Supporting your family-focused goals

HSBC Premier Elite

HSBC Premier Elite provides an elevated experience that takes your everyday above and beyond. Join Premier Elite from now until 30 June 2024 to enjoy welcome rewards worth up to HKD86,300, including new funds offer, wealth offers, best-in-class health, dining, travel, and lifestyle benefits. You can also enjoy 3-month new fund time deposit interest rates1 up to 4.2% p.a. for USD placements / up to 3.8% p.a. for HKD placements. Terms and conditions apply.

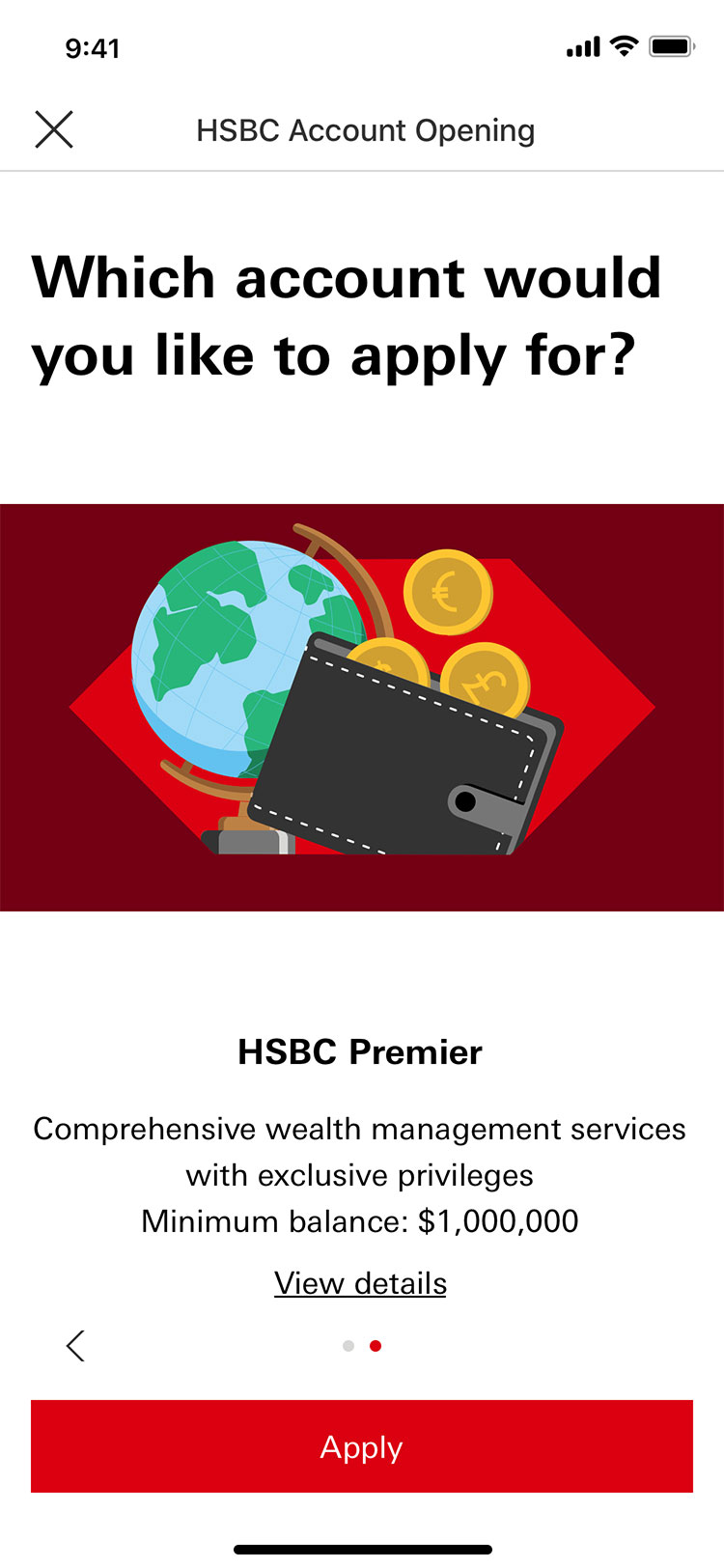

How to become an HSBC Premier customer

You're eligible for Premier if you:

- Maintain a Total Relationship Balance (TRB) with us of HKD1,000,000 or more. A Below Balance Fee (BBF) of HKD380 per month will be applied if your TRB falls below that amount.

- Join today and enjoy the BBF waiver for your first 6 months2

What does TRB include?

- Your savings

- Your investments and insurance

- Any retirement schemes you're a part of

- Utilised lending facilities

Join HSBC Premier today

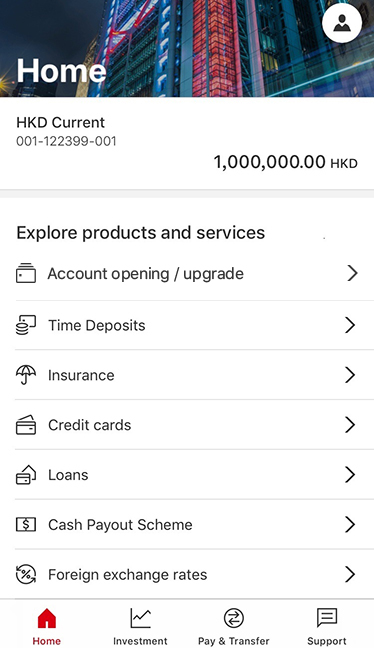

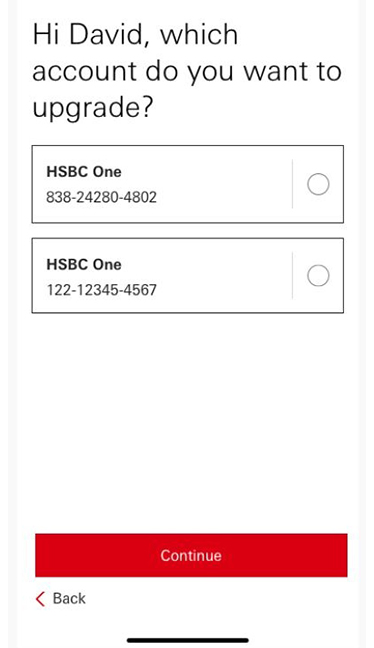

Existing customers

For holders of HSBC One, Personal Integrated Account or standalone HSBC deposit accounts, as well as Personal Internet Banking users

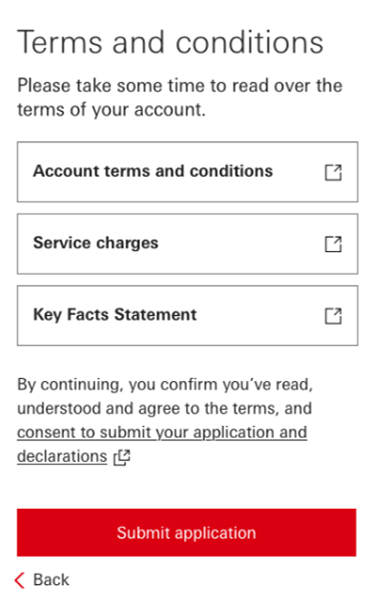

Upgrade to HSBC Premier account in minutes with our Mobile Banking app.

For desktop users:

Online banking is secure and easy to use. Register today

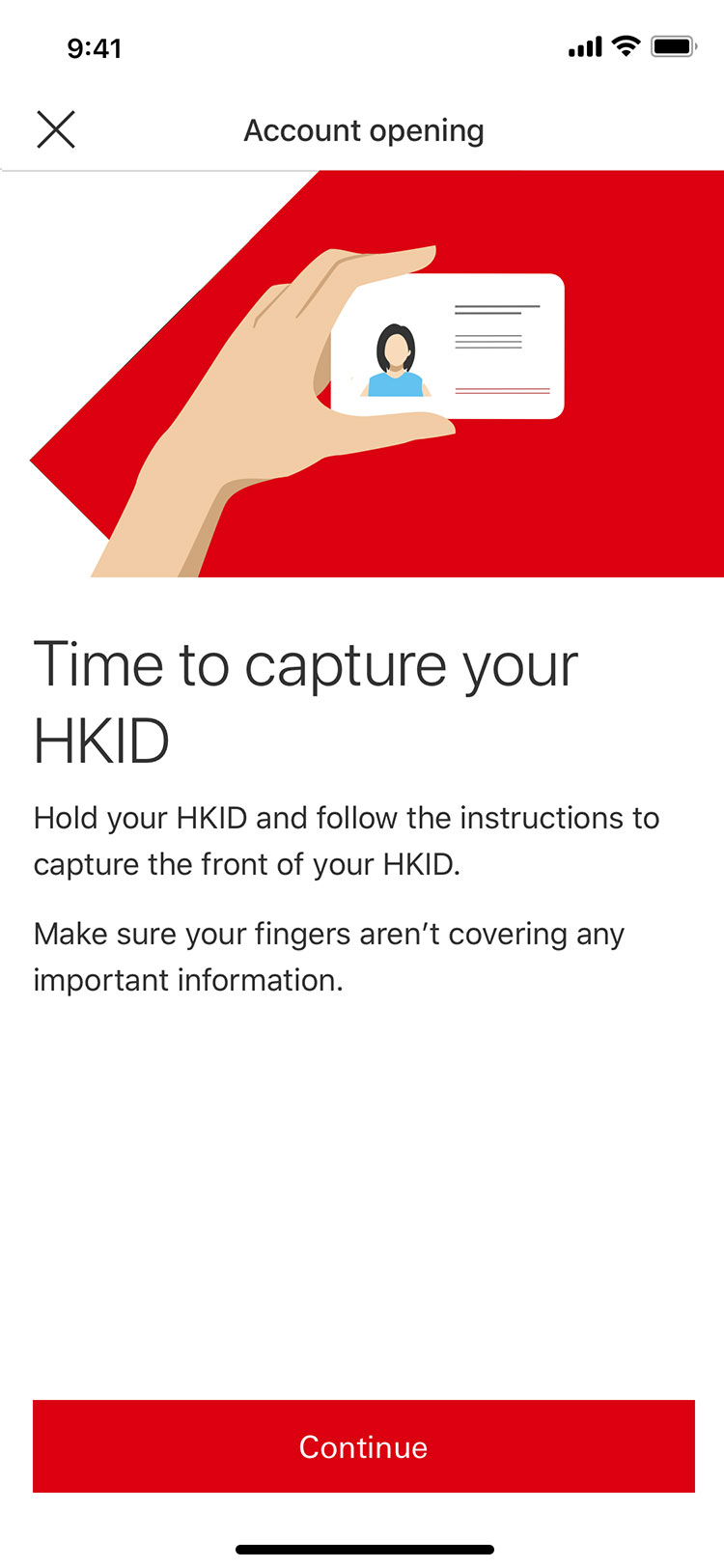

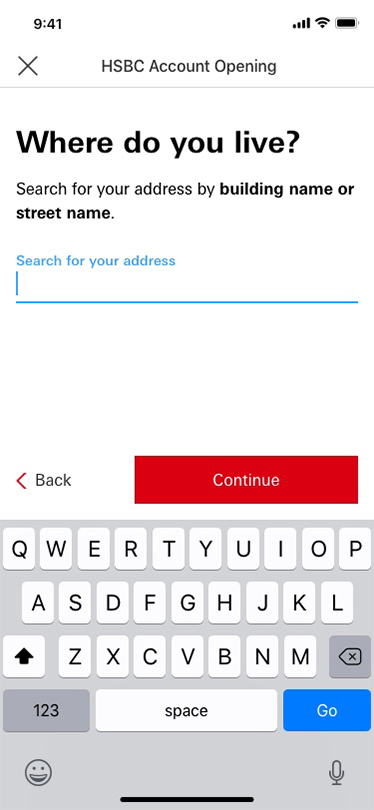

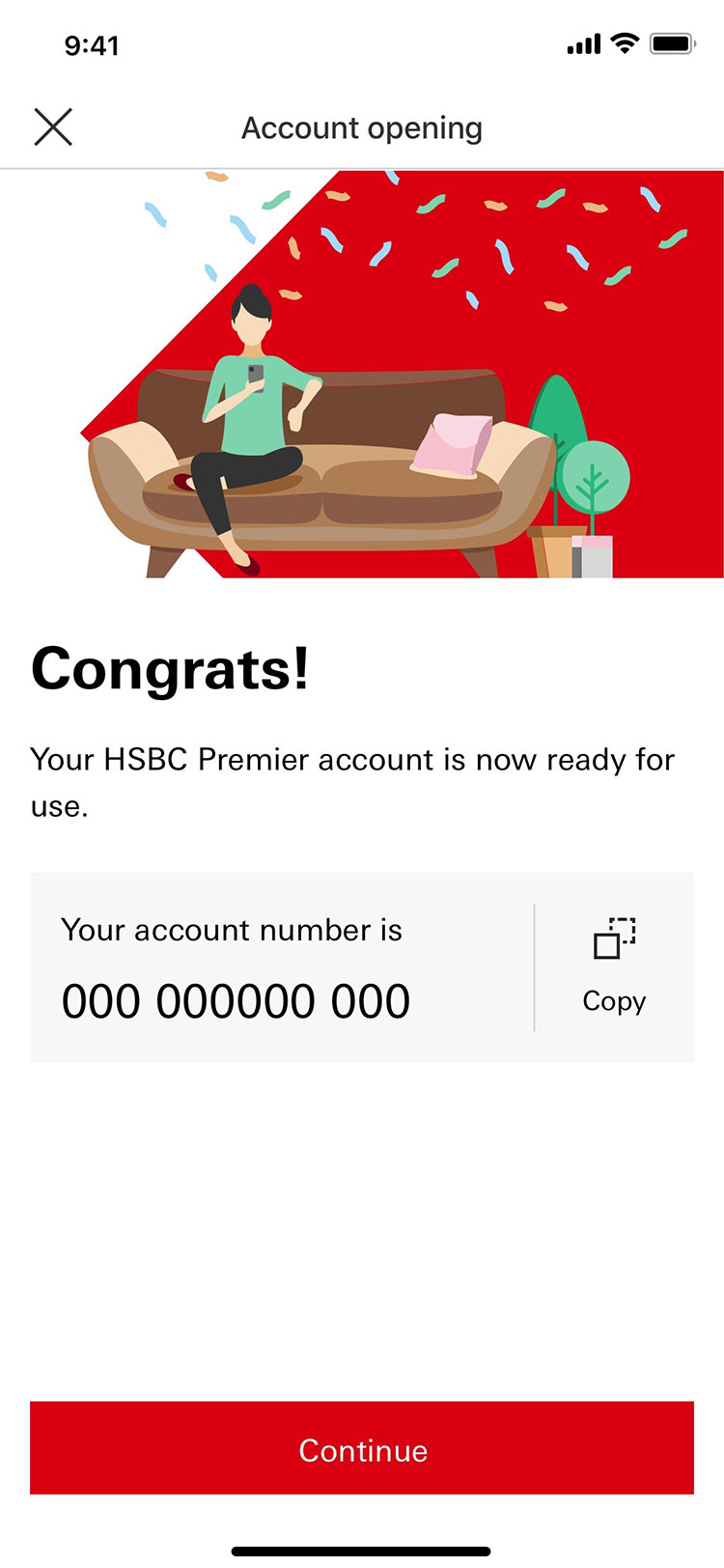

New customers

Open an HSBC Premier account in less than 5mins with our Mobile Banking app3

Offline applications for all customers

Apply in branch4

You can now make a booking online for account opening at select branches, prior to your visit and get appointment confirmation instantly.

For account opening at other branches, please fill in your personal information and booking details here.

Remarks: Priority will be given to customers who have made appointments for account opening.

Apply by phone

How to apply via mobile or online banking

Exclusive privileges and beyond

Preferential offers

- Get up to $7,000 RewardCash when you purchase selected life insurance plan of designated amount. See details and T&C.

- Get HKD1,250 cash rebate for every HKD500,000 subscription of any bond (excluding Retail Bond IPO) without cap. See details and T&C.

Want to make sure you never miss an offer? Simply opt in to subscribe for offer updates via HSBC Online Banking. You can opt out any time.

Wealth insights

Tap into our latest investment technology and insights to help maximise your wealth potential:

- Stress-test your portfolio and diversify risk with our bespoke Wealth Portfolio Intelligence Service

- Are you prepared for a volatile market? Here are our market outlook and global house views

Notes and remarks

The information provided is intended as a general guide for reference. Benefits and features of our services shall be subject to relevant terms and conditions and local regulatory restrictions. Please refer to the HSBC Premier Welcome Pack and HSBC Integrated Account Terms and Conditions. For fees and charges, please visit https://www.hsbc.com.hk/fees/ for details.

- New-to-Premier Elite customers can enjoy an extra +0.2% p.a. on top of the current HSBC Premier Elite new fund time deposit rates for USD and HKD. The current HSBC Premier Elite new fund time deposit rates are with reference to the rates under "Preferential New Fund Time Deposit Rates - branch/phone-banking offer" on our website. Terms and conditions apply. Please visit HSBC Hong Kong Deposit Offers website or contact your Relationship Manager for the latest rates.

- Existing HSBC One/ Personal Integrated Account holders/ New to HSBC account holders after upgraded their account to Premier are required to maintain an average daily Total Relationship Balance for 3 consecutive months at HKD1,000,000 or above, or a monthly below balance fee of HKD380 will apply after the 6-month Below Balance Fee waiver offer ends. Please visit https://www.hsbc.com.hk/fees/ for the latest bank tariff guide. Selected customers may enjoy other below balance fee waiver offers and please refer to the communications sent by the Bank or contact any of the Bank’s staff for details.

- Applicable to HKID holders (permanent or non-permanent resident) aged 18-64 residing in Hong Kong who do not hold any HSBC bank/ investment accounts or credit cards currently. If you fall outside this criteria, you can apply in a branch or by phone.

- For new customers, just bring your identification document and a recent proof of address. Please visit https://www.hsbc.com.hk/docs/premier/application-notes.pdf for details of account opening required documents. For existing customers upgrading to a Premier account, you don't need to bring an identification document or a proof of address when applying in branch. You can set up HSBC Premier Junior Pack and Premier for Next Generation accounts for your children, and create an investment account when you apply in branch.