Convert your available credit limit into handy cash or transfer the outstanding balance from another credit card to your HSBC credit card account to reduce interest expenses. HSBC credit card Cash Instalment plan allows you to repay your approved amount by 6-60 months instalment. Apply now to enjoy your financial flexibility.

Features

- Personalised monthly handling fee as low as 0.13%1

- 6-60 months repayment periods

- Scheduled monthly repayment with fixed repayment amount and repayment period

Direct cash disbursement to your designated account

Up to HKD1,100 spending credit. Terms and Conditions apply.

Example – calculation of monthly repayment amount for the HSBC credit card Cash Instalment Plan

| Monthly Instalment Principal |

Monthly Handling Fee |

Monthly Repayment Amount |

||

|---|---|---|---|---|

HKD5,555.56 (= HKD200,000 ÷ 36) |

+ | HKD260(= HKD200,000 x 0.13%)

|

= | HKD5,815.56 |

*Assume 30 calendar days per month, daily handling fee is only HKD8.67 ( = HKD200,000 x 0.13% ÷ 30). The annualised percentage rate is 3.03% (calculated based on 36 months repayment period). This example is based on a customer making full payment of monthly repayment amount.

How to apply

Existing customer

New customer

Application Hotline

Download and apply via HSBC HK Mobile Banking app

Document Upload

How to apply Cash Instalment Plan on the HSBC Hong Kong Mobile Banking app

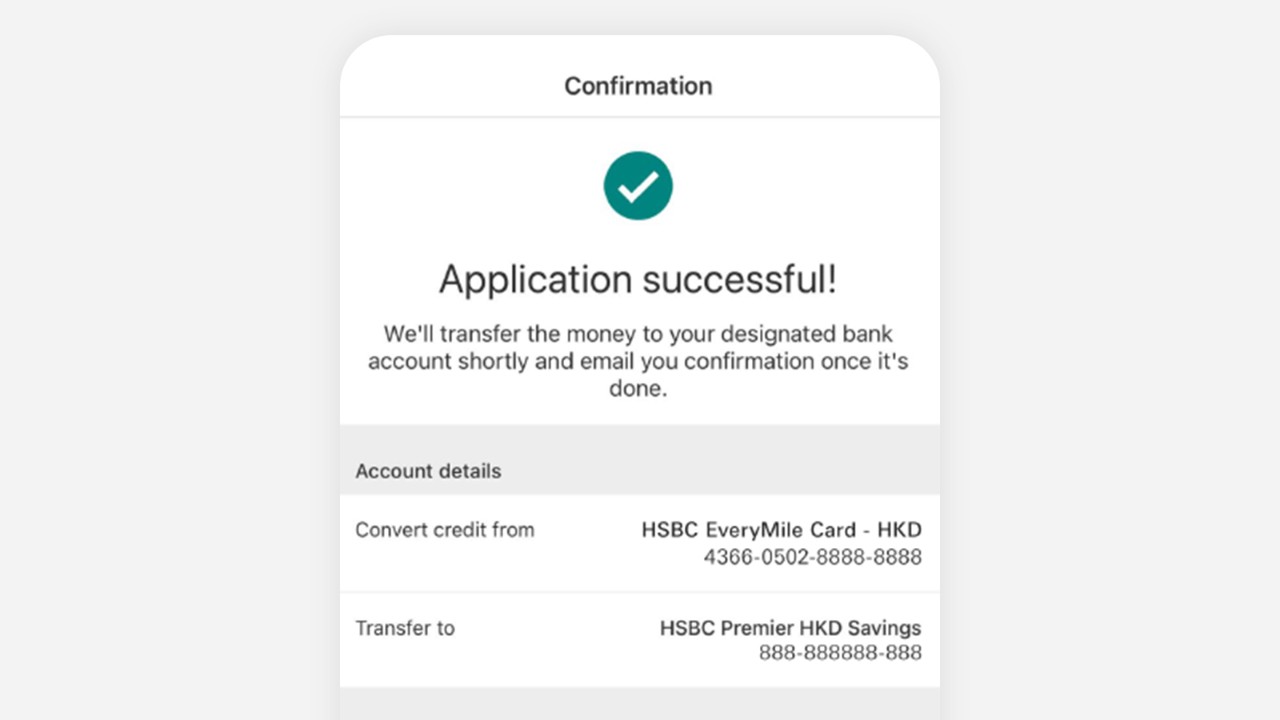

This video shows you how to apply Cash Instalment Plan in a fast easy way via HSBC HK App

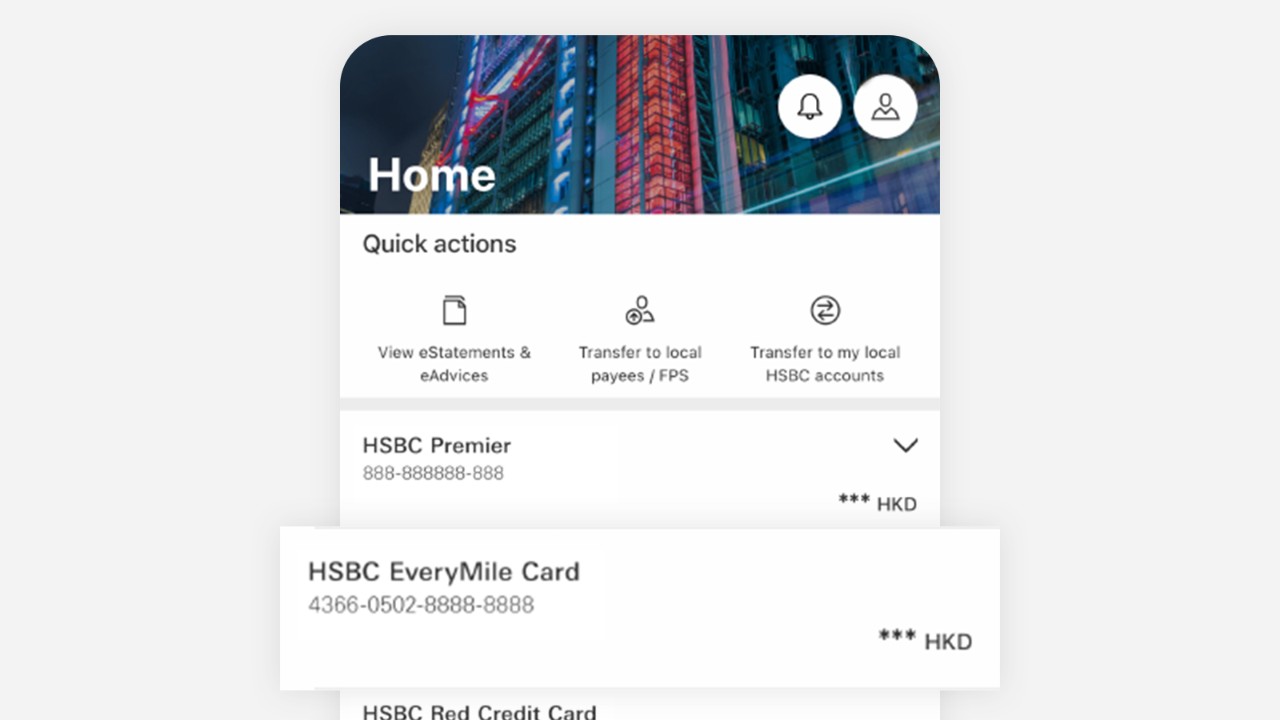

Step 1: Select one of your HKD credit cards

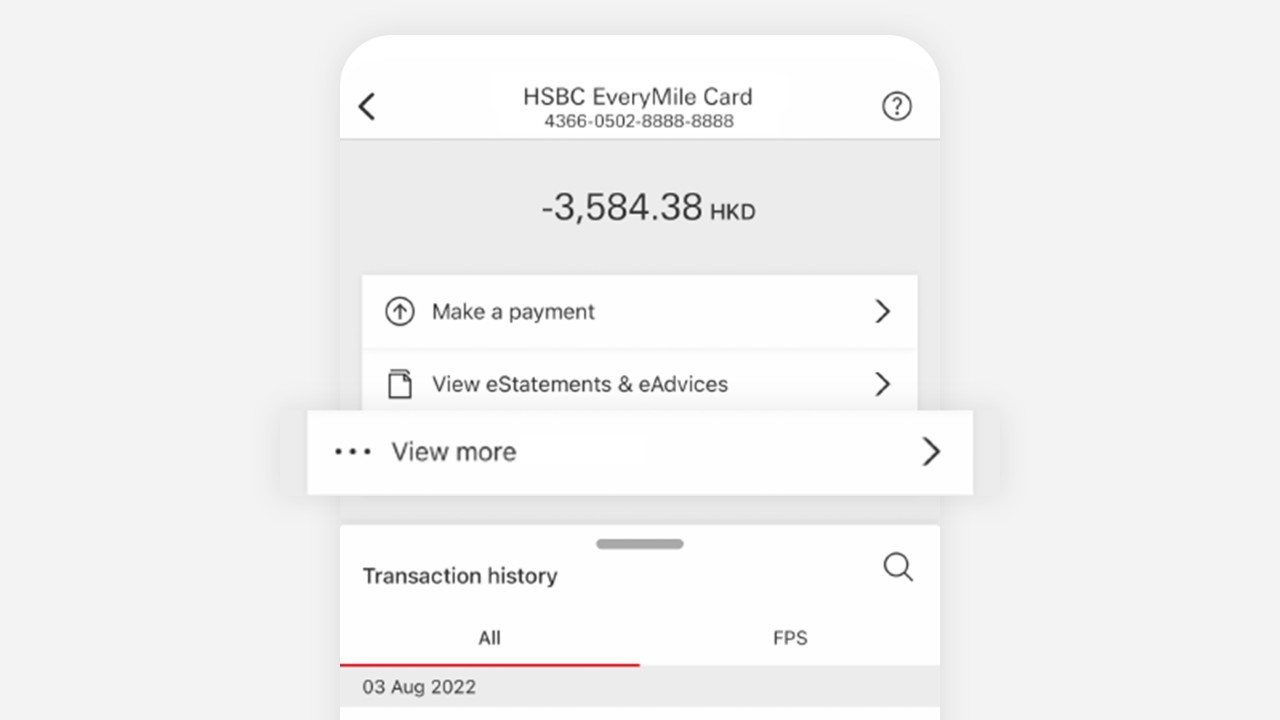

Step 2: Tap on View more

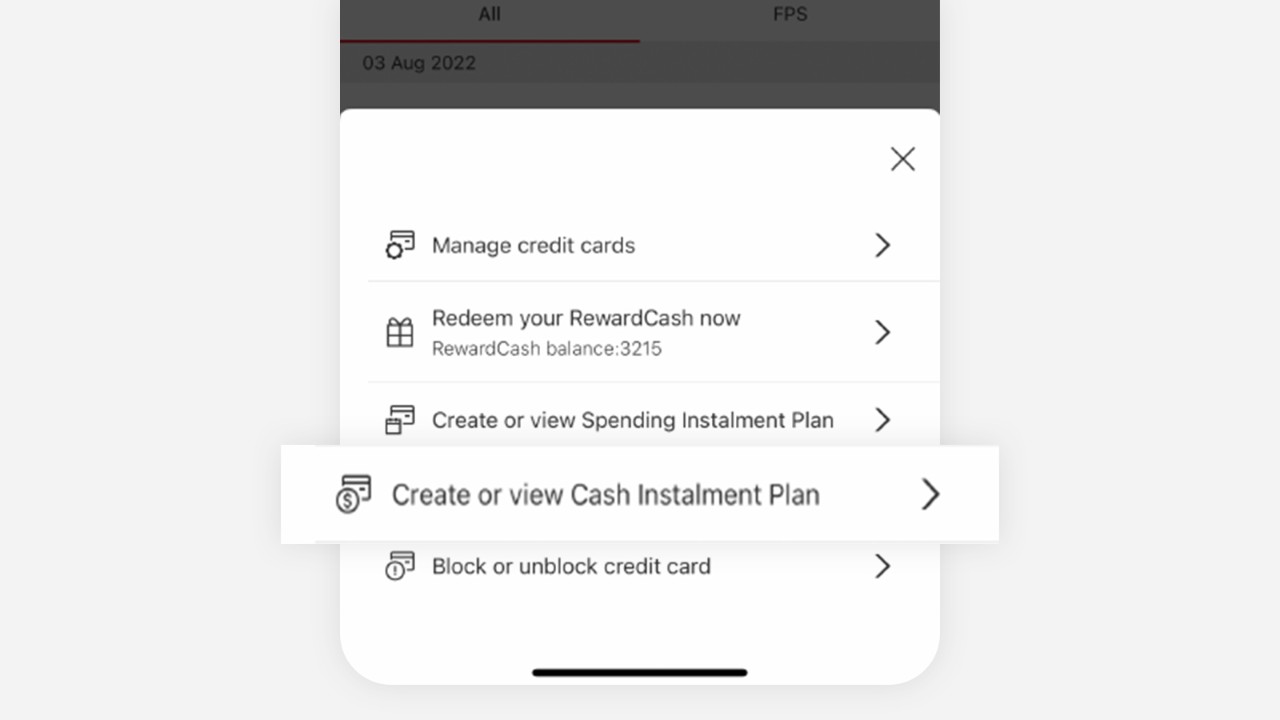

Step 3: Select 'Create or view Cash Instalment Plan'

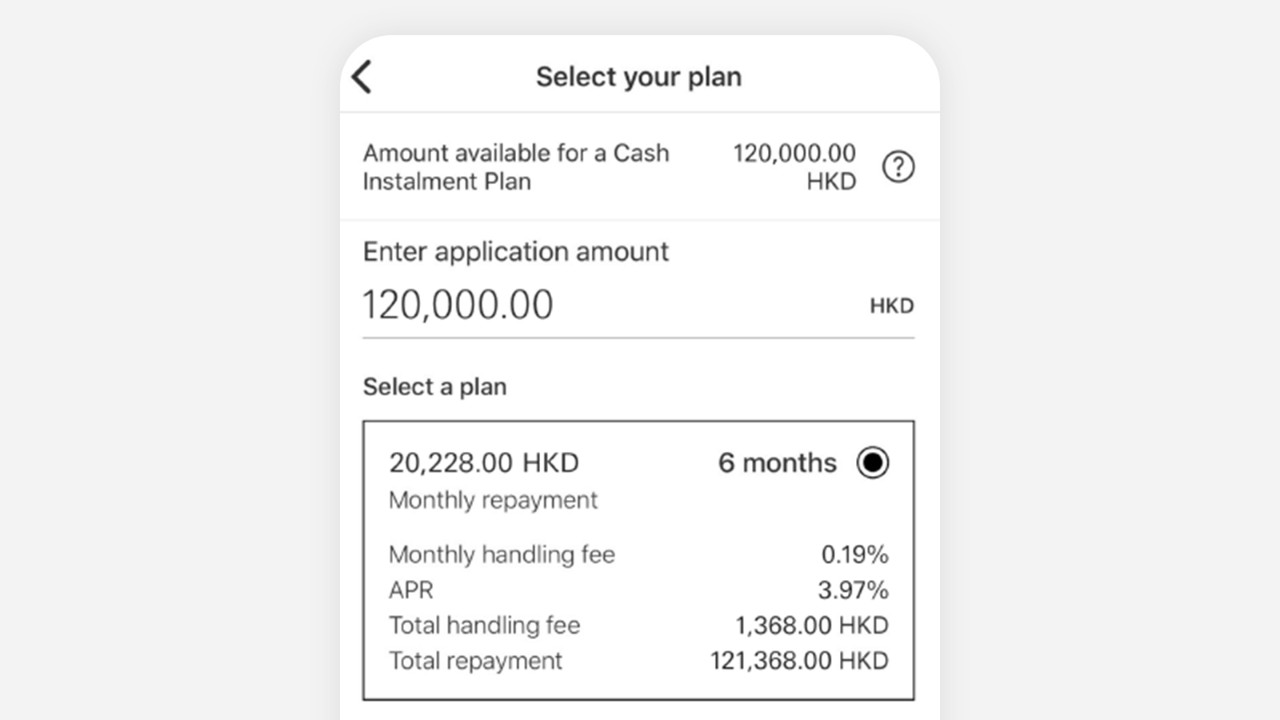

Step 4: Input application details

Step 5: Instant application result

The screens above are for illustration only. Applicant is required to go through all necessary steps during the application process and will be asked to accept the relevant terms and conditions.

Product resources and services

Document Upload

Submit supporting document for Cash Instalment Plan application.

Tips to get cash from credit cards

Travelling is so easy.

Related products

Spending Instalment Plan

Get greater financial flexibility when you repay your credit card balance by instalments.

Personal Instalment Loan

Fixed monthly payments so you can plan accurately.

HSBC credit cards

Enjoy exclusive rewards and privileges when you shop, eat and travel with an HSBC credit card.

To borrow or not to borrow? Borrow only if you can repay!

Important information

Remarks

- The 0.13% personalised monthly handling fee of HSBC credit card Cash Instalment Plan is applicable to selected customers and the approved withdrawal amount has to reach the specific requirement, and is for reference only. The handling fee is to be determined by HSBC from time to time for individual promotion. The annualized percentage rate ("APR") of 0.13% monthly handling fee are as follows: 2.70% for 6 months, 2.91% for 12 months, 2.98% for 18 months, 3.01% for 24 months, 3.02% for 30 months, 3.03% for 36 months, 3.04% for 42 months, 3.04% for 48 months, 3.04% for 54 months, 3.04% for 60 months.The APR is calculated based on the requirement of the Code of Banking Practice. APR is a reference rate which expresses the fees and charges of respective product as an annualized rate. The minimum withdrawal amount is HKD2,000 and the maximum withdrawal amount is 100% of the credit limit of the cardholder's designated HSBC credit card account.

- Please note that we do not appoint any third parties to refer Cash Instalment Plan applications to us and will not process any application that was referred by a third party under beneficial arrangement. For enquiry, please call our hotline at (852)2233 3000.