Table of contents

- General Credit Card FAQs

- Rewards FAQs

- HSBC Reward+ App FAQs

- Apple Pay FAQs

- Google Pay FAQs

- Samsung Pay FAQs

- Cash Instalment Plan FAQs

- Cash Credit Plan FAQs

- Spending Instalment Plan FAQs

- Credit Limit Increase FAQs

- Submit Supporting Documents FAQs

- 2 Way SMS FAQs

- Verification Code for Online Transaction/HSBC HK App Online Transaction Authentication Service

General Credit Card

How long will it take to get my new credit card?

Once we receive your application and supporting documents, please allow us up to 6 working days to process them. If your application is approved, we’ll send you your new credit card within 3 to 5 working days.

Rewards

Can I take part in the Standalone RewardCash Programme?

Yes, you can take part in the RewardCash Programme if you hold a personal HSBC credit card or you have a Standalone RewardCash Programme profile.

But if you hold a standalone private label card or an iCAN card, you're not eligible for the programme.

HSBC Reward+ App

What can I see in 'Offers'?

In 'Offers', you can:

- Explore all the latest offers and promotions for our HSBC credit cards and bank accounts

- Check out offers and promotions that are exclusive to Reward+

- Register for offers and promotions

Apple Pay

What is Apple Pay?

Apple Pay is one of the mobile payments solutions that's available to HSBC personal card cardholders. It provides a fast, easy and private way to pay in stores with your compatible iPhone or Apple Watch, and in some apps on your compatible iPhone or iPad. Simply add your HSBC Visa, Mastercard or UnionPay Dual Currency Credit Card or ATM card (with the UnionPay logo) to Apple Wallet and you can make payments with Apple Pay.

Google Pay

What is Google Pay?

Google Pay is one of the Mobile Payments solutions available to HSBC personal card cardholders. It provides a simple and secure way to pay using your compatible Android devices. Choose your device and add your HSBC credit card to Google Pay app to make transactions with your Android device in stores or in app.

Samsung Pay

What is Samsung Pay?

Samsung Pay is one of the Mobile Payments solutions available to HSBC personal card cardholders. Samsung Pay is a secure and easy-to-use mobile payment service which employs Magnetic Secure Transmission (MST) and Near Field Communication (NFC) technology, making it available almost anywhere accepting credit cards. Add your HSBC credit card to Samsung Pay app to make transactions with your Samsung device in stores or in app.

Cash Instalment plan

Do I save interest expenses by making early repayment of Cash Instalment Plan?

The Monthly Instalment Amount is calculated by dividing the aggregate of the Loan and all the handling fees by the relevant number of instalments. The same handling fee will be charged for each instalment. You can choose to make early repayment, however, the total outstanding principal amount plus an early repayment fee calculated at 2% of such outstanding principal amount will be charged (except early repayment during cooling-off period*). For HSBC Privé, the early repayment fee is waived. If you choose to pay off the loan early, the loss may outweigh the gain as the amount of handling fee saved may not be enough to cover the relevant fees and charges for early repayment. You may contact us to check about the total amount involved in early repayment (including outstanding principal amount, early repayment fee and other fees, etc.). You should then compare the outstanding handling fee and early repayment fee and consider carefully before making a decision of repaying early or not.

Can I request to make early repayment of the total outstanding amount?

You can choose to make early repayment, however, the total amount of outstanding principal amount plus an early repayment fee calculated at 2% of such outstanding principal amount will be charged (except early repayment during cooling-off period*). Therefore, you are advised to make careful consideration before making any early repayment decision. For HSBC Privé, the early repayment fee is waived.

Cash Credit Plan

Do I need to provide any supporting documents when I apply for a Cash Credit Plan?

You may need to upload your proof of income to complete your Cash Credit Plan application. You can do so through the following ways:

- On the HSBC website: Go to 'Borrowing' and select 'Submit documents for Cash Credit Plan'.

- By mail: Make sure you state your HKID or credit card number on your proof of income, and mark it for 'Cash Credit Plan application'.

Spending Instalment plan

Can I request to make early repayment of the total outstanding amount?

You can choose to make early repayment, however, the total amount of outstanding monthly handling fee for the remaining Instalment Period plus any interest (if applicable) and an administration fee of HKD300 will be charged. Therefore, you are advised to make careful consideration before making any early repayment decision. For HSBC Privé, the early repayment fee is waived.

Credit Limit Increase

How can I apply credit card limit increase via the HSBC HK App?

Simply log on to the HSBC HK App and follow these steps to increase the credit limit for your card.

- Select the credit card you want to increase the credit limit for.

- Choose 'More', and 'Credit limit increase'.

- Enter your preferred credit limit and declare your relationship with HSBC.

- Review the information, accept the credit card terms and key facts statement, then select ‘Confirm’.

Please note the credit limit increase is subject to bank checks and approvals. If need be, we'll request you to upload your income proof. It'll take up to 4 working days process your application.

Submit supporting documents

What supporting documents do I need to submit for my credit card application?

You don't need to submit any supporting documents if you meet all of the following criteria:

- You're already an HSBC customer

- You have a payroll account with us

- You hold an HKID card

If you'd like to set a payroll account up before you apply for a credit card, simply mail us a completed instruction form for setting up / transfer of salary autoPay (PDF).

If you don't meet any of those criteria, we'll ask you to provide the following documents.

Proof of identity

If you don't hold an HKID card, please provide a copy of your passport (page with photo) or your Exit-Entry Permit for Travelling to and from Hong Kong and Macau. You'll also need to provide a copy of your employment contract. Your employment contract should show a contract period of at least 9 months from the date you submit your application.

Proof of income or assets

We accept the following as proof of income:

- Bank book

- Bank statement or eStatement

- Online transaction history

If you earn regular income, please provide proof of income from the past 1 month.

If you earn irregular income or work part-time, please provide proof of income from the past 3 months.

If you're self-employed, please provide proof of income from the past 3 months or your latest tax demand note. You'll also need to provide a current Business Registration Certificate, proof of ownership of business and your tax return from over the past 2 years.

If you earn income as a landlord, please provide proof of income or regular monthly rental income from the past 3 months. You'll also need to provide a copy of the signed tenancy agreement.

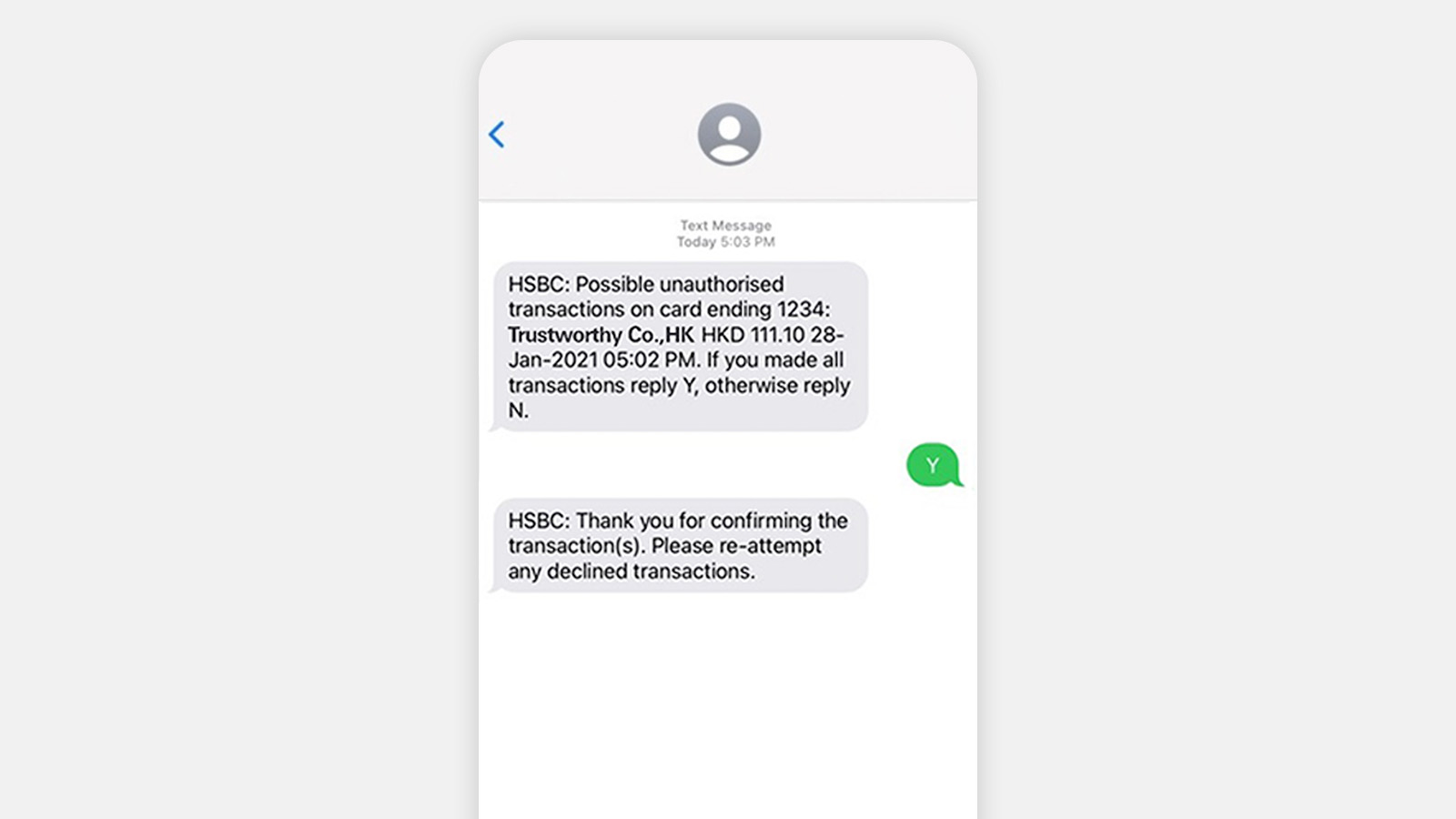

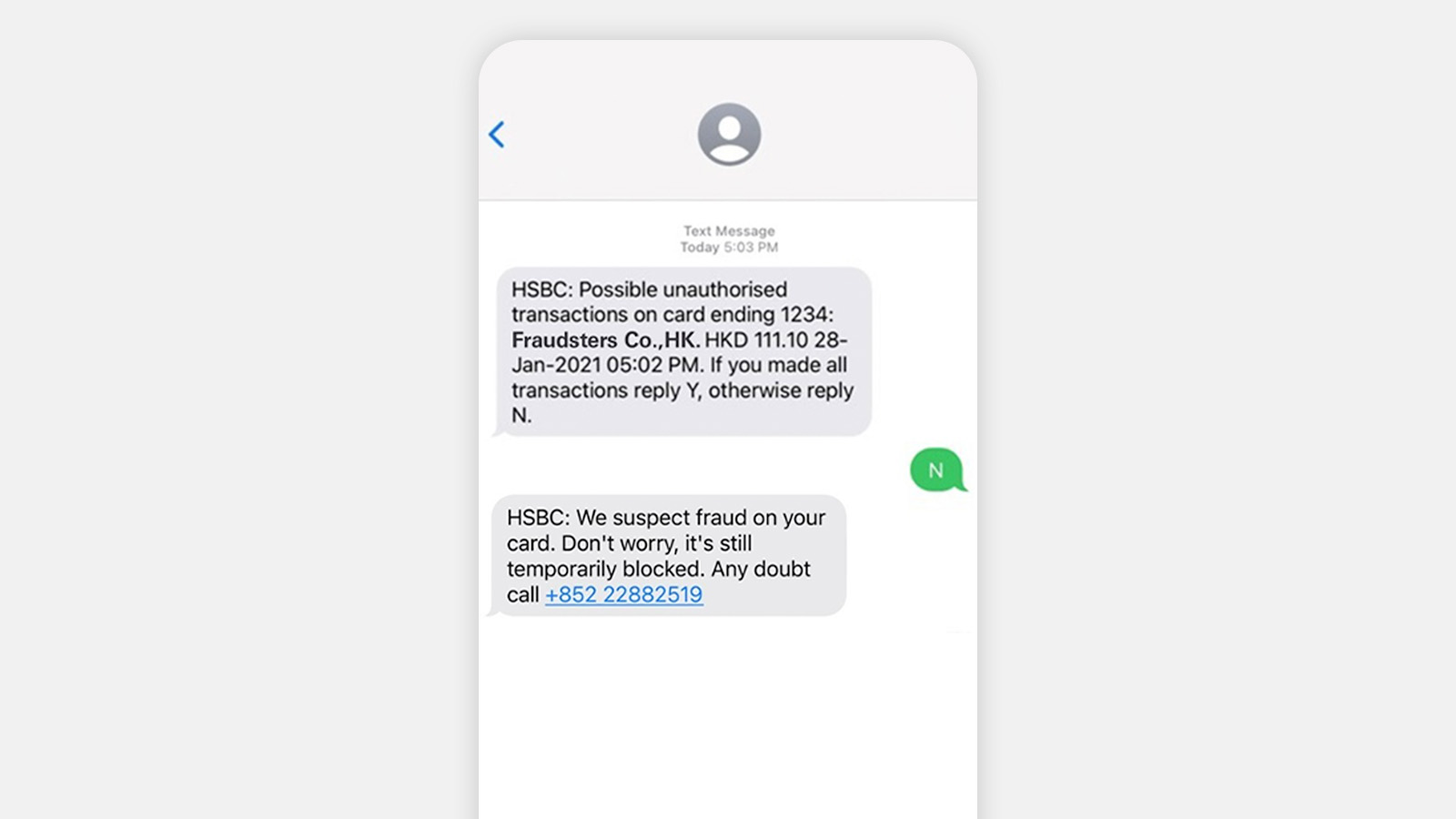

2 Way SMS

What's a 2-way SMS?

We'll send you a 2-way SMS alert if we see a suspicious transaction on your credit card. You can then reply to it to let us know if it was you who made the transaction.

What should I do if I receive a 2-way SMS for a transaction I made?

If you recognise the transaction and the details are correct, please reply with a 'Yes' or 'Y'.

Next, check if your transaction is successful. Payment may sometimes be declined for security reasons. If that happens, you'll need to make the transaction again.

What should I do if I receive a 2-way SMS for a transaction I didn't make or has the wrong details?

If you don't recognise the transaction or the details are wrong, please reply with a 'No' or 'N'. Next, get in touch with us right away.

We'll then decline the transaction and block your card. If you haven't reached out to us after replying to the 2-way SMS, we'll contact you between 9am and 10:30pm HKT to learn more about this.

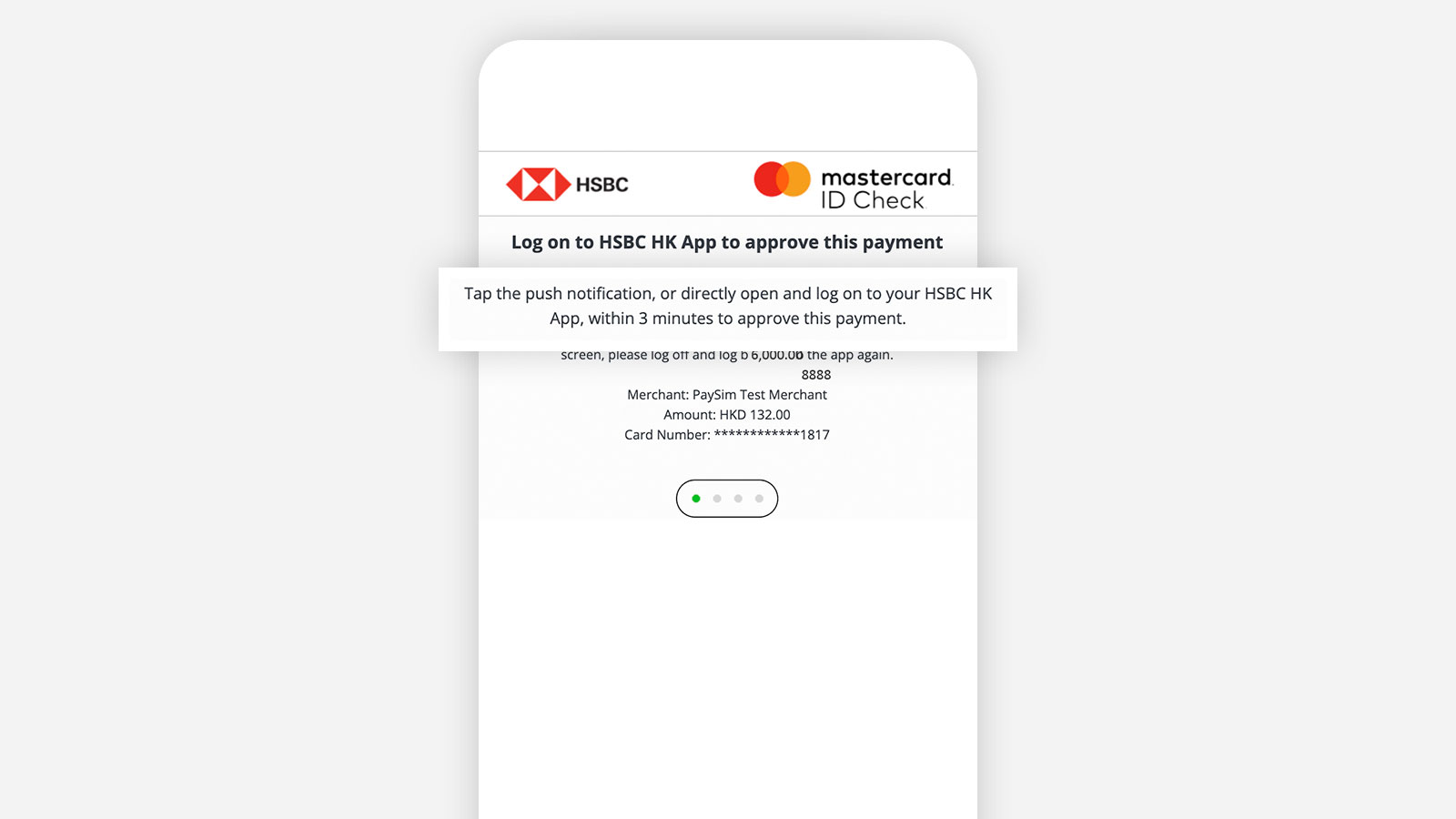

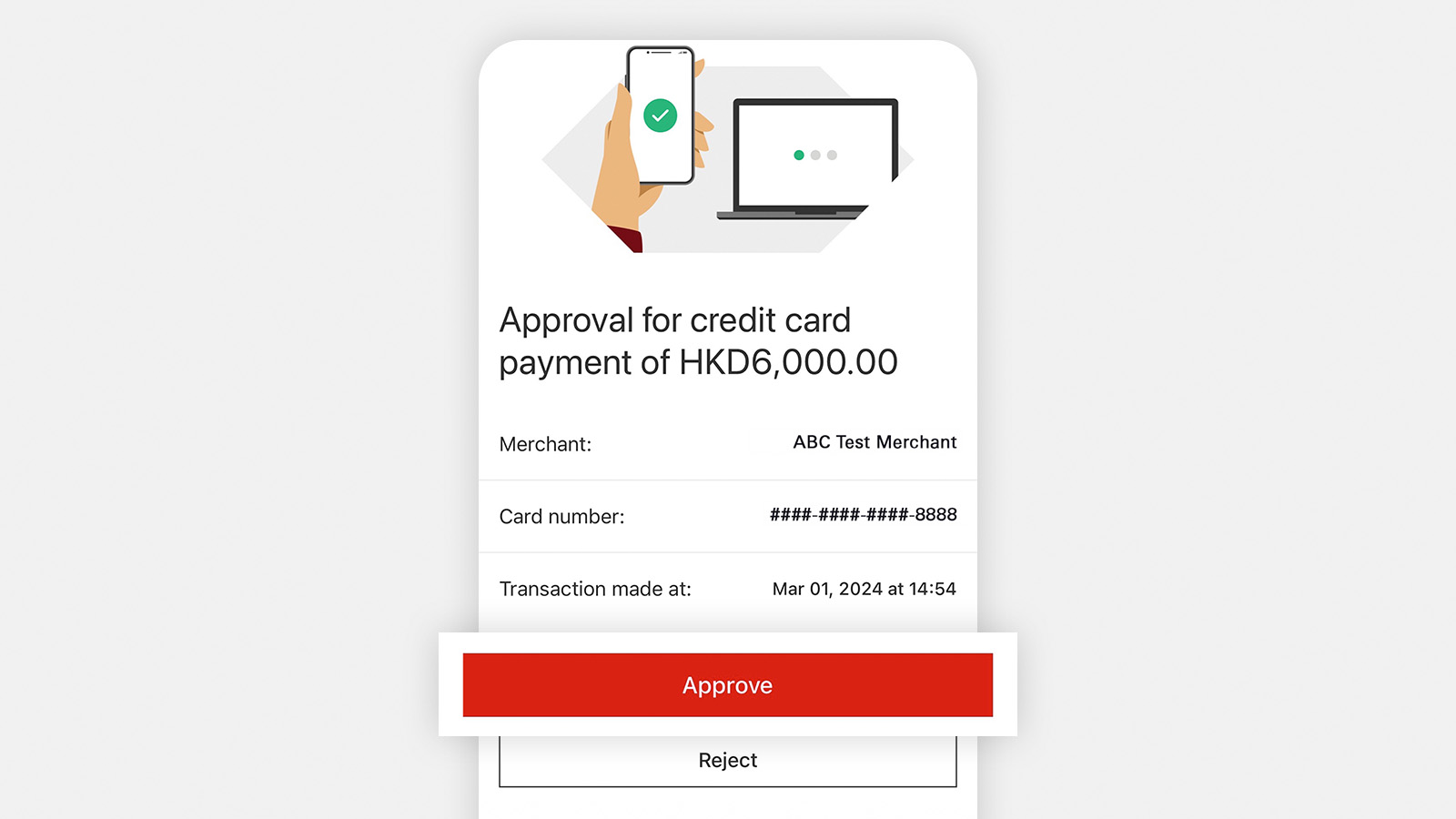

Verification Code for Online Transaction/HSBC HK App Online Transaction Authentication Service

What’s the online transaction authentication service?

It lets you review and approve your online payments safely and conveniently. Simply log on to the HSBC HK App to approve or reject them.

Why do I need to authenticate an online transaction with a verification code or in the HSBC HK App?

When you make an online transaction with your HSBC card, you may be asked to authenticate it. This is because some merchants use 3D Secure to enhance security for online purchases. You can do it with a verification code or in the HSBC HK App.

If you’ve already set up your HSBC HK App and verified your identity, you can authenticate the purchase in the HSBC HK App. We’ll send you an authentication request so you can do so with your 6-digit Mobile Banking PIN. Or you can do it with your biometric authentication on supported devices.

Otherwise, we’ll send a verification code to your registered mobile number by SMS. Simply enter the code on the merchant’s payment page to authenticate the purchase.