Unlock your true wellness

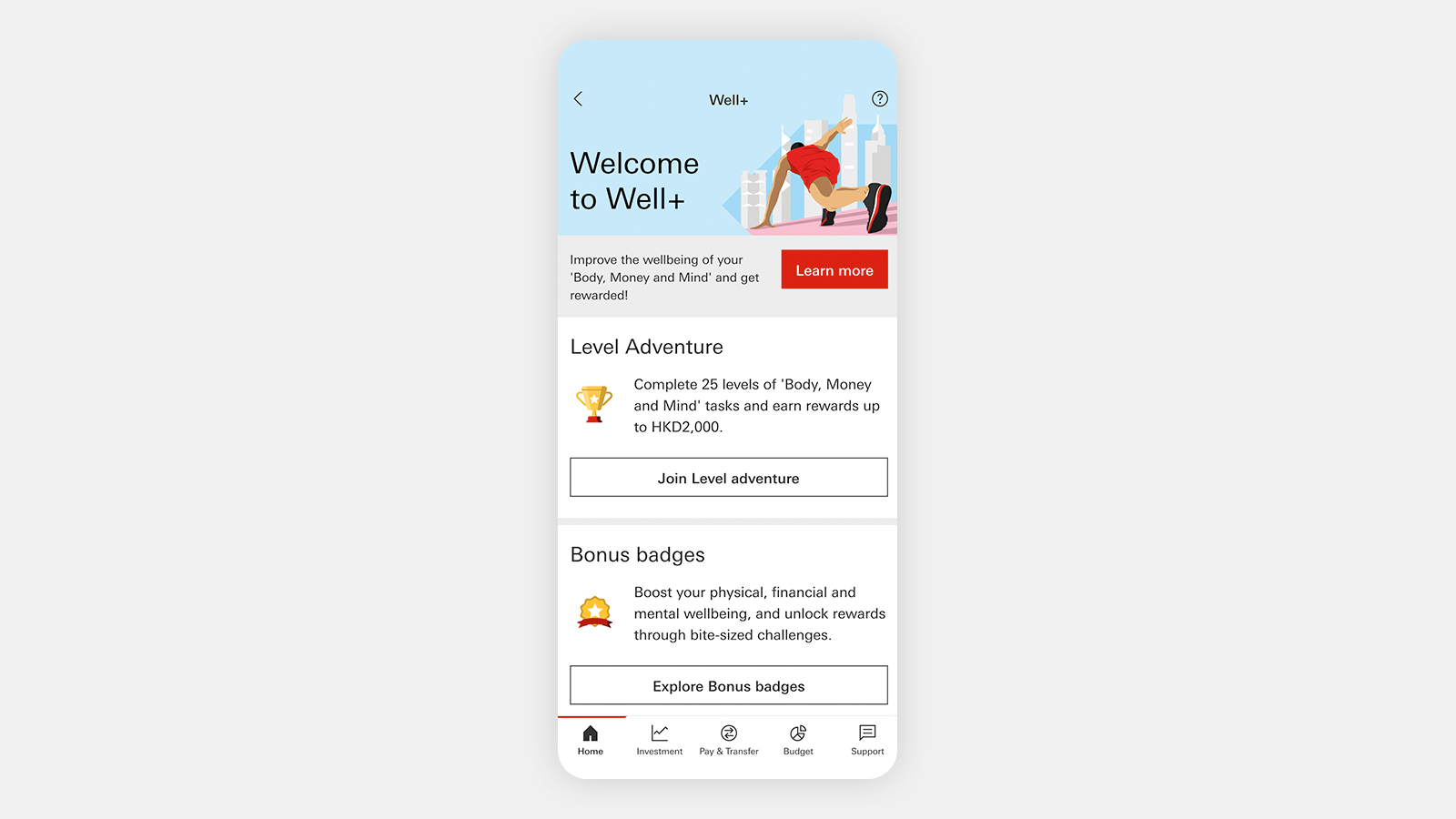

Wellness encompasses your body, money and mind. With Well+, our wellness reward programme, you can nurture all 3 aspects of your well-being… and have fun doing it. Earn up to $2,000 RewardCash and/or vouchers[@wellplusreward] just by completing simple activities for all 3 badges at each level.

Discover even more enticing rewards in the 'Bonus Badge' section.

Join now on the HSBC HK Mobile Banking app (HSBC HK App), for free.

Key features

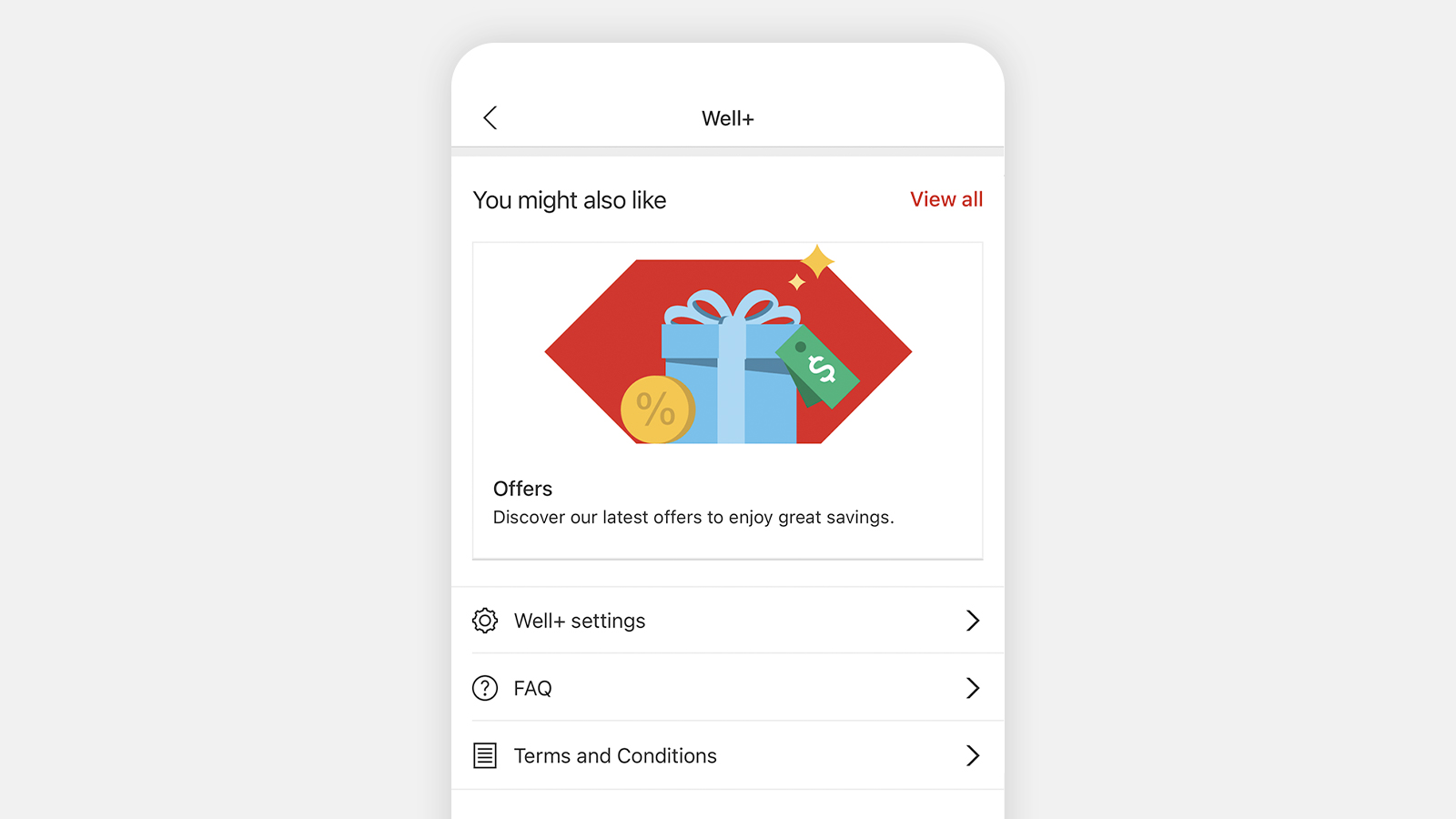

Keep track of your offers and challenges

Check out our member exclusive offers

Don't miss out on offers only available on Well+ including insurance plans and banking products. Offers include:

- Enjoy extra discounts on insurance plans such as term life insurance, Voluntary Health Insurance Scheme and critical illness insurance

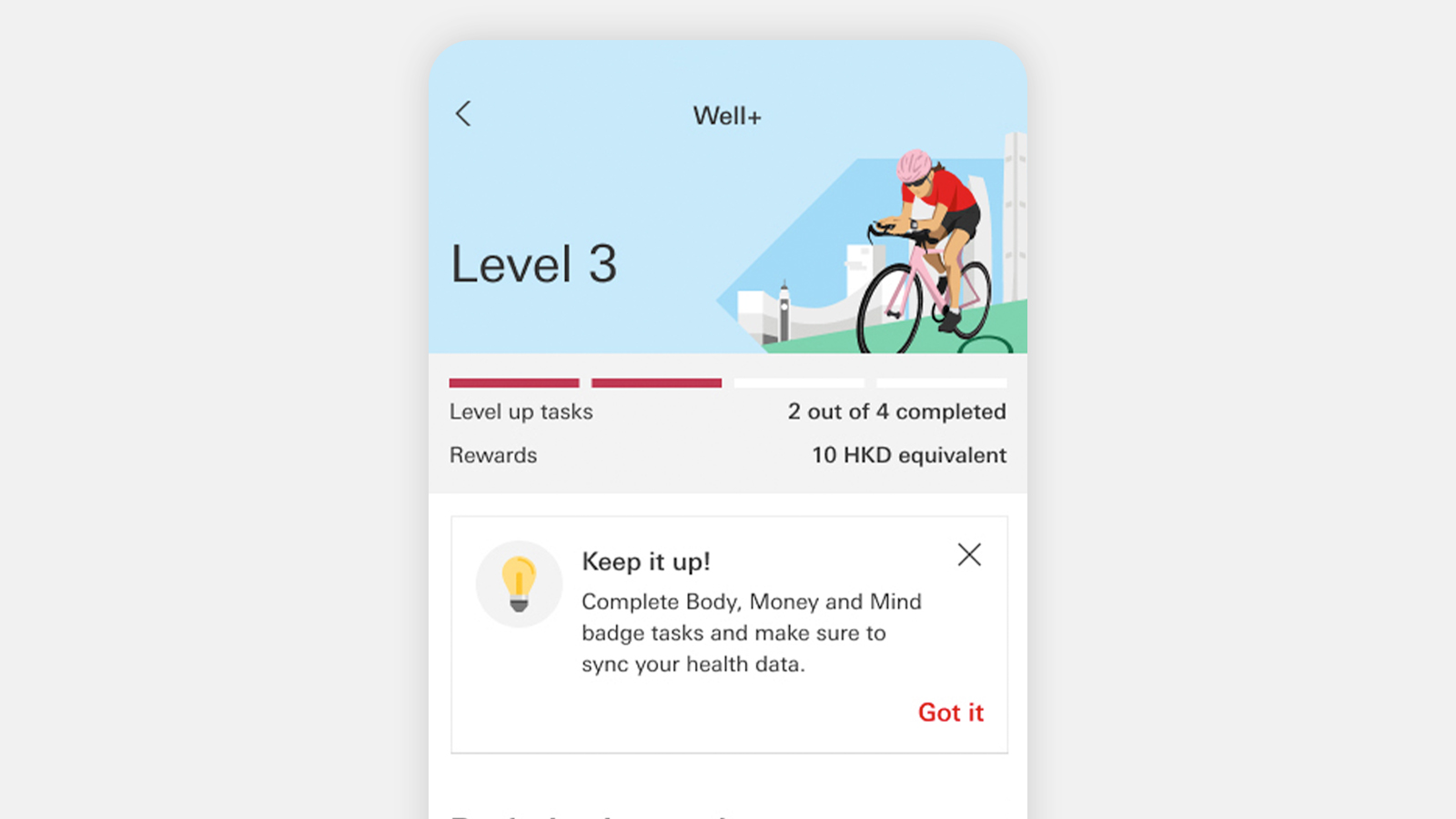

Stay on top of your wellness progress anytime anywhere

Keep track of your wellness progress and your next tasks in just a few taps, whether from your couch or on a jog.

- Check your Level Adventure and Bonus Badge progress anytime on the HSBC HK App home page

- Tasks that await you are shown front and centre on our dashboard, ensuring you never miss a challenge

Join Well+ in just a few steps

Step 1

Step 2

How to get started

What you'll need

To join Well+, you'll need to:

- be registered for mobile banking on the HSBC HK App

- have the Apple Health app if you're on an iOS device; or the Fitbit, Garmin Connect or Google Fit app if you're on an Android device

Got questions?

Go to 'Support' on HSBC HK App, then select 'Chat with us'. One of our service agents will be happy to help you.

Don't have the app yet?

Find out more

For more frequently asked questions, please log on to the HSBC HK App. Go to 'Well+' and select 'FAQ'.