HSBC MPF Default Investment Strategy

What is DIS?

The Default Investment Strategy (DIS) is a standardised and fee-controlled MPF investment strategy that was applied since from 1 April 2017 as the "default" investment strategy in all MPF schemes in Hong Kong. It replaced the different default investment strategies employed by different MPF schemes prior to 1 April 2017. From now on, MPF members joining an MPF scheme without providing a valid investment choice will have their monies invested in accordance with the DIS.

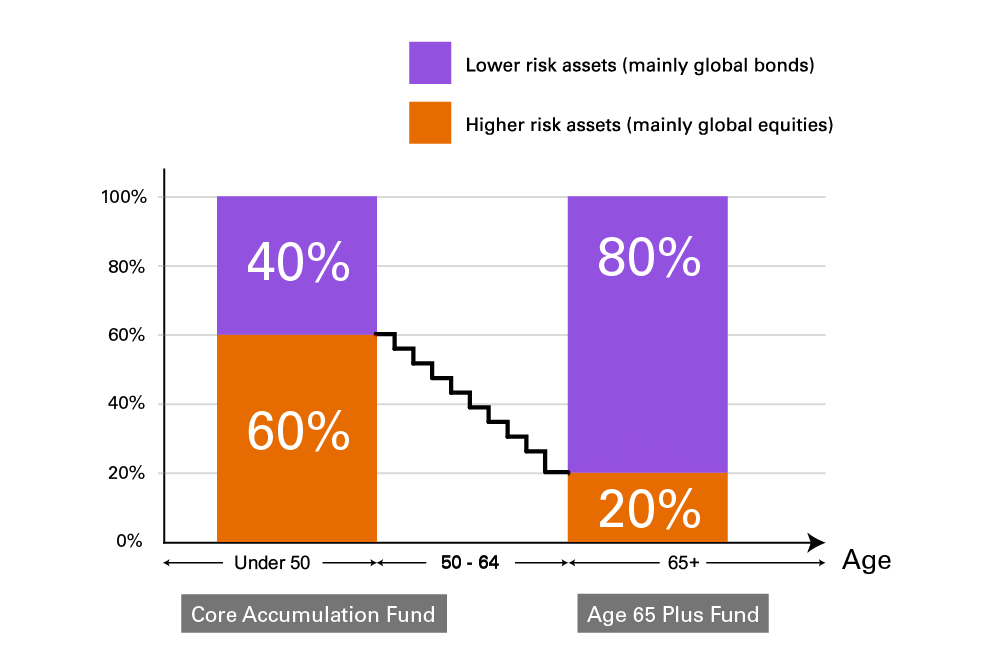

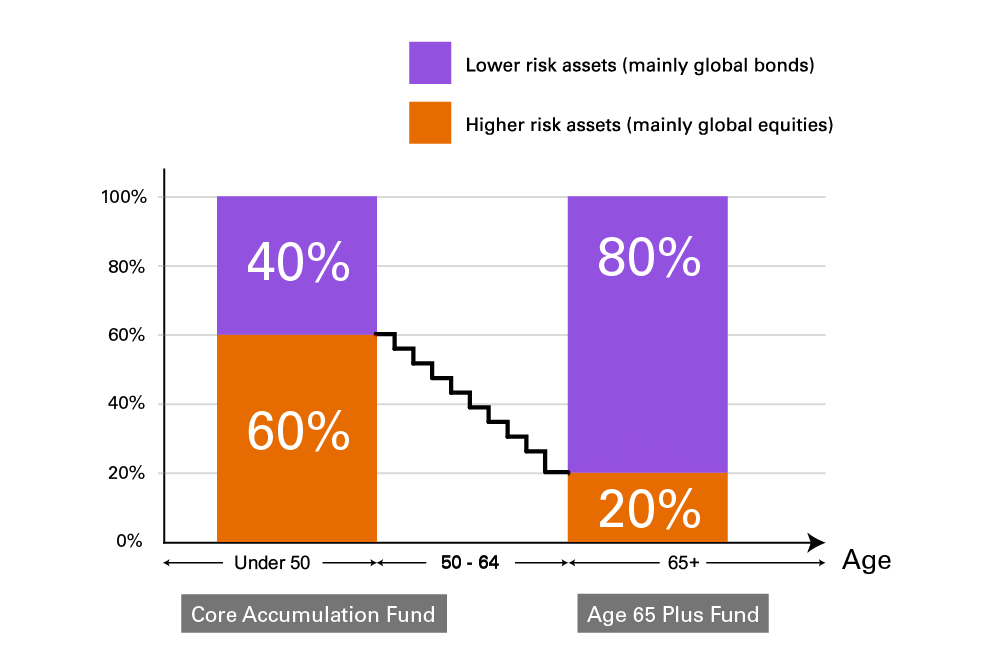

The DIS consists of 2 Constituent Funds, the Core Accumulation Fund (CAF) and the Age 65 Plus Fund (A65F). Both funds adopt a globally diversified investment approach, with the CAF investing 60% of its assets in higher risk assets such as equities and 40% in lower risk assets such as global bonds and money market instruments. The A65F has 20% of its assets invested in higher risk assets, and 80% in lower risks assets.

DIS contains an automatic de-risking feature, under which, members who are below age 50 investing in DIS will have their new contributions and accrued benefits 100% invested in CAF. In general, when a member turns 50, their accrued benefits and new contributions will automatically be partially allocated to the A65F annually on their birthdays until they reach 64, when the entire accrued benefits will be invested in the A65F. This is illustrated by the diagram and the DIS de-risking table.

Another key feature of the DIS is that both the CAF and A65F are subject to a management fee cap of 0.75% of the net asset value of the fund each year (measured on a daily basis). Furthermore, there is an additional cap of 0.2% of net asset value on the recurrent out-of-pocket expenses in operating the funds.

While the DIS has been intended for members who have not made any investment choices before, it may also be an appropriate investment option for you if the features of it fits your circumstances. The DIS is available as a standalone investment option that you may choose explicitly, or you may also choose to invest in the CAF and A65F separately.

| Age | Core Accumulation Fund ("CAF") | Age 65 Plus Fund ("A65F") |

|---|---|---|

| Below 50 | 100.0% | 0.0% |

| 50 | 93.3% |

6.7% |

| 51 | 86.7% |

13.3% |

| 52 | 80.0% |

20.0% |

| 53 | 73.3% |

26.7% |

| 54 | 66.7% |

33.3% |

| 55 | 60.0% |

40.0% |

| 56 | 53.3% | 46.7% |

| 57 | 46.7% | 53.3% |

| 58 | 40.0% | 60.0% |

| 59 | 33.3% | 66.7% |

| 60 | 26.7% | 73.3% |

| 61 | 20.0% | 80.0% |

| 62 | 13.3% | 86.7% |

| 63 | 6.7% | 93.3% |

| 64 and above | 0.0% | 100.0% |

| Age | Below 50 |

|---|---|

| Core Accumulation Fund ("CAF") | 100.0% |

| Age 65 Plus Fund ("A65F") | 0.0% |

| Age | 50 |

| Core Accumulation Fund ("CAF") |

93.3% |

| Age 65 Plus Fund ("A65F") |

6.7% |

| Age | 51 |

| Core Accumulation Fund ("CAF") |

86.7% |

| Age 65 Plus Fund ("A65F") |

13.3% |

| Age | 52 |

| Core Accumulation Fund ("CAF") |

80.0% |

| Age 65 Plus Fund ("A65F") |

20.0% |

| Age | 53 |

| Core Accumulation Fund ("CAF") |

73.3% |

| Age 65 Plus Fund ("A65F") |

26.7% |

| Age | 54 |

| Core Accumulation Fund ("CAF") |

66.7% |

| Age 65 Plus Fund ("A65F") |

33.3% |

| Age | 55 |

| Core Accumulation Fund ("CAF") |

60.0% |

| Age 65 Plus Fund ("A65F") |

40.0% |

| Age | 56 |

| Core Accumulation Fund ("CAF") | 53.3% |

| Age 65 Plus Fund ("A65F") | 46.7% |

| Age | 57 |

| Core Accumulation Fund ("CAF") | 46.7% |

| Age 65 Plus Fund ("A65F") | 53.3% |

| Age | 58 |

| Core Accumulation Fund ("CAF") | 40.0% |

| Age 65 Plus Fund ("A65F") | 60.0% |

| Age | 59 |

| Core Accumulation Fund ("CAF") | 33.3% |

| Age 65 Plus Fund ("A65F") | 66.7% |

| Age | 60 |

| Core Accumulation Fund ("CAF") | 26.7% |

| Age 65 Plus Fund ("A65F") | 73.3% |

| Age | 61 |

| Core Accumulation Fund ("CAF") | 20.0% |

| Age 65 Plus Fund ("A65F") | 80.0% |

| Age | 62 |

| Core Accumulation Fund ("CAF") | 13.3% |

| Age 65 Plus Fund ("A65F") | 86.7% |

| Age | 63 |

| Core Accumulation Fund ("CAF") | 6.7% |

| Age 65 Plus Fund ("A65F") | 93.3% |

| Age | 64 and above |

| Core Accumulation Fund ("CAF") | 0.0% |

| Age 65 Plus Fund ("A65F") | 100.0% |

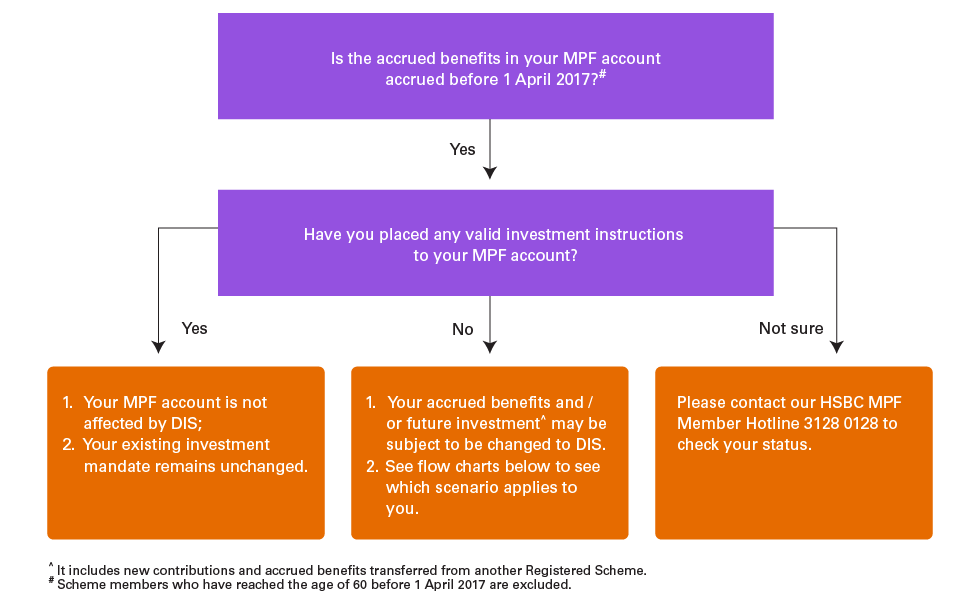

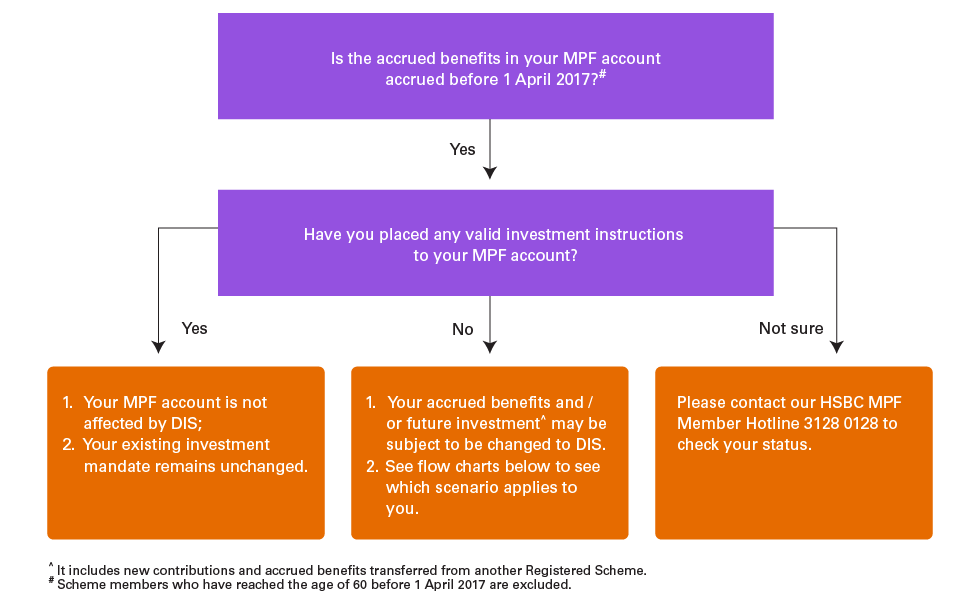

How does DIS impact you?

What do you need to do?

If you have a pre-existing MPF account set up before 1 April 2017, and if you have not made any valid investment instructions for the corresponding account such that all of your accrued benefits are currently 100% invested in the existing default fund of HSBC MPF scheme (ie MPF Conservative Fund), and if you are below or at age 60 on 1 April 2017, you may be affected by DIS.

Are you affected?

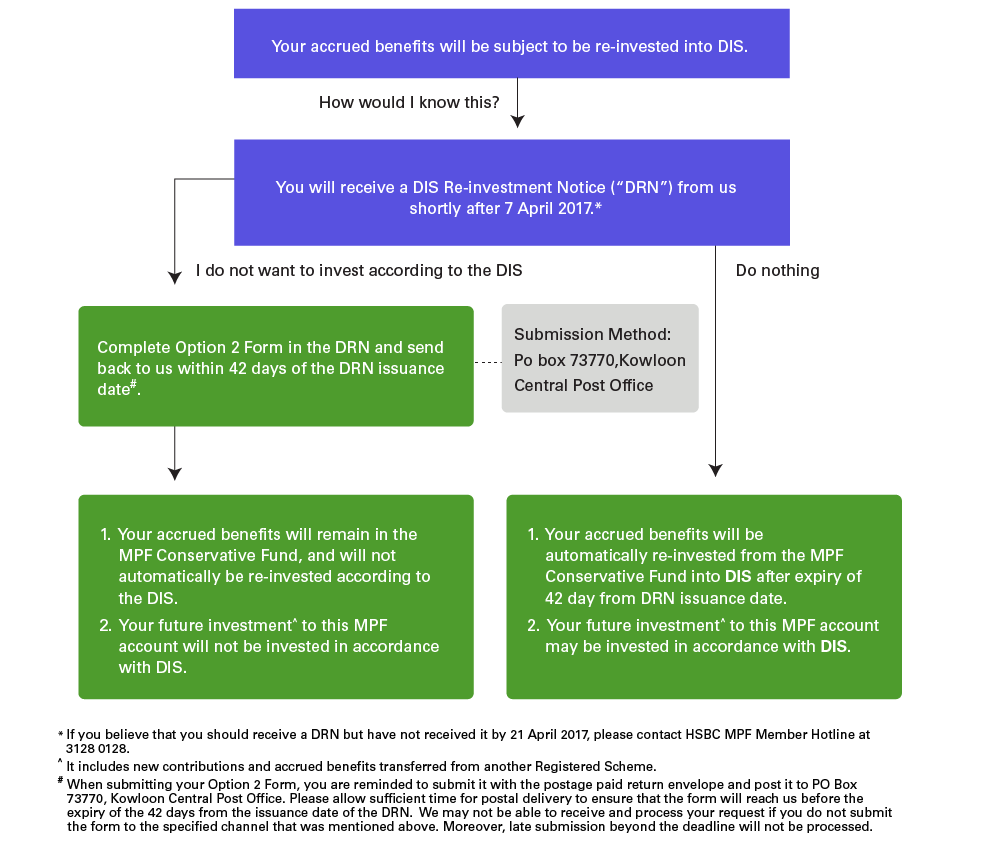

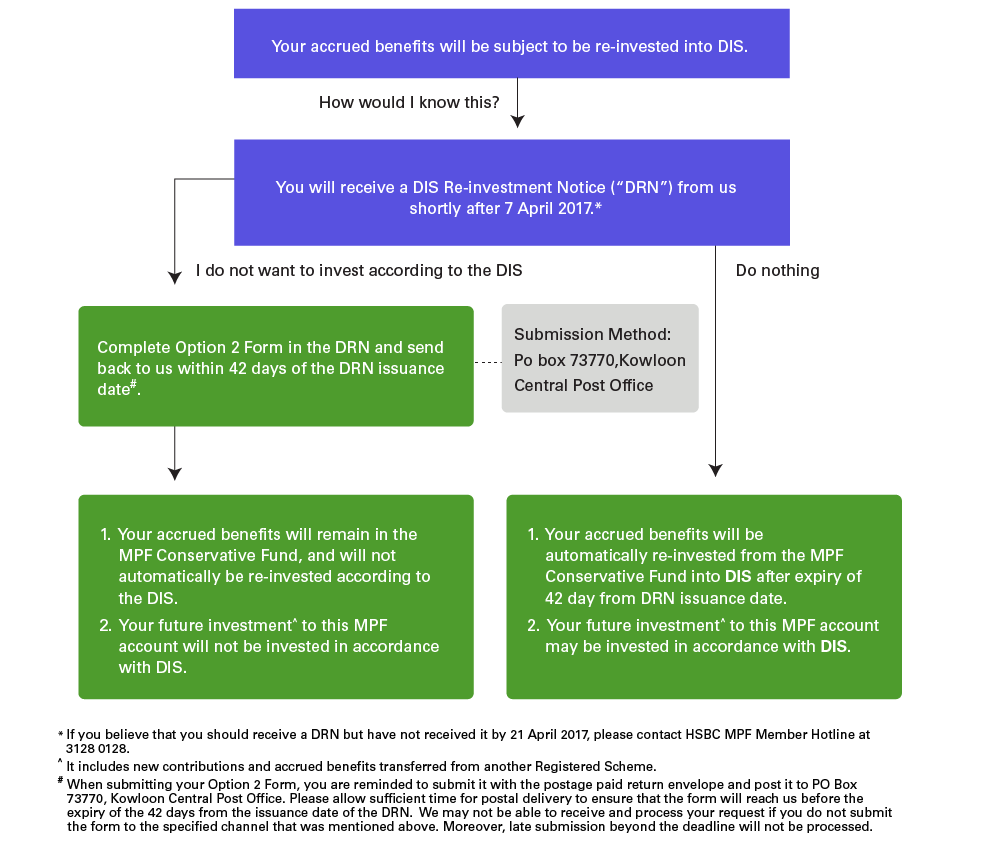

What if my accrued benefits will be affected?

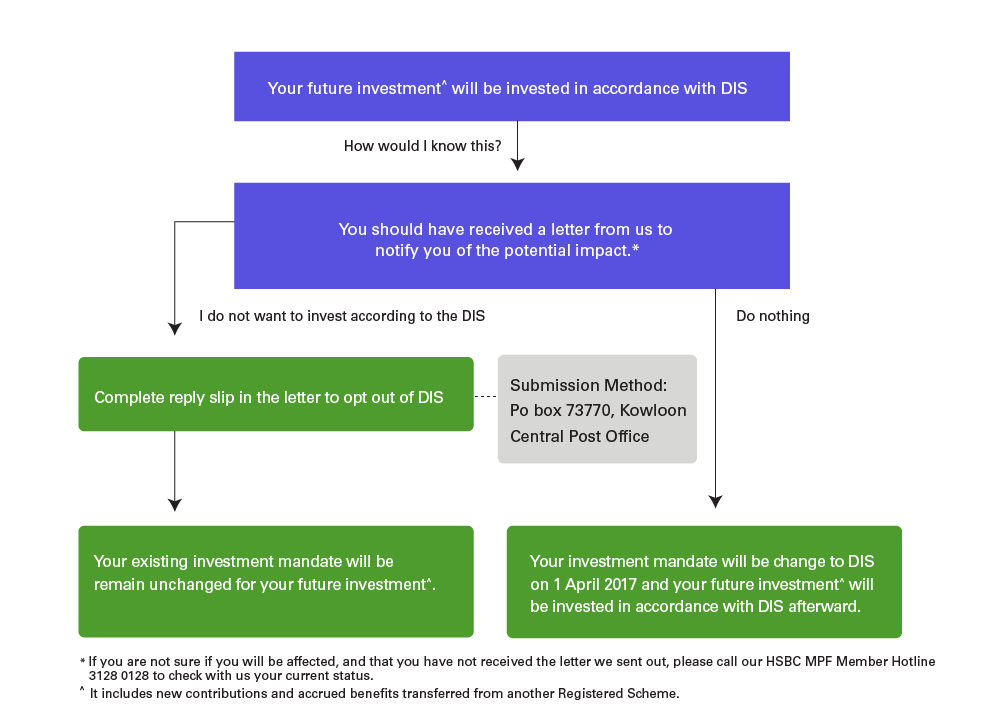

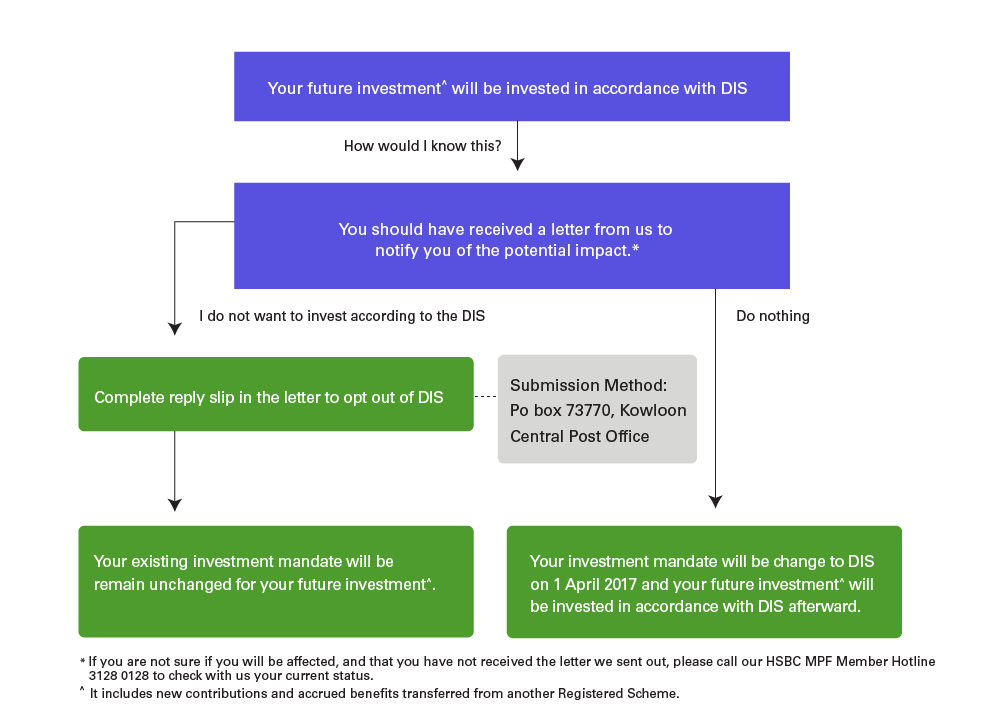

What if my future investment^ will be affected?

Key dates of DIS

| Date |

Details |

|---|---|

| December 2016 |

If you're a contributing member who we've determined as not having a valid investment mandate, you'll receive a letter from us notifying you that your investment mandate will follow the Default Investment Strategy from 1 April 2017. You may review your investment choice submit a valid investment instruction before 1 April 2017 if you want to opt-out of this arrangement. |

| December 2016 onwards |

All members of HSBC MPF will receive a DIS Pre-implementation Notice, which provides general information on the DIS. You can also download this here. |

| April 2017 |

For members whose accrued benefits are subjected to be moved into DIS automatically after 1 April 2017, a DIS Re-investment Notice (DRN) will be sent to you from 7 April 2017 onwards to notify you of the arrangement. Update your contact information to make sure important notices can be delivered to you in a timely manner. If you believe that you should receive a DRN but have not received it by 21 April 2017, contact the HSBC MPF member hotline at +852 3128 0128. Click here for the DRN template.

If you do not take action after receiving the DRN, your accrued benefits will be automatically re-invested from the MPF Conservative Fund into the DIS after the 42-day expiry from the DRN issuance date. Your new contributions and accrued benefits transferred from another registered scheme following the expiry of the 42 days may be invested in accordance with the DIS.

If you don't want your accrued benefits to be re-invested according to the DIS, you should complete the Option 2 Form in the DRN and send it back to us within 42 days of the DRN issuance date. After receiving your Option 2 Form, your accrued benefits will remain in the MPF Conservative Fund, and will not be automatically re-invested according to the DIS. Your new contributions and accrued benefits transferred from another registered scheme also won't be invested in accordance with the DIS.

Important note:

Submit your Option 2 Form with a postage-paid return envelope to PO Box 73770, Kowloon Central Post Office. Allow sufficient time for postal delivery to make sure the form will reach us before the 42-day expiry from the issuance date of the DRN. We may not be able to receive and process your request if you do not submit the form to this specified channel. Late submissions beyond the deadline will not be processed. |

| Date |

December 2016 |

|---|---|

| Details |

If you're a contributing member who we've determined as not having a valid investment mandate, you'll receive a letter from us notifying you that your investment mandate will follow the Default Investment Strategy from 1 April 2017. You may review your investment choice submit a valid investment instruction before 1 April 2017 if you want to opt-out of this arrangement. |

| Date |

December 2016 onwards |

| Details |

All members of HSBC MPF will receive a DIS Pre-implementation Notice, which provides general information on the DIS. You can also download this here. |

| Date |

April 2017 |

| Details |

For members whose accrued benefits are subjected to be moved into DIS automatically after 1 April 2017, a DIS Re-investment Notice (DRN) will be sent to you from 7 April 2017 onwards to notify you of the arrangement. Update your contact information to make sure important notices can be delivered to you in a timely manner. If you believe that you should receive a DRN but have not received it by 21 April 2017, contact the HSBC MPF member hotline at +852 3128 0128. Click here for the DRN template.

If you do not take action after receiving the DRN, your accrued benefits will be automatically re-invested from the MPF Conservative Fund into the DIS after the 42-day expiry from the DRN issuance date. Your new contributions and accrued benefits transferred from another registered scheme following the expiry of the 42 days may be invested in accordance with the DIS.

If you don't want your accrued benefits to be re-invested according to the DIS, you should complete the Option 2 Form in the DRN and send it back to us within 42 days of the DRN issuance date. After receiving your Option 2 Form, your accrued benefits will remain in the MPF Conservative Fund, and will not be automatically re-invested according to the DIS. Your new contributions and accrued benefits transferred from another registered scheme also won't be invested in accordance with the DIS.

Important note:

Submit your Option 2 Form with a postage-paid return envelope to PO Box 73770, Kowloon Central Post Office. Allow sufficient time for postal delivery to make sure the form will reach us before the 42-day expiry from the issuance date of the DRN. We may not be able to receive and process your request if you do not submit the form to this specified channel. Late submissions beyond the deadline will not be processed. |

Download area

HSBC MPF Documents

MPFA Publications (Download from MPFA's Website)

HSBC MPF Publications (Content is edited by Sky Post)

What is DIS?

What is DIS?

The Default Investment Strategy (DIS) is a standardised and fee-controlled MPF investment strategy that was applied since from 1 April 2017 as the "default" investment strategy in all MPF schemes in Hong Kong. It replaced the different default investment strategies employed by different MPF schemes prior to 1 April 2017. From now on, MPF members joining an MPF scheme without providing a valid investment choice will have their monies invested in accordance with the DIS.

The DIS consists of 2 Constituent Funds, the Core Accumulation Fund (CAF) and the Age 65 Plus Fund (A65F). Both funds adopt a globally diversified investment approach, with the CAF investing 60% of its assets in higher risk assets such as equities and 40% in lower risk assets such as global bonds and money market instruments. The A65F has 20% of its assets invested in higher risk assets, and 80% in lower risks assets.

DIS contains an automatic de-risking feature, under which, members who are below age 50 investing in DIS will have their new contributions and accrued benefits 100% invested in CAF. In general, when a member turns 50, their accrued benefits and new contributions will automatically be partially allocated to the A65F annually on their birthdays until they reach 64, when the entire accrued benefits will be invested in the A65F. This is illustrated by the diagram and the DIS de-risking table.

Another key feature of the DIS is that both the CAF and A65F are subject to a management fee cap of 0.75% of the net asset value of the fund each year (measured on a daily basis). Furthermore, there is an additional cap of 0.2% of net asset value on the recurrent out-of-pocket expenses in operating the funds.

While the DIS has been intended for members who have not made any investment choices before, it may also be an appropriate investment option for you if the features of it fits your circumstances. The DIS is available as a standalone investment option that you may choose explicitly, or you may also choose to invest in the CAF and A65F separately.

| Age | Core Accumulation Fund ("CAF") | Age 65 Plus Fund ("A65F") |

|---|---|---|

| Below 50 | 100.0% | 0.0% |

| 50 | 93.3% |

6.7% |

| 51 | 86.7% |

13.3% |

| 52 | 80.0% |

20.0% |

| 53 | 73.3% |

26.7% |

| 54 | 66.7% |

33.3% |

| 55 | 60.0% |

40.0% |

| 56 | 53.3% | 46.7% |

| 57 | 46.7% | 53.3% |

| 58 | 40.0% | 60.0% |

| 59 | 33.3% | 66.7% |

| 60 | 26.7% | 73.3% |

| 61 | 20.0% | 80.0% |

| 62 | 13.3% | 86.7% |

| 63 | 6.7% | 93.3% |

| 64 and above | 0.0% | 100.0% |

| Age | Below 50 |

|---|---|

| Core Accumulation Fund ("CAF") | 100.0% |

| Age 65 Plus Fund ("A65F") | 0.0% |

| Age | 50 |

| Core Accumulation Fund ("CAF") |

93.3% |

| Age 65 Plus Fund ("A65F") |

6.7% |

| Age | 51 |

| Core Accumulation Fund ("CAF") |

86.7% |

| Age 65 Plus Fund ("A65F") |

13.3% |

| Age | 52 |

| Core Accumulation Fund ("CAF") |

80.0% |

| Age 65 Plus Fund ("A65F") |

20.0% |

| Age | 53 |

| Core Accumulation Fund ("CAF") |

73.3% |

| Age 65 Plus Fund ("A65F") |

26.7% |

| Age | 54 |

| Core Accumulation Fund ("CAF") |

66.7% |

| Age 65 Plus Fund ("A65F") |

33.3% |

| Age | 55 |

| Core Accumulation Fund ("CAF") |

60.0% |

| Age 65 Plus Fund ("A65F") |

40.0% |

| Age | 56 |

| Core Accumulation Fund ("CAF") | 53.3% |

| Age 65 Plus Fund ("A65F") | 46.7% |

| Age | 57 |

| Core Accumulation Fund ("CAF") | 46.7% |

| Age 65 Plus Fund ("A65F") | 53.3% |

| Age | 58 |

| Core Accumulation Fund ("CAF") | 40.0% |

| Age 65 Plus Fund ("A65F") | 60.0% |

| Age | 59 |

| Core Accumulation Fund ("CAF") | 33.3% |

| Age 65 Plus Fund ("A65F") | 66.7% |

| Age | 60 |

| Core Accumulation Fund ("CAF") | 26.7% |

| Age 65 Plus Fund ("A65F") | 73.3% |

| Age | 61 |

| Core Accumulation Fund ("CAF") | 20.0% |

| Age 65 Plus Fund ("A65F") | 80.0% |

| Age | 62 |

| Core Accumulation Fund ("CAF") | 13.3% |

| Age 65 Plus Fund ("A65F") | 86.7% |

| Age | 63 |

| Core Accumulation Fund ("CAF") | 6.7% |

| Age 65 Plus Fund ("A65F") | 93.3% |

| Age | 64 and above |

| Core Accumulation Fund ("CAF") | 0.0% |

| Age 65 Plus Fund ("A65F") | 100.0% |

How does DIS impact you ?

How does DIS impact you?

What do you need to do?

If you have a pre-existing MPF account set up before 1 April 2017, and if you have not made any valid investment instructions for the corresponding account such that all of your accrued benefits are currently 100% invested in the existing default fund of HSBC MPF scheme (ie MPF Conservative Fund), and if you are below or at age 60 on 1 April 2017, you may be affected by DIS.

Are you affected?

What if my accrued benefits will be affected?

What if my future investment^ will be affected?

Key dates of DIS

Key dates of DIS

| Date |

Details |

|---|---|

| December 2016 |

If you're a contributing member who we've determined as not having a valid investment mandate, you'll receive a letter from us notifying you that your investment mandate will follow the Default Investment Strategy from 1 April 2017. You may review your investment choice submit a valid investment instruction before 1 April 2017 if you want to opt-out of this arrangement. |

| December 2016 onwards |

All members of HSBC MPF will receive a DIS Pre-implementation Notice, which provides general information on the DIS. You can also download this here. |

| April 2017 |

For members whose accrued benefits are subjected to be moved into DIS automatically after 1 April 2017, a DIS Re-investment Notice (DRN) will be sent to you from 7 April 2017 onwards to notify you of the arrangement. Update your contact information to make sure important notices can be delivered to you in a timely manner. If you believe that you should receive a DRN but have not received it by 21 April 2017, contact the HSBC MPF member hotline at +852 3128 0128. Click here for the DRN template.

If you do not take action after receiving the DRN, your accrued benefits will be automatically re-invested from the MPF Conservative Fund into the DIS after the 42-day expiry from the DRN issuance date. Your new contributions and accrued benefits transferred from another registered scheme following the expiry of the 42 days may be invested in accordance with the DIS.

If you don't want your accrued benefits to be re-invested according to the DIS, you should complete the Option 2 Form in the DRN and send it back to us within 42 days of the DRN issuance date. After receiving your Option 2 Form, your accrued benefits will remain in the MPF Conservative Fund, and will not be automatically re-invested according to the DIS. Your new contributions and accrued benefits transferred from another registered scheme also won't be invested in accordance with the DIS.

Important note:

Submit your Option 2 Form with a postage-paid return envelope to PO Box 73770, Kowloon Central Post Office. Allow sufficient time for postal delivery to make sure the form will reach us before the 42-day expiry from the issuance date of the DRN. We may not be able to receive and process your request if you do not submit the form to this specified channel. Late submissions beyond the deadline will not be processed. |

| Date |

December 2016 |

|---|---|

| Details |

If you're a contributing member who we've determined as not having a valid investment mandate, you'll receive a letter from us notifying you that your investment mandate will follow the Default Investment Strategy from 1 April 2017. You may review your investment choice submit a valid investment instruction before 1 April 2017 if you want to opt-out of this arrangement. |

| Date |

December 2016 onwards |

| Details |

All members of HSBC MPF will receive a DIS Pre-implementation Notice, which provides general information on the DIS. You can also download this here. |

| Date |

April 2017 |

| Details |

For members whose accrued benefits are subjected to be moved into DIS automatically after 1 April 2017, a DIS Re-investment Notice (DRN) will be sent to you from 7 April 2017 onwards to notify you of the arrangement. Update your contact information to make sure important notices can be delivered to you in a timely manner. If you believe that you should receive a DRN but have not received it by 21 April 2017, contact the HSBC MPF member hotline at +852 3128 0128. Click here for the DRN template.

If you do not take action after receiving the DRN, your accrued benefits will be automatically re-invested from the MPF Conservative Fund into the DIS after the 42-day expiry from the DRN issuance date. Your new contributions and accrued benefits transferred from another registered scheme following the expiry of the 42 days may be invested in accordance with the DIS.

If you don't want your accrued benefits to be re-invested according to the DIS, you should complete the Option 2 Form in the DRN and send it back to us within 42 days of the DRN issuance date. After receiving your Option 2 Form, your accrued benefits will remain in the MPF Conservative Fund, and will not be automatically re-invested according to the DIS. Your new contributions and accrued benefits transferred from another registered scheme also won't be invested in accordance with the DIS.

Important note:

Submit your Option 2 Form with a postage-paid return envelope to PO Box 73770, Kowloon Central Post Office. Allow sufficient time for postal delivery to make sure the form will reach us before the 42-day expiry from the issuance date of the DRN. We may not be able to receive and process your request if you do not submit the form to this specified channel. Late submissions beyond the deadline will not be processed. |