Bank anywhere, anytime with phone banking from HSBC

A single number for all your phone banking services.

Features of HSBC phone banking

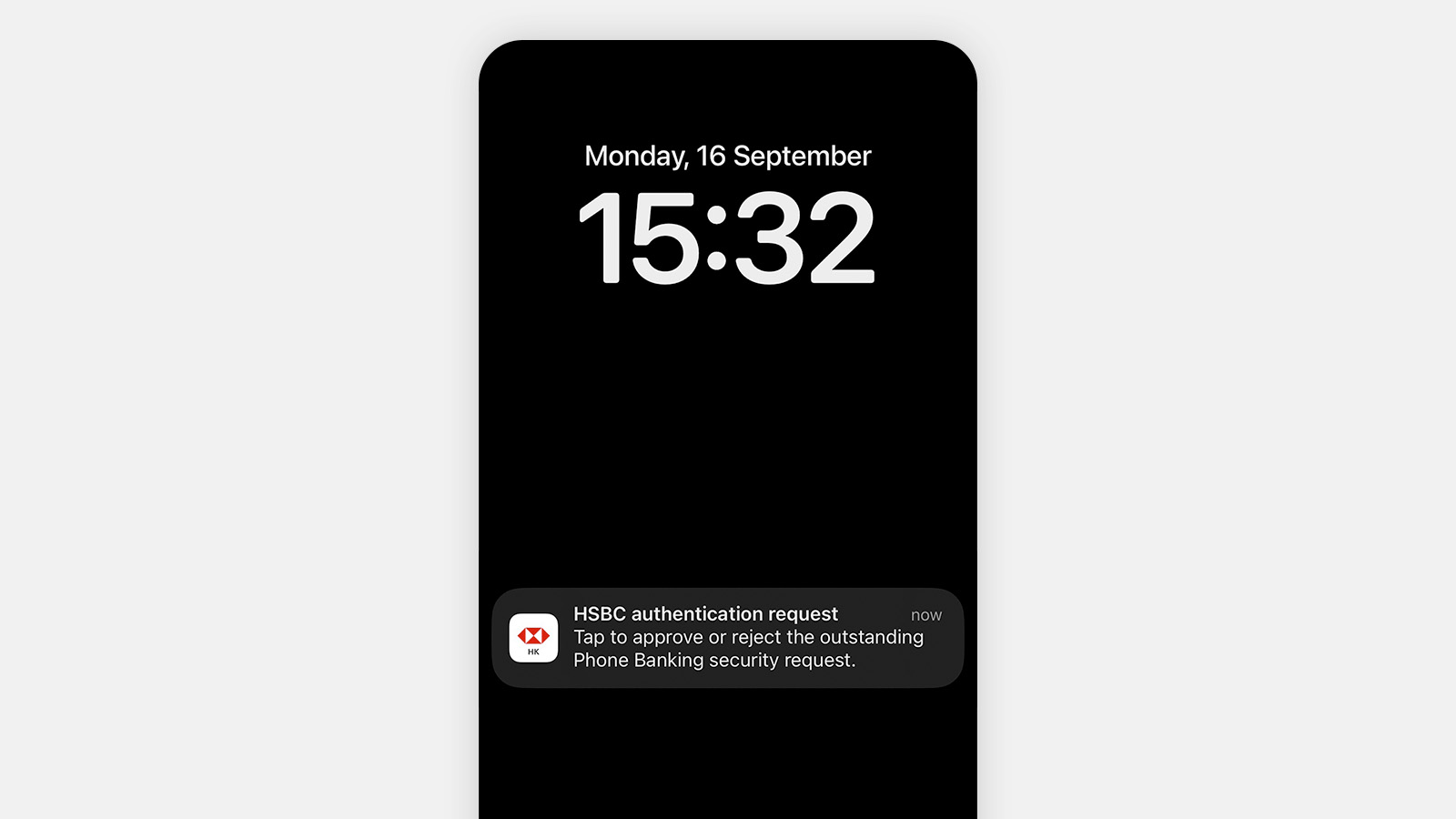

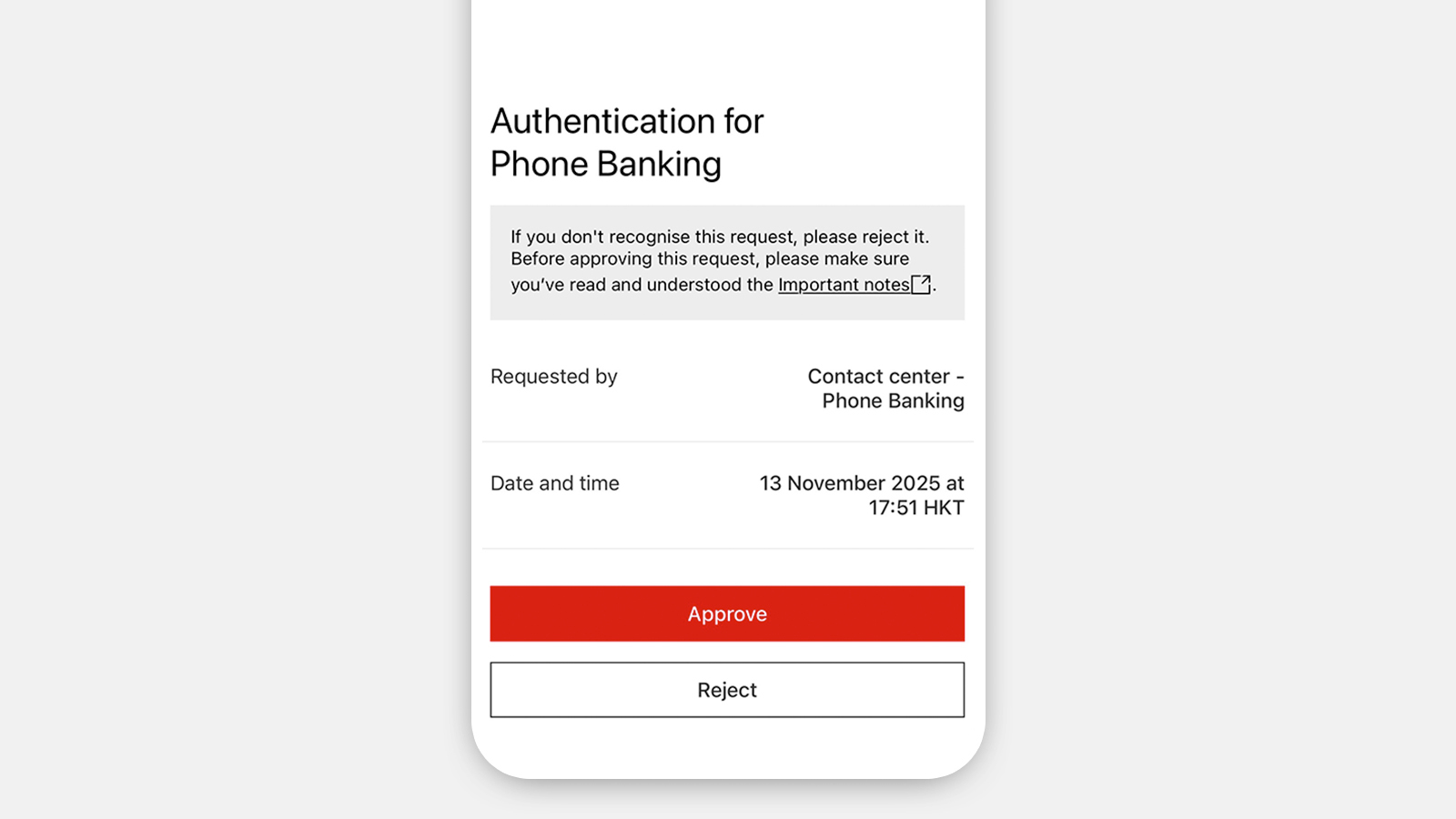

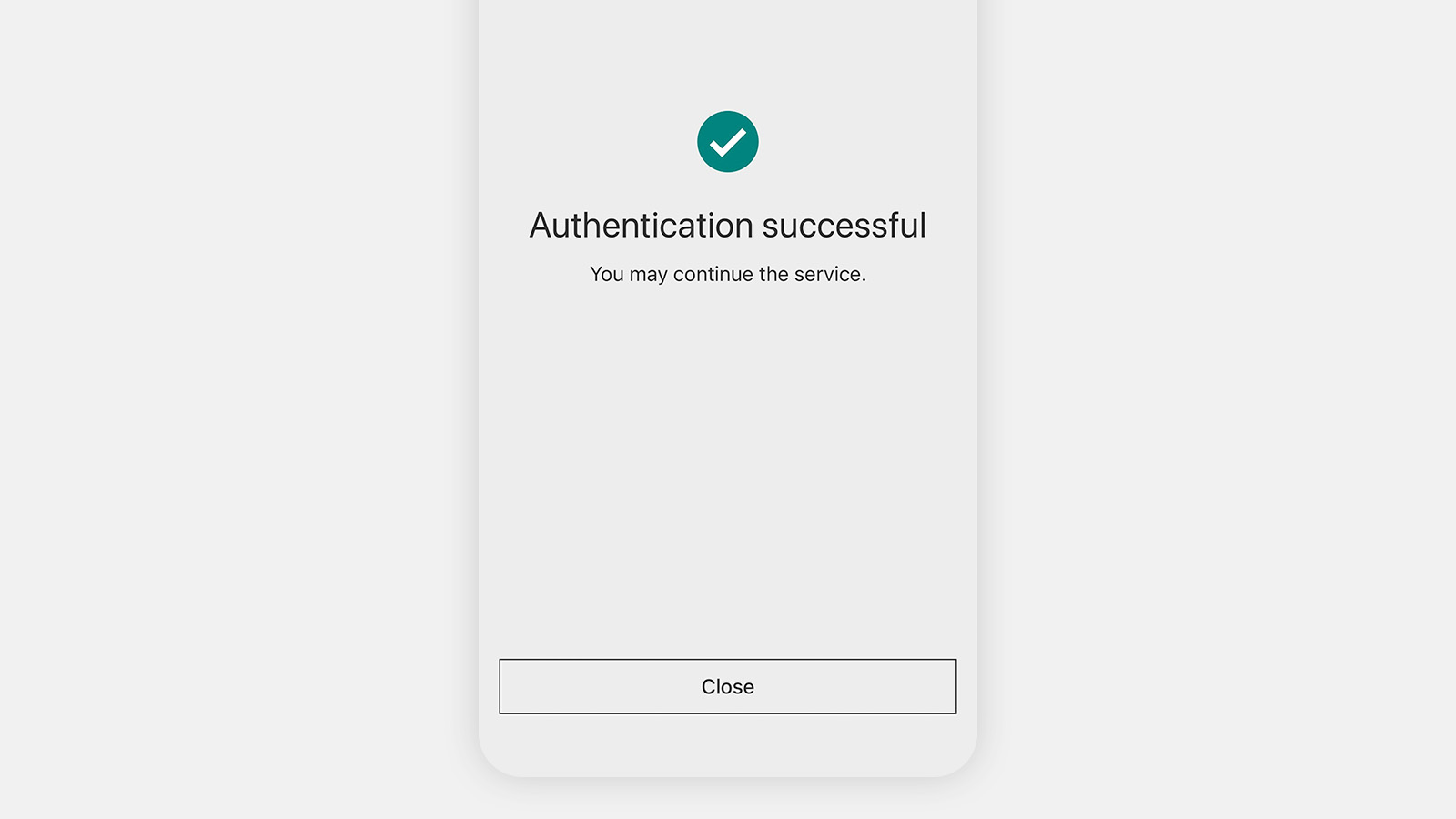

HSBC in-app authentication[@wtb-in-app-auth-tnc]

We can now verify your identity by sending an authentication request to your HSBC HK App when you call us or 'chat with us'. Once you've approved it, you can access our full suite of automated banking services or connect with our customer service officer to process your request[@wtb-in-app-auth-request].

Caller line identification

No more entering your bank account or credit card number every time when you bank with us on your phone.

Now call us from your registered HK mobile number and our system will be able to recognise your banking profile.

This feature is only applicable for HK mobile number maintained in customer's record with the bank, subjected to mobile number received from telecom service provider.

If you aren't calling from your registered HK mobile number, you can still enter your mobile number for the identification process. If you're calling from a non-local number, you'll need to enter the country or region code, followed by your non-local number. Alternatively, you can go through the usual steps of entering your bank account or credit card number. After entering your mobile number, account number or credit card number, you can verify your identity using your phone banking PIN or in-app authentication.

Conversational phone banking

We've made phone banking an even easier and more natural experience now. Just call us and say what you need help with – our speech recognition technology will be able to understand you and direct you to the service you need.

Here's what our innovative phone banking service offers at a glance:

- Smart technology that recognises your query and directs you to the right place

- A voice-driven menu that replaces the touch-tone menu

- Self-service options once you verify your identity via phone banking PIN or in-app authentication

- Support in 3 languages: Cantonese, English and Mandarin

Please read FAQ to learn more.

Register for phone banking

Register for phone banking easily to enjoy our full suite of services.

Your Phone Banking PIN

With one single PIN, you can now set up new accounts and services. Just use any bank account or credit card number registered in your name plus your phone banking PIN to access the service. Joint account holders also need to provide separate identity document numbers or dates of birth.

Reset Phone Banking PIN

You can reset your PIN by calling our hotline number, or at any HSBC ATM in Hong Kong.

For security reasons, resetting your PIN will also reset your phone banking transfer limit for non-registered third party accounts to zero. Visit any HSBC branch to restore your previous limit.

Got a question? Please see our FAQ.

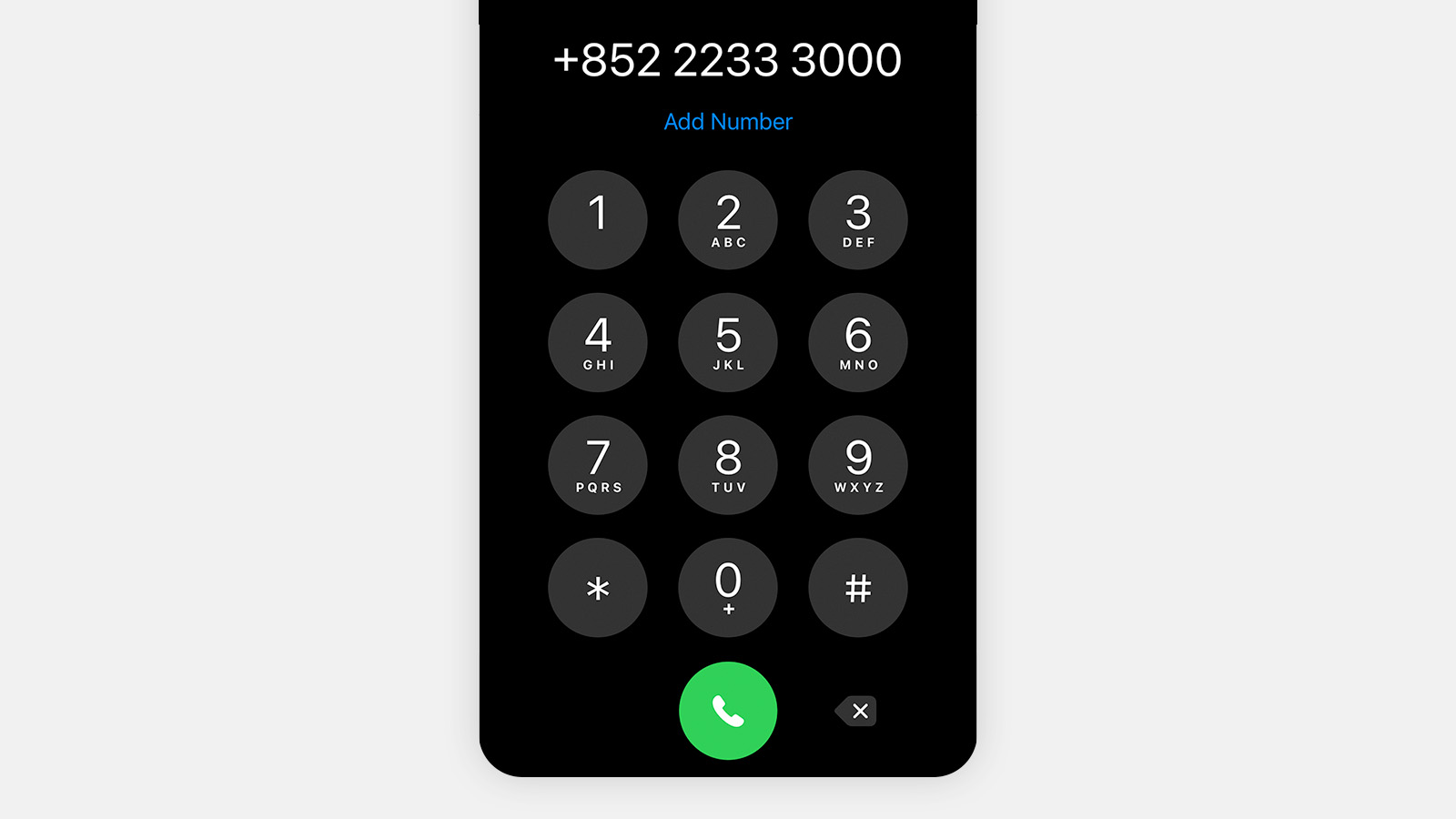

Call to find out more

Start banking with us via the hotlines below:

HSBC Global Private Banking and Premier Elite customers:

HSBC Premier customers:

Other personal banking customers:

More ways to bank

Important notice: Enhance the security of phone banking

To enhance the security of phone banking, in addition to verification with your phone banking PIN or HSBC in-app authentication, we may need to verify you with a one-time passcode sent by SMS for some of the transactions. We may also send a notification to your mobile number and/or e-mail address registered with the bank once the transaction is completed. For details, please contact our phone banking customer service officer.

Related information

The Code of Practice on Person-to-Person Marketing Calls (CoP) promotes good banking practices. It is issued by Hong Kong Association of Banks (HKAB) and the Hong Kong Association of Restricted License Banks and Deposit-taking Companies (DTC Association) and endorsed by the Office of the Telecommunications Authority.

Visit the HKAB website for the full document of the CoP.