Affluent Investor Snapshot 2025: A Quality of Life special report[@affluent-investor-snapshot-2025]

We surveyed over 10,000 affluent individuals across 12 markets and asked some simple yet important questions about investment behaviours worldwide.

Accelerating alternatives investment through multi-asset portfolios

By Jennie Byun

Senior Multi-asset Investment Specialist, HSBC Asset Management

Key takeaways

- Think beyond just stocks and bonds – as the changing market landscape reduces the diversification benefits of bonds, alternatives are playing a bigger role in portfolios.

- Alternatives can shine when traditional markets struggle – in times of high inflation, slow growth or market volatility, certain alternatives can help protect your wealth and keep returns steadier

- Multi-asset portfolios make alternatives easier to access – giving you professional management across asset allocation, fund due diligence and monitoring, in a cost-effective way.

This year's Affluent Investor Snapshot continues to explore how affluent investors are navigating their investment and wealth decisions, and how these choices are reflected in the way they build their portfolios to meet short, medium and long-term objectives.

The latest HSBC Affluent Investor Snapshot highlights a growing trend in asset allocation and diversification towards alternative assets such as commodities, hedge funds, private credit, and infrastructure. This has coincided with the rise in equity/bond correlation post the pandemic induced inflationary environment, leading investors to search for other sources of diversification. As mentioned in the report, “diversification is one of the most effective ways to weather uncertainty, and these findings highlight how affluent investors are building more diversified portfolios”.

We explore the role alternative assets play in diversifying portfolios and enhancing their resilience across different market environments. We also outline how ownership of alternatives through multi-asset portfolios can help investors address some of the barriers they face in accessing these asset classes directly.

The growing importance of alternatives in managing the economic cycle

In the last decade, equities and bonds worked well together in what was a relatively benign period of low-inflation and “goldilocks growth”. However, the tides have since turned. While bonds play a key role in multi-asset portfolios for diversification and income generation, the diversification benefits are arguably not as strong as they used to be.

This new environment requires a flexible approach not only in duration management but also in broader asset allocation. Unconventional, or alternative assets, can help individual investors bring diversification to the next level.

First, let’s define what is meant by alternatives – they’re an investment that falls outside of conventional equities, bonds or cash. Within alternatives there are two main types. The first are liquid alternatives, which encompass investments such as commodities (including gold), listed property/infrastructure, and liquid hedge funds strategies. Inflation-linked bonds can be considered alternatives as they are not typical holdings within a traditional bond portfolio. As the name suggests, liquid alternatives can be bought and sold relatively easily, usually within a daily or weekly priced mutual fund or exchange traded listing.

The second are illiquid, or private, markets. These include private equity, private credit, as well as private property/infrastructure as well as those hedge funds with lock-up periods. These investments are typically closed to retail investors and are also characterised by long lock-up periods, between three months to sometimes ten years. For multi-asset managed solutions, which are typically structured as liquid portfolios, most alternatives investments fall within the liquid category and that is where we will focus our analysis.

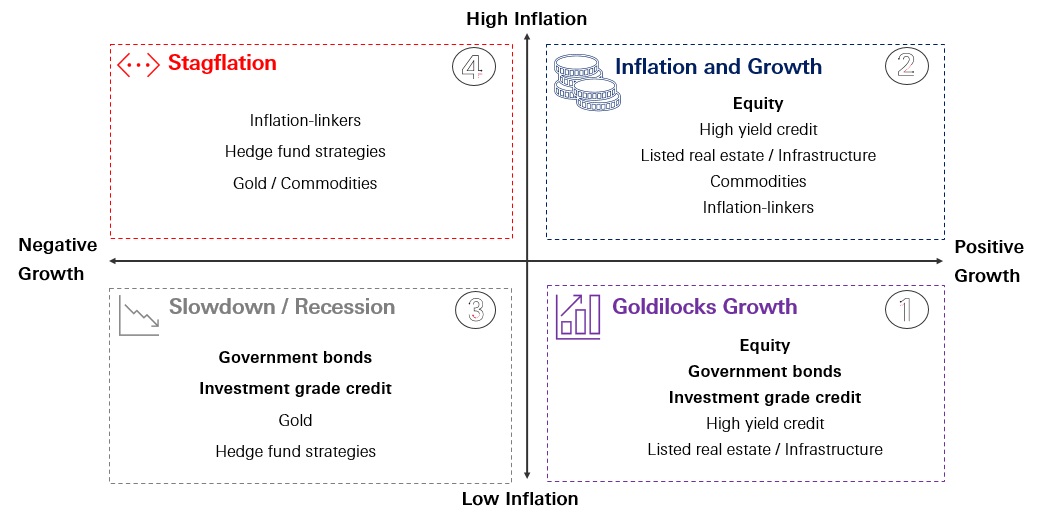

Below outlines the different macroeconomic environments investors face from an inflation (y-axis) and growth perspective (on x-axis). Each quadrant represents a relatively distinct part of the economic cycle and the asset classes that tend to perform during each cycle.

Fully diversified portfolios can better navigate different market regimes

Typically, equities tend to drive performance during periods of moderately high inflation and growth (quadrant 2), as well as in quadrant 1, in what we term “goldilocks growth” of low inflation and positive growth. During periods of economic slowdown or recession (quadrant 3), equities tend to suffer. High quality government and corporate bonds help to buffer the portfolio during these periods but generally not enough.

Without the equity driver, investors will need additional sources of returns to generate performance. This is when gold and hedge funds tend to outperform and serve as further support for the portfolio. Performance is challenged even further during periods of stagflation (quadrant 4), as both bond and equity markets suffer due to high interest rates. Particularly in this environment, alternatives are key to stabilising the portfolio.

Having the right mix of asset classes that can perform in rising and falling markets can help boost portfolio returns, and this is particularly relevant as we navigate through these uncertain times. This leaves the question: how much should investors allocate to alternatives, and which ones?

Easing alternatives access through multi-asset portfolios

Liquid alternatives are accessible by retail investors. However, the challenge is in the knowledge and expertise required to understand their behaviour not only with equities and bonds, but also with each other. Multi-asset portfolios provide a straightforward, professionally managed route into liquid alternatives. By investing through a multi-asset solution, investors can:

- Delegate asset allocation decisions – Not all alternatives are the same in terms of their risk and correlation to equity and bond markets. Relying on experienced managers to decide the mix and the allocation across different liquid alternative strategies removes the guesswork for investors.

- Benefit from rigorous due diligence – Alternative funds come in varying structures, liquidity profiles, and risk-return characteristics. Multi-asset managers have a tried and tested due diligence framework for choosing high-quality liquid alternative strategies, managing the complexity and risk for clients.

- Avoid market timing risks – Instead of trying to decide when to buy or sell individual alternative investments, investors can rely on experienced portfolio managers who actively allocate across a range of assets, adjusting exposure as market conditions evolve where appropriate.

- Cost-efficiency – By pooling assets together, managers can access funds at lower cost, through what is commonly referred to as “institutional pricing”.

Through efficient asset allocation and institutional execution, managed solutions help optimise returns, enhance portfolio diversification, and provide a holistic approach to investing—all without introducing unnecessary complexity or additional risk. In short, multi-asset and active strategies help investors build a diversified investment portfolio for a balanced, modern approach to long-term wealth.

Unit trusts

Invest in a diversified portfolio to achieve your financial goals

Wealth Portfolio Intelligence Service

Build a personalised portfolio made just for your wealth goals and manage your investments seamlessly