Important Risk Warning

1) Investment involves risks. The value of HSBC Gold Token may go down as well as up.

2) The value of the HSBC Gold Token reflects the value of gold and fluctuation in the price of the gold may materially adversely affect the value of the HSBC Gold Token. The price of the gold can be unpredictable, sudden and drastic, and may be affected by complex political and macroeconomic factors which include but are not limited to interest rates, inflation, economic growth, geopolitical tension and the sale of gold by investment vehicles tracking gold markets.

3) Investment in HSBC Gold Token is not the same as acquiring a physical gold bar. As an investor, you will receive a fractional ownership of the Gold as defined in the Principal Brochure and Key Facts Statement. Investors will not be able to take physical delivery of Gold at any time. There is no market for the trading of the Tokens. Investors in general may only redeem their investment by selling the Tokens back to the Bank, at a price determined by the Bank, which includes Bank‘s margin.

4) Your investments in the HSBC Gold Token are not principal protected. Your investments in this product may fall in value and therefore, your investments in the gold represented by HSBC Gold Tokens may suffer losses. In the worst-case scenario, you can lose your entire investment.

5) HSBC Gold Token is not, and not equivalent to, a time deposit. For further details including the product features and risks involved, please refer to the HSBC Gold Token Key Facts Statement, Principal Brochure and other Product Documents.

6) Investors can only trade the Gold represented by the HSBC Gold Token via the Bank, subject to the below:

(i) the price of the Gold represented by HSBC Gold Tokens is determined by the Bank according to the pricing mechanism of the Product;

(ii) any trading outside the Gold Trading Hours will be subject to a higher Bank Margin of 5% at maximum; and

(iii) suspension of dealing may be imposed by the Bank.

New flexible way to invest in gold

HSBC Gold Token is a digital token which, unlike some common gold products in the market, allows investors to acquire Fractional Ownership of physical gold represented by tokens recorded on a distributed ledger. Each HSBC Gold Token represents the fractional ownership record of 0.001 troy ounce of gold.

You should note that the nature of fractional ownership means that your ability to deal with the Gold will be subject to the limitations outlined in the Principal Brochure and Key Facts Statement.

Why invest in HSBC Gold Token

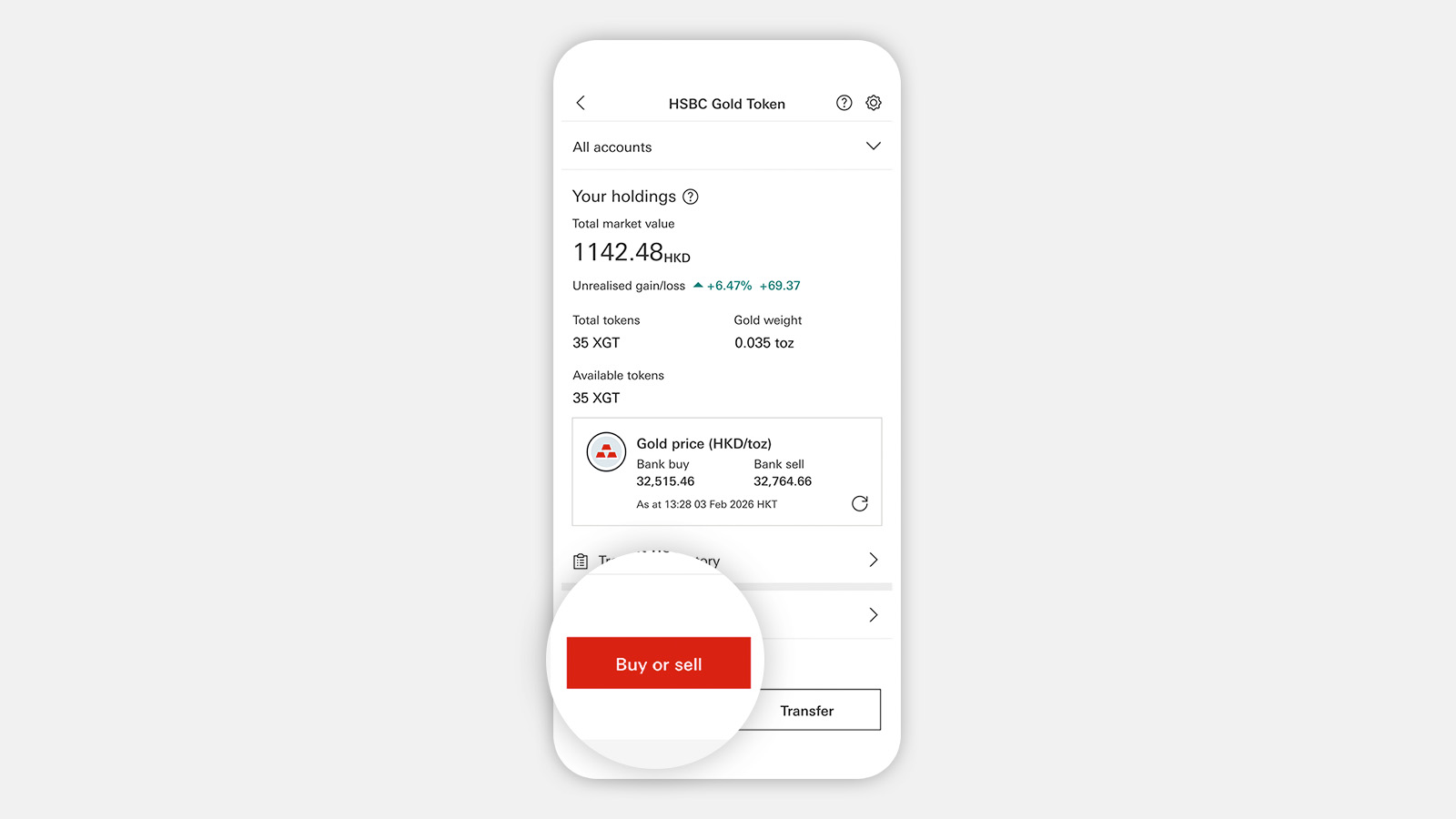

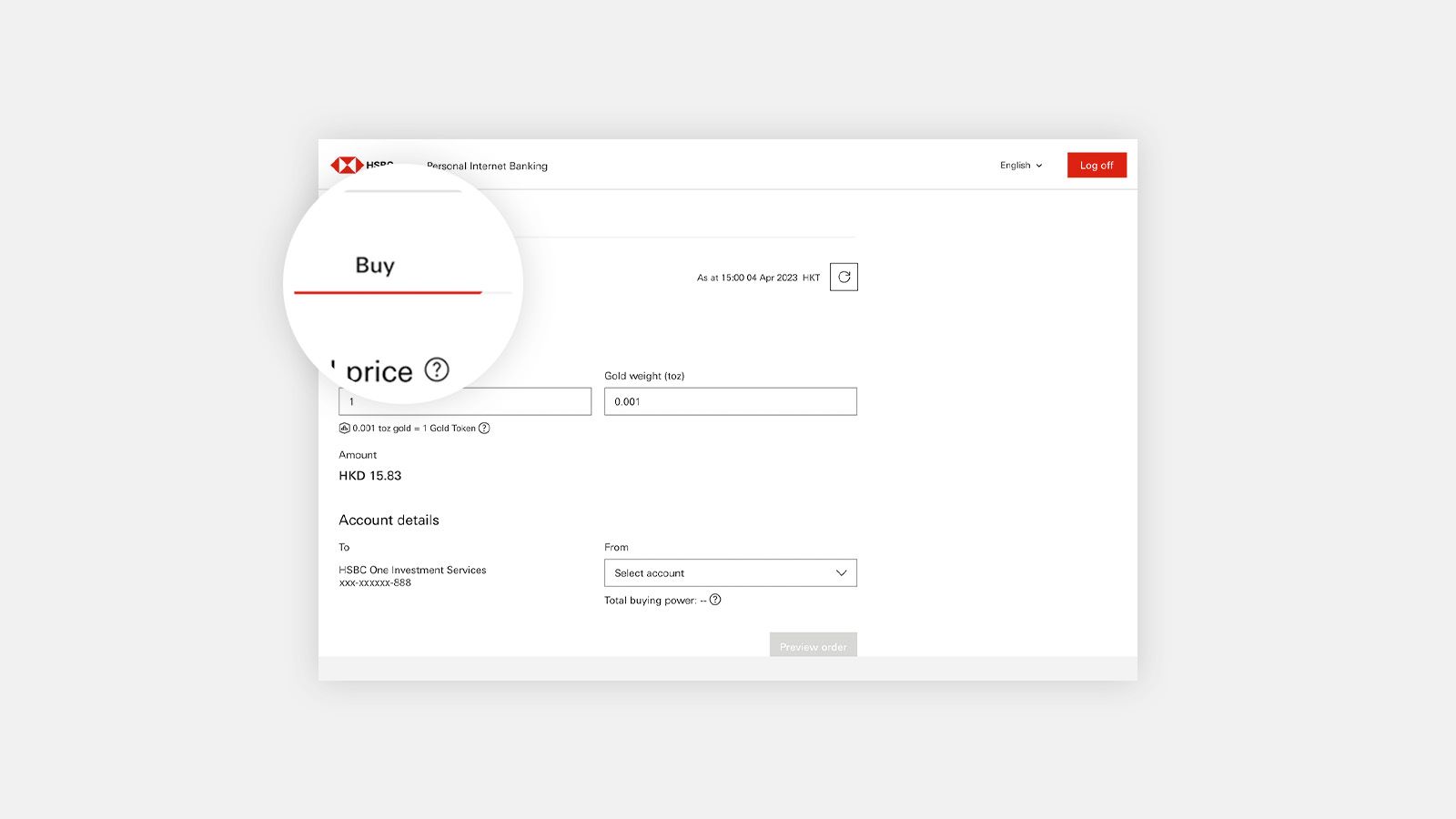

How to trade HSBC Gold Token

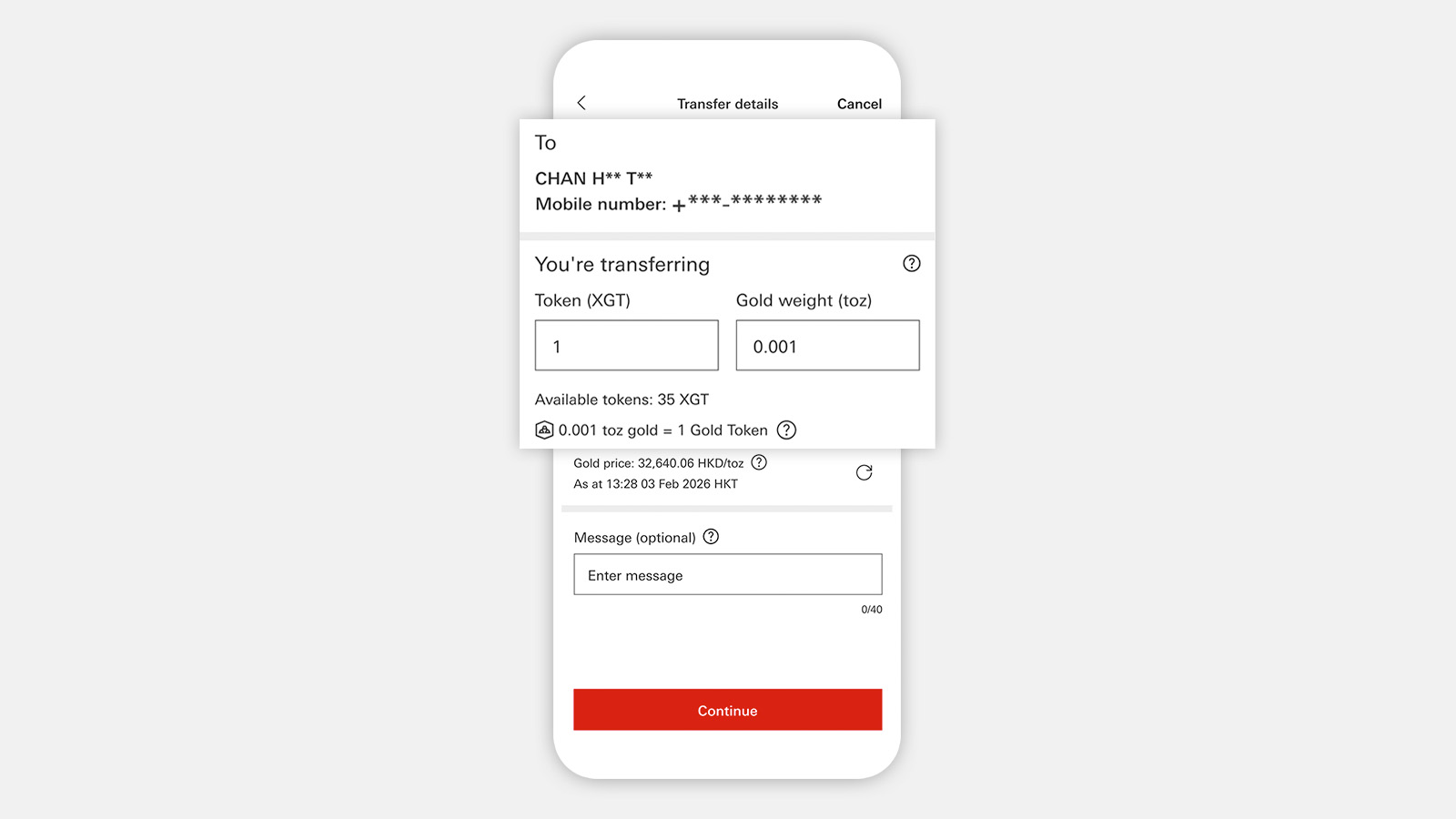

How to transfer your HSBC Gold Token

Things you should know

Who can apply?

To be able to trade HSBC Gold Token, you need to have an active HSBC HK Investment Account and HK residential address registered with the bank. For further details, please refer to the section 1.2 (How can I open an Investment Account?) and section 1.3 (How do I carry out Product transactions?) on Principal Brochure.

You are not eligible if you are a US citizen, a US resident or a US tax payer, or have US nationality or a US address (for example: primary mailing, residence or business address in the US).

Get ready to trade

Via HSBC HK App

If you have the HSBC HK App installed on your device and set up an investment account, you can trade HSBC Gold Token in the app.

Via HSBC Online Banking

If you're already registered for HSBC Online Banking, simply log on to get started.

Award-winning HSBC Gold Token product

HSBC won the top award of 'Excellence Performance in HK Banking Securities Sector – Digital Innovation' at Bloomberg Businessweek: Financial Institutions Awards 2025

HSBC won the top award of 'Best New Wealth Management Product' at The Digital Banker – Global Retail Banking Innovation Awards 2024