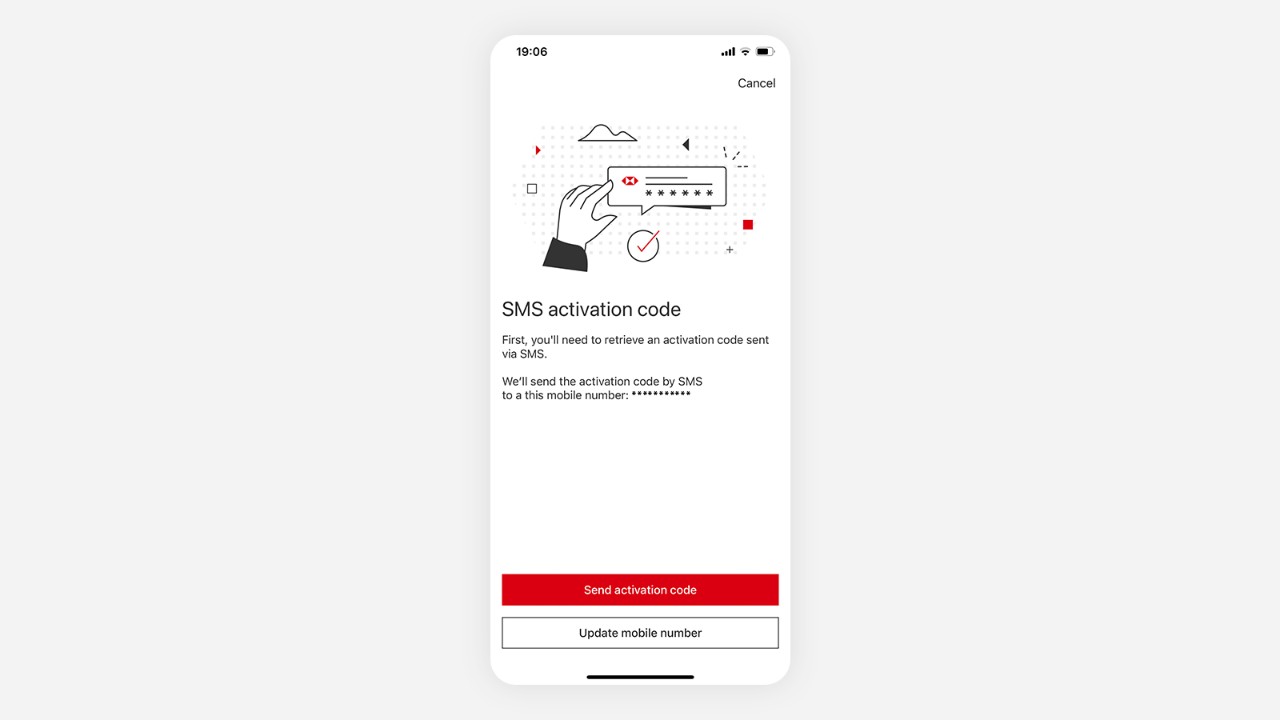

11: My mobile number has changed. How can I receive SMS activation codes?

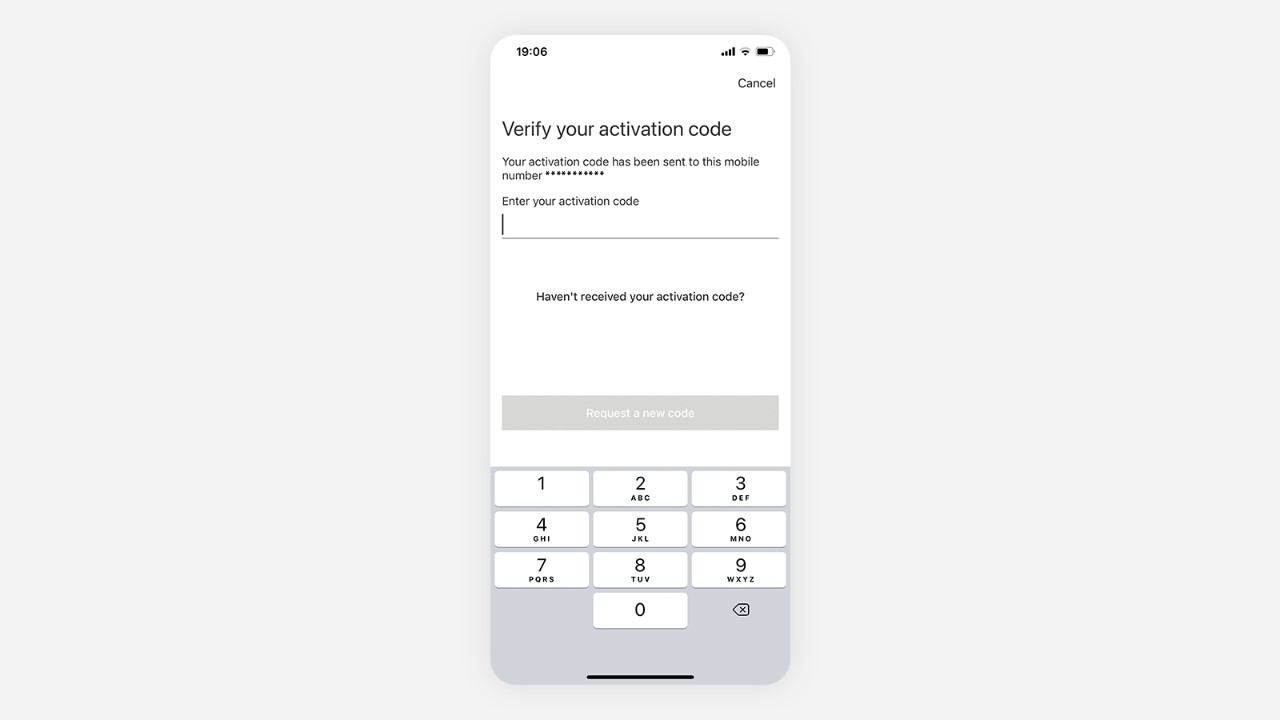

Your masked destination mobile number is shown on the verification instruction page when we send out the SMS activation code. Please make sure if the number is yours and updated.

To update your contact details, please log on to HSBC Online Banking, visit your nearest branch, or fill out this form and return it to us by post. If you are an MPF member without an HSBC bank account, please visit designated branches with MPF services in Hong Kong, or fill out this form (MPF IN91) and return it to us by post. If you are an ORSO member without an HSBC bank account, please fill out this form (ORSO INCDEE01) and submit it to your employer.

12: I haven't received any SMS verification code for verifying my browser. What can I do?

Please first make sure your mobile number is correct and updated in our records. To update your contact details, please log on to HSBC Online Banking or visit your nearest branch. If you are an MPF member without an HSBC bank account, please visit designated branches with MPF services in Hong Kong, or fill out this form (MPF IN91) and return it to us by post. If you are an ORSO member without an HSBC bank account, please fill out this form (ORSO INCDEE01) and submit it to your employer.

Alternatively, you can try again and request a new SMS verification code or log on with a security code generated from the HSBC HK App instead.

13: What can I do if I've forgotten my Personal Internet Banking username, password or security question?

If you've forgotten your username, you can retrieve it on the Personal Internet Banking log on screen by clicking ‘Forgot your username or password' and then selecting ‘Recover username’. Please make sure you have registered a valid mobile number and email address. You'll need to provide your bank account number, ATM PIN and identification document number, and input a SMS verification code sent by us for verification to retrieve your username.

If you've forgotten your password, you can reset it by selecting 'Forgotten your password?' on the Personal Internet Banking log on screen. You'll need the answer to your security question then generate a security code or input the SMS verification code sent by us to complete the reset.

If you've forgotten both your password and security answer, you can reset them on the Personal Internet Banking log on screen by clicking 'Forgotten your password?' and then selecting ‘Account details and SMS one-time verification code’. Please make sure you have a valid mobile number and email address registered with us. You'll need to provide your bank account number, ATM PIN and identification document number that you've maintained in our bank record. You’ll then be requested to input a SMS verification code sent by us for verification. You’ll be able to reset password, security question and answer after verification. You may also reset password, security question and answer on the HSBC HK App.

If you’re unable to use any of these methods, you can select 'Forgotten your password?' on the Personal Internet Banking log on screen, then 'Reset security details and call us to complete the reset process'. Enter a new password and select a new security question to answer. You'll then be given a unique reference number, which you will need to call our hotline to complete the process.

14: Why am I being requested to create a new Personal Internet Banking password?

To get access to our full suite of services on HSBC Online and Mobile Banking, please set up a new password.

If you have not created a Personal Internet Banking password before, we'll remind you to set one up when you log on. This is used to securely log you into your account and for us to identify you.

If you do not create one for now, we will remind you again on your next log on attempts until it has been created. We recommended you to complete the setup as soon as you can to protect your account.

15: Can I still log on to HSBC Online Banking with Mobile Security Key or Security Device after creating a new password?

Yes, you can choose to log on with your username and password to access some functions or use your username and security code generated from Mobile Security Key or Security Device to access all functions.

16: Can I still log on to the HSBC HK App if I don’t create a new password?

For your security and convenience, a password is required to log on to HSBC Online and Mobile Banking. If you haven’t created a password, you will be prompted to create one.

This is used to securely log you into your account and for us to identify you. It can also be used to securely activate Mobile Security Key on the HSBC HK App and reset your mobile banking PIN.

17: Can I still use Internet Explorer to log on to HSBC Online Banking?

Unfortunately, no. For the best experience, we recommend the latest versions of Chrome, Firefox, Microsoft Edge and Safari.

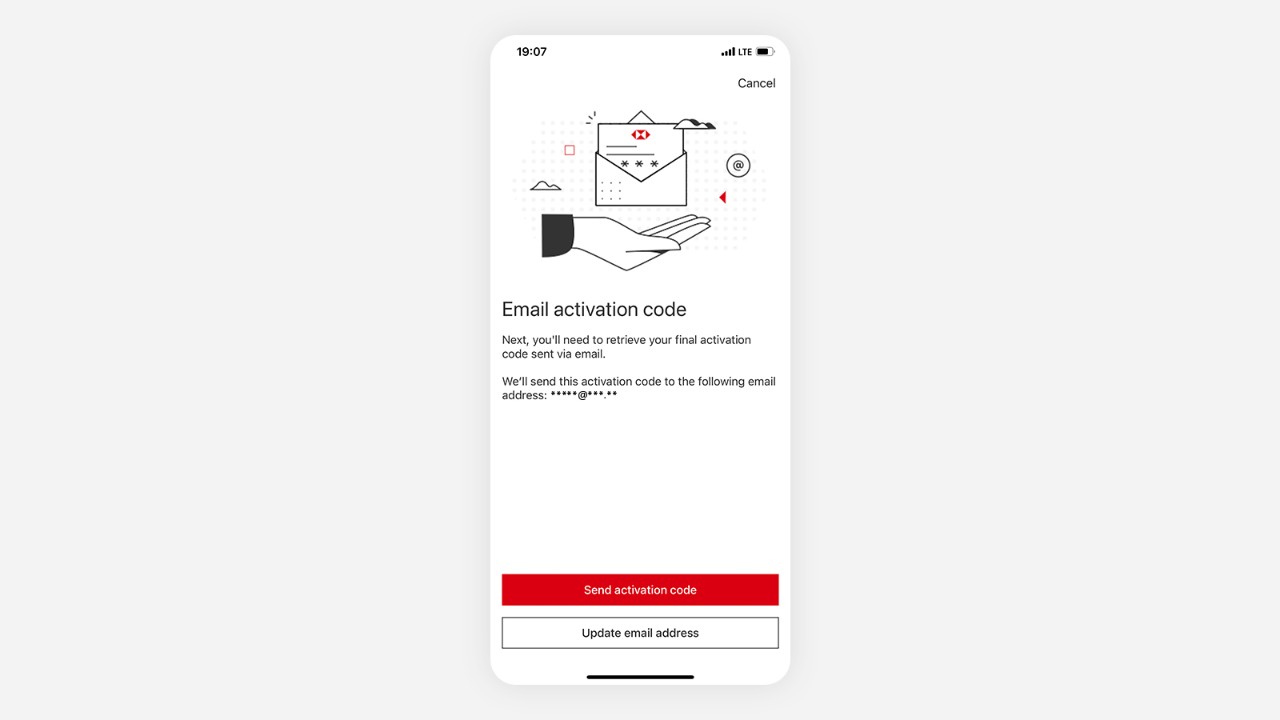

18: How can I update my personal information (i.e. mobile number, email address, date of birth)?

If you're updating your contact details on HSBC Online and Mobile Banking, please ensure your mobile number and email address are up to date.

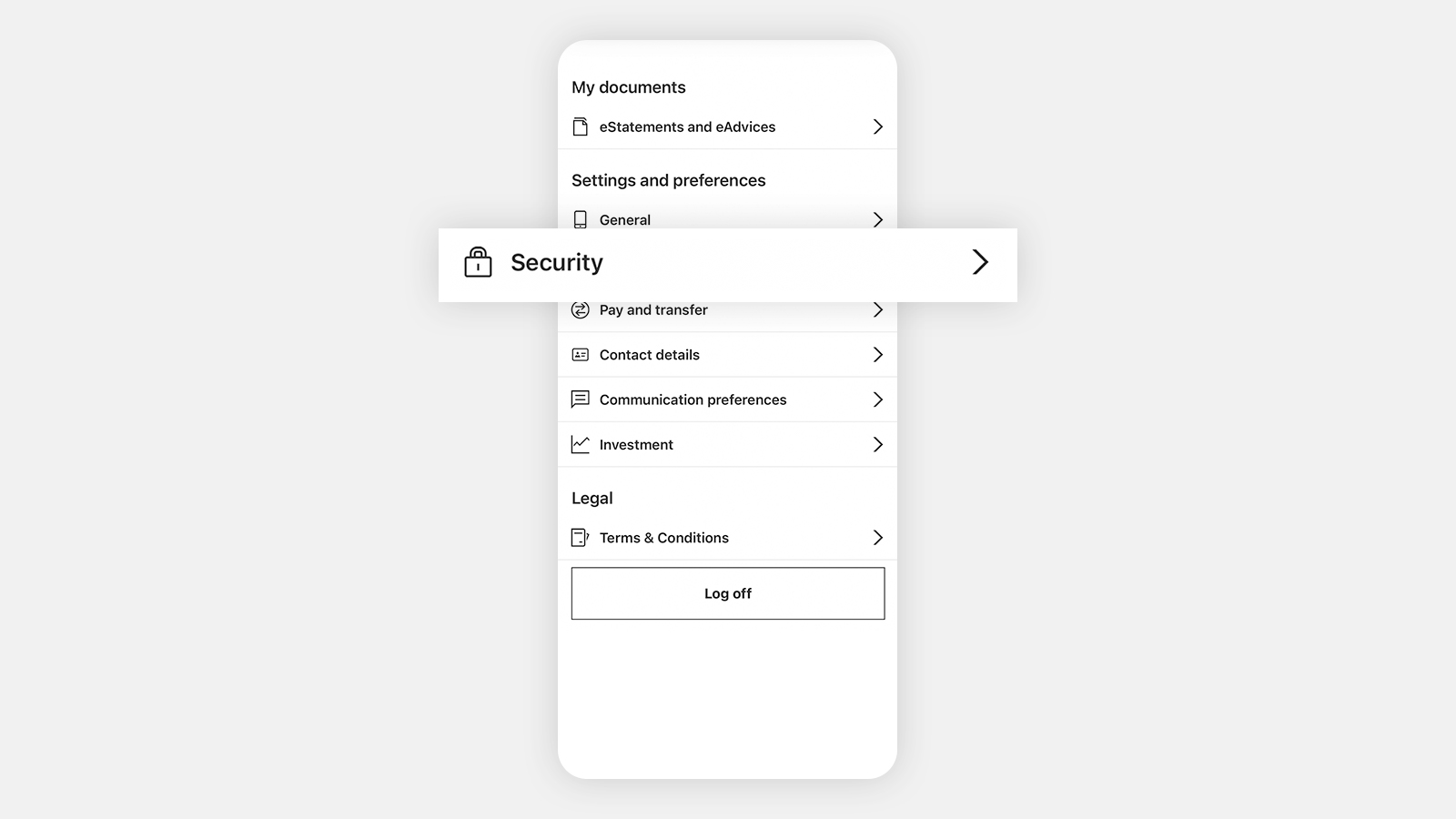

You can log on to HSBC Online Banking at the HSBC website > Log on > HSBC Online Banking > Personal details (at the top right corner), or you can log on to the HSBC HK App, click on Profile icon (at the top right corner) > Contact information (under your name).

Alternatively, you can visit your nearest HSBC branch in Hong Kong, or fill out this form and return it to us by post. If you are an MPF member without an HSBC bank account, please visit designated branches with MPF services in Hong Kong, or fill out this form (MPF IN91) and return it to us by post. If you are an ORSO member without an HSBC bank account, please fill out this form (ORSO INCDEE01) and submit it to your employer.

To update your date of birth, please visit any HSBC branch in Hong Kong and bring along your identity documents so our staff can help process your request.