You can increase your credit card limit to enjoy extra financial flexibility. Find out how.

Mobile Banking

Simply log on to the HSBC HK App and follow these steps to increase the credit limit for your card.

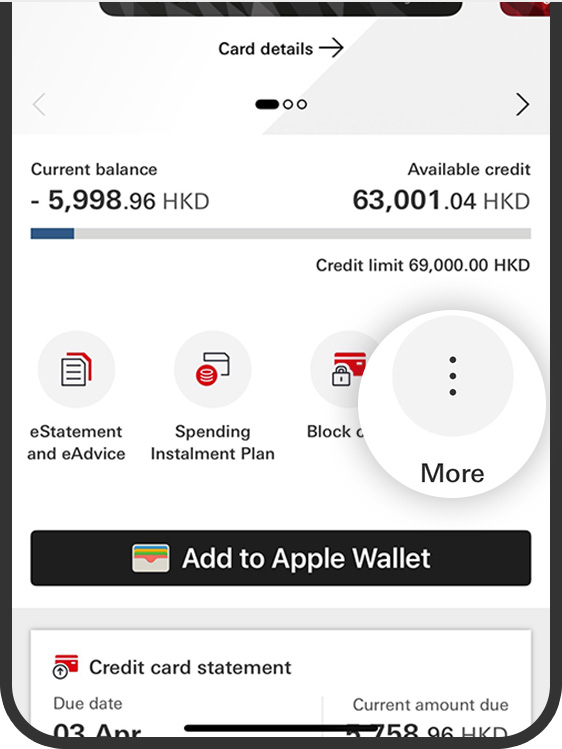

- Select the credit card you want to increase the credit limit for.

- Tap on 'More', and then on 'Credit limit increase’.

- Enter your preferred credit limit and declare your relationship with HSBC.

- Review the information, accept the credit card terms and key facts statement, then tap on 'Confirm'.

Please note the credit limit increase is subject to bank checks and approvals. If need be, we'll request you to upload your income proof. It'll take up to 4 working days process your application.

Scan the QR code to open the HSBC HK App.

Simply log on to the HSBC HK App and follow these steps to increase the credit limit for your card.

- Select the credit card you want to increase the credit limit for.

- Tap on 'More', and then on 'Credit limit increase'.

3. Enter your preferred credit limit and declare your relationship with HSBC.

4. Review the information, accept the credit card terms and key facts statement, then tap on 'Confirm'.

Please note the credit limit increase is subject to bank checks and approvals. If need be, we'll request you to upload your income proof. It'll take up to 4 working days process your application.

Online Banking

It's not difficult to alter your credit card limit at all. You can do it online in just a few simple steps.

- Log on to online banking.

- Select the credit card for which you want to change the credit limit.

- Choose to either increase or decrease your credit limit.

For credit limit increases, you may choose between the options of a permanent or temporary change.

For a temporary credit limit increase, the start date must be between 5 working days and 1 calendar month from the present day, and the end date must fall on a working day. A temporary credit limit increase will last a maximum of 2 months.

Phone Banking

You may also make a credit limit change request by calling our customer service hotline.

HSBC Global Private Banking customers: (852) 2233 3033

HSBC Premier Elite customers: (852) 2233 3033

HSBC Premier customers: (852) 2233 3322

Other customers: (852) 2233 3000

To avoid over limit charges, make sure your balance doesn't exceed the original credit limit before the end of an increased credit limit period.

To borrow or not to borrow? Borrow only if you can repay!