Pay and transfer abroad, faster and easier than ever

Enjoy the convenience of FPS, now available even outside of Hong Kong. Pay to designated merchants abroad, or transfer to your friends and family in mainland China via HSBC HK App anytime. You can also receive instant payments from mainland China without charges.

Enjoy hassle-free payments and transfers abroad with FPS

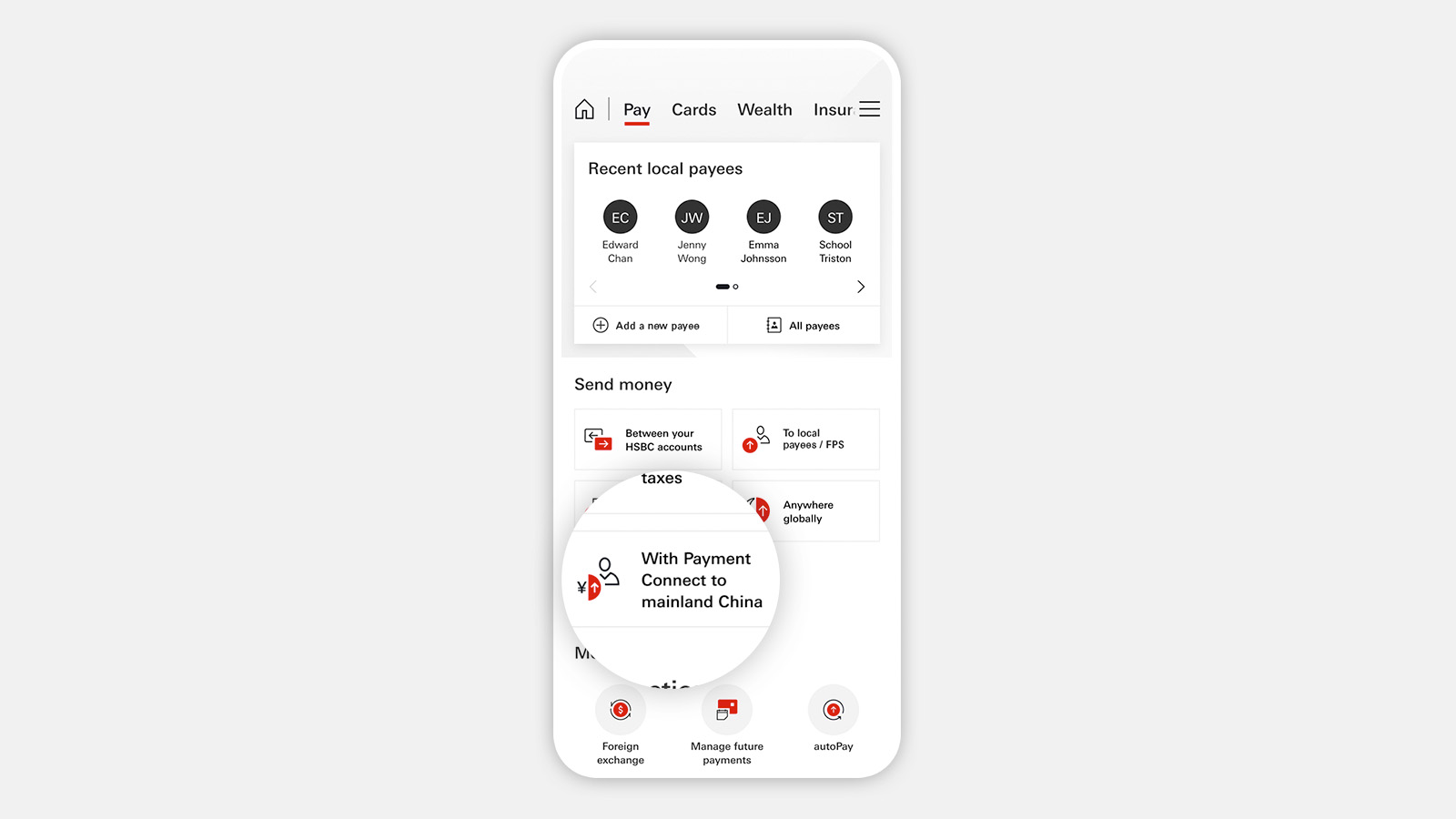

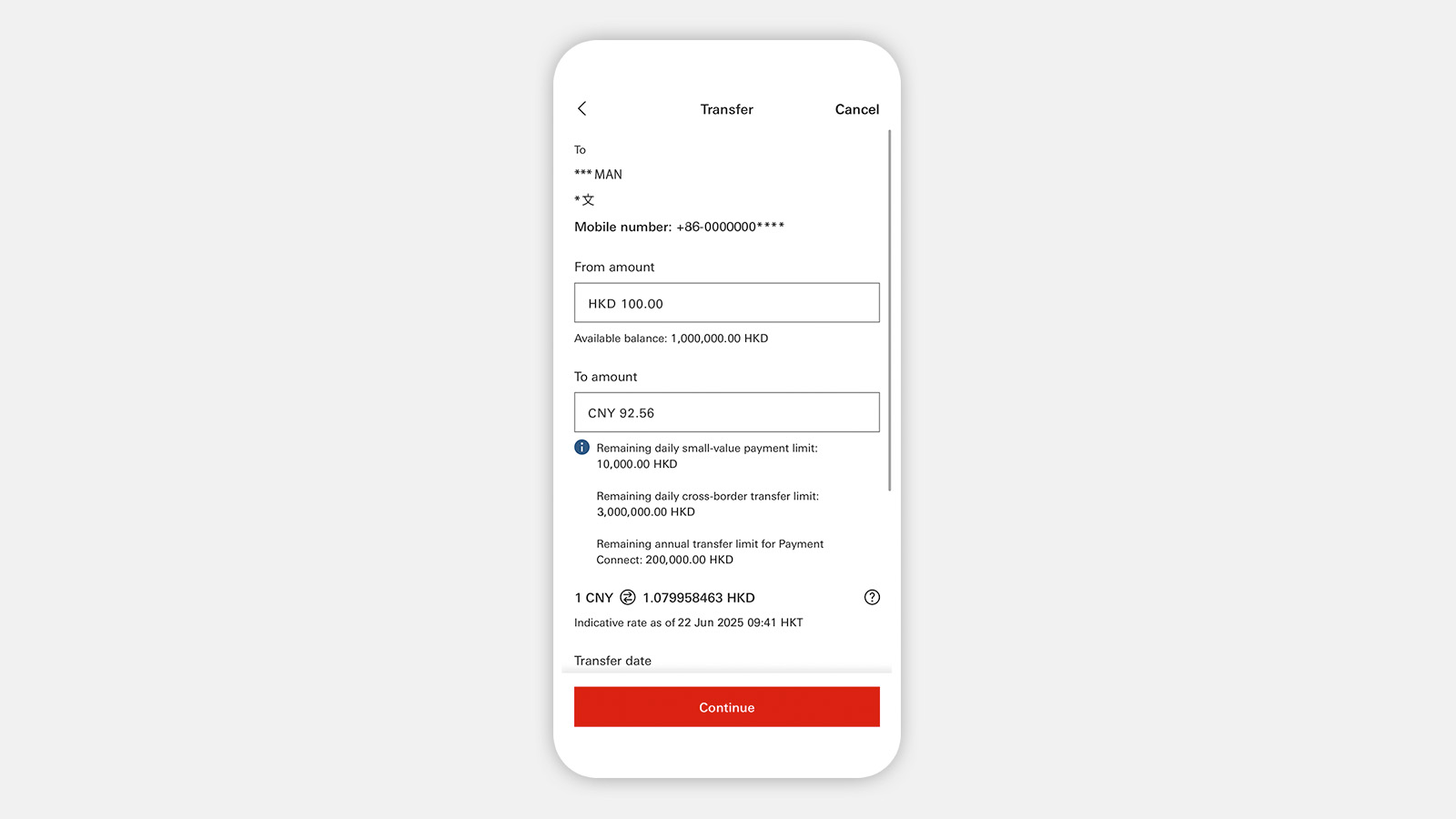

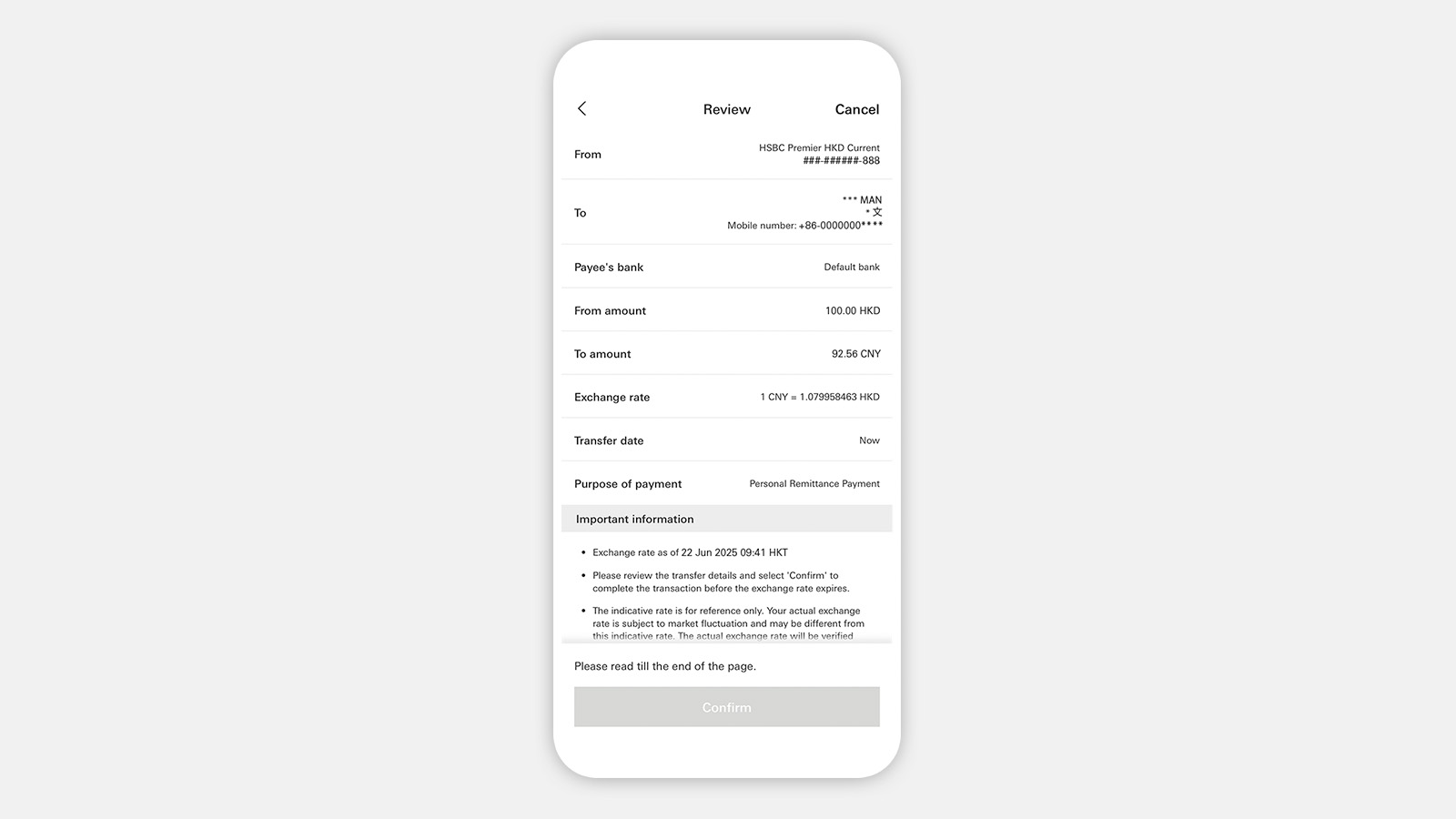

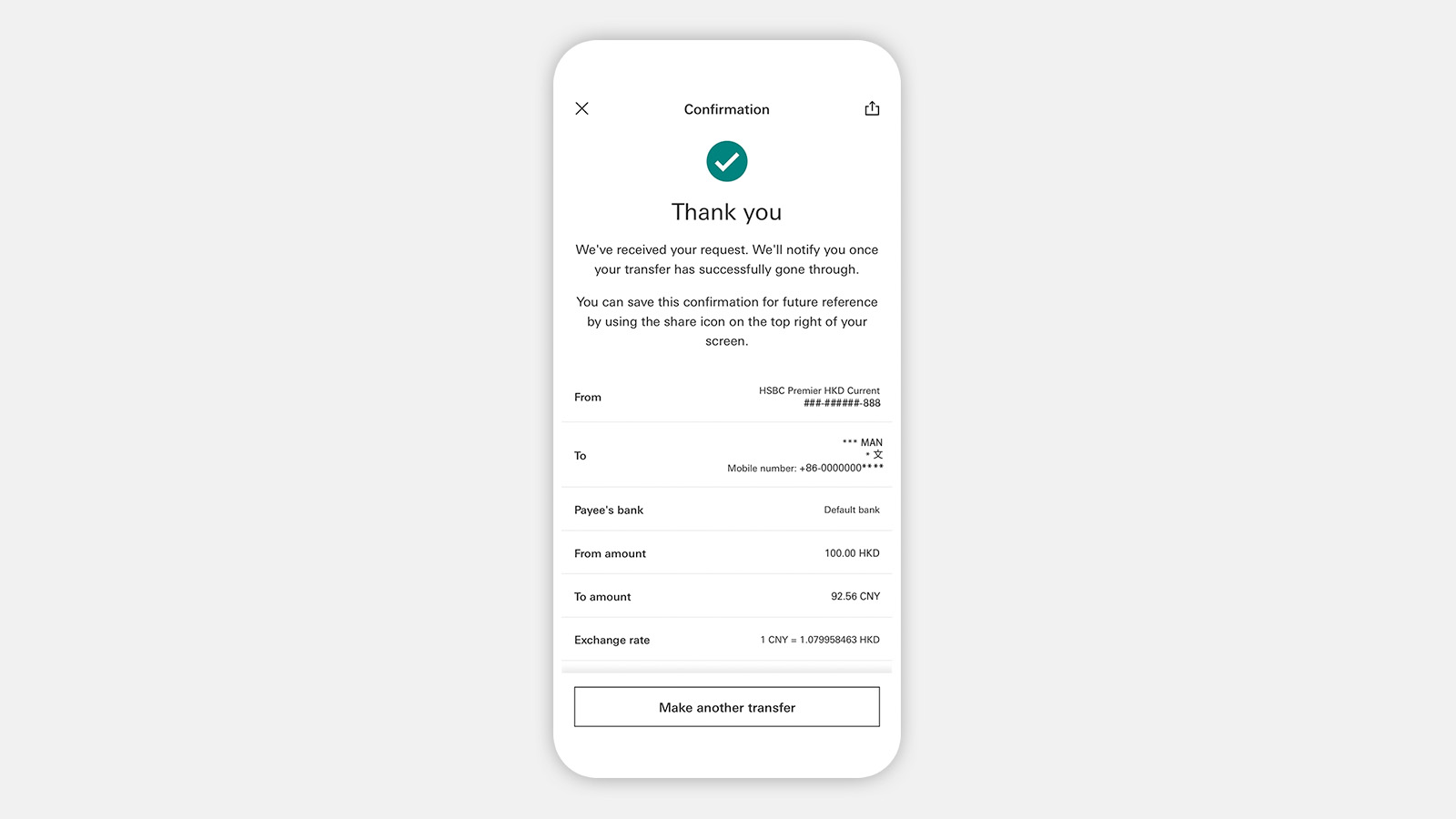

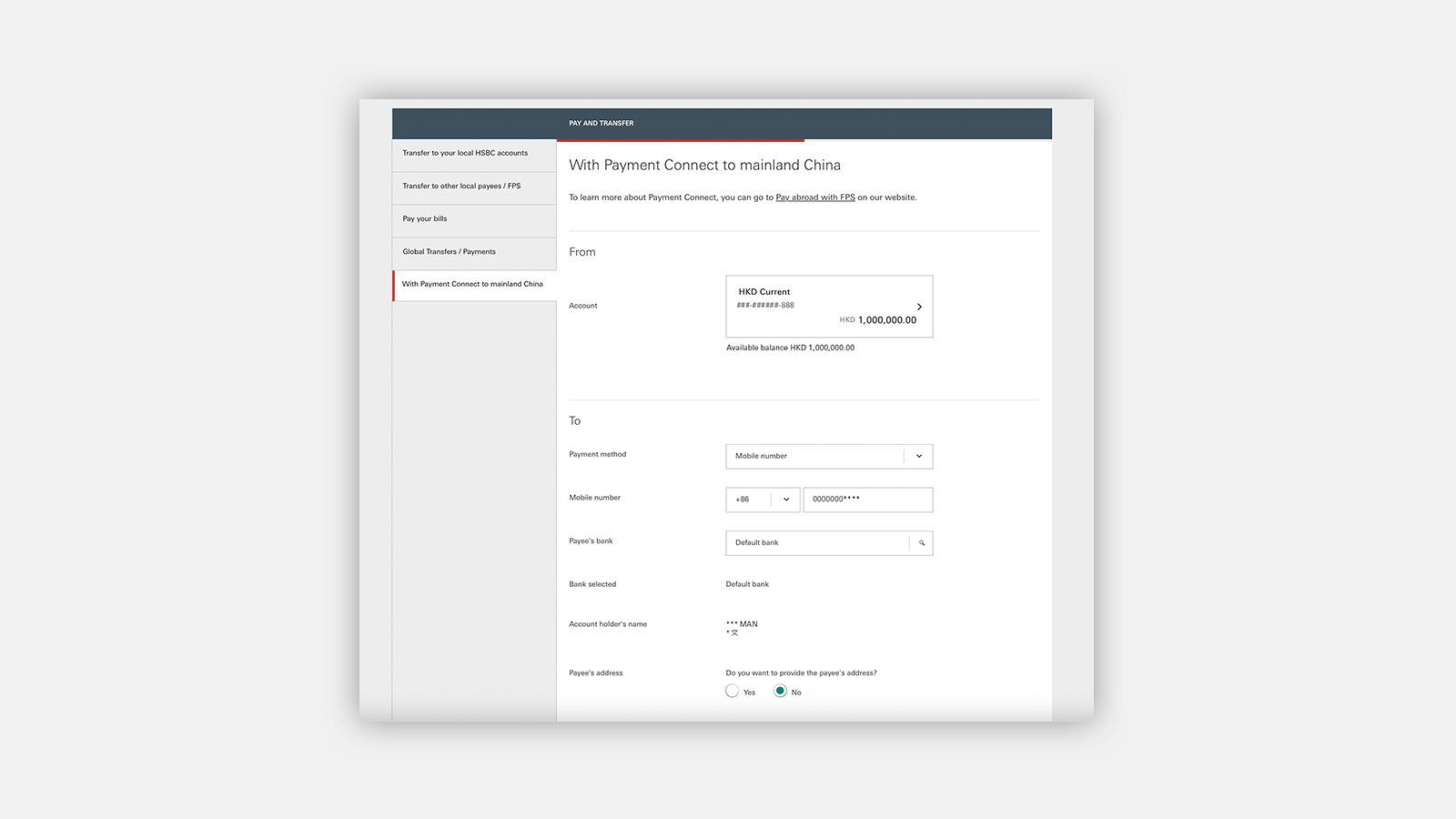

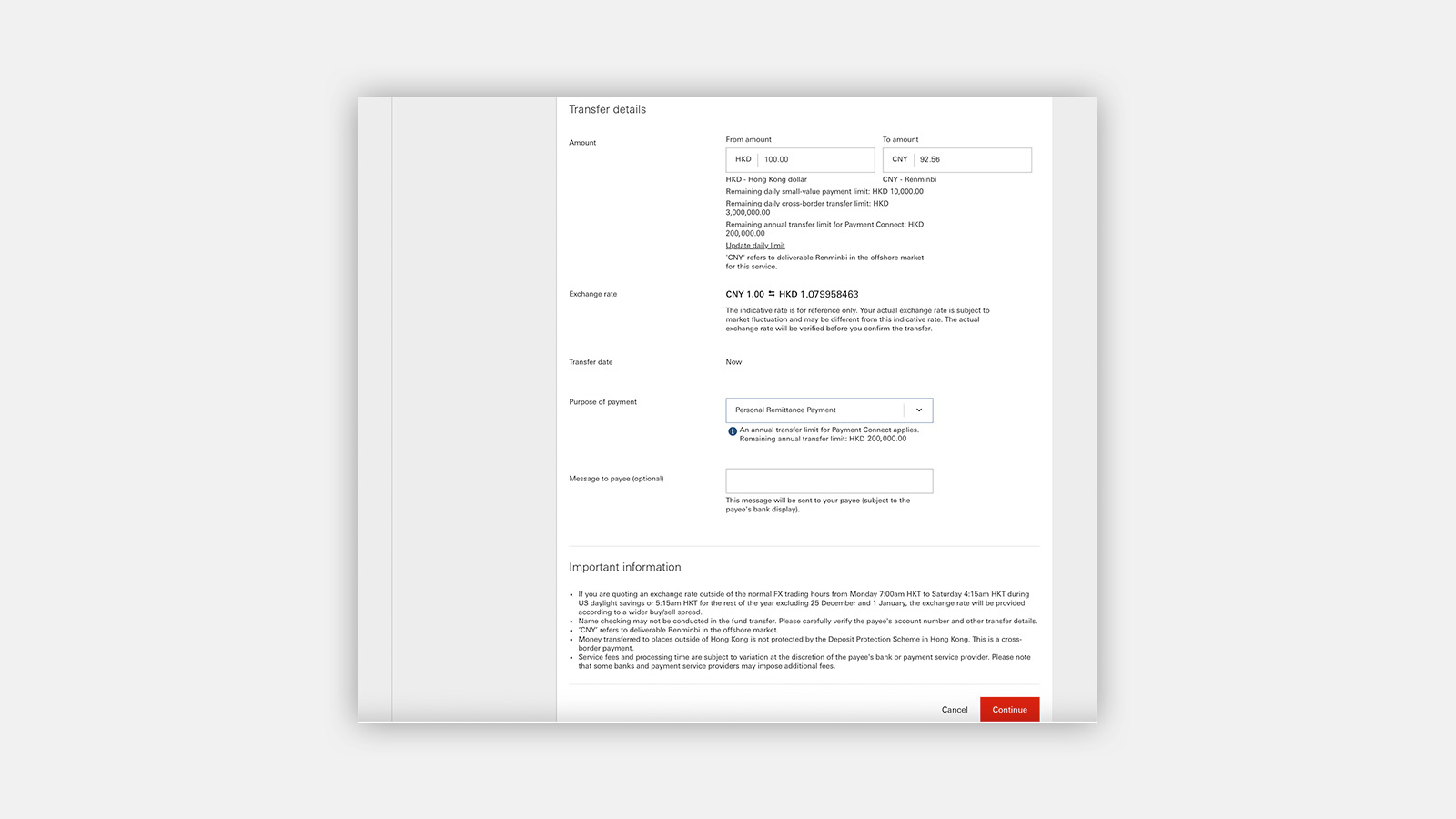

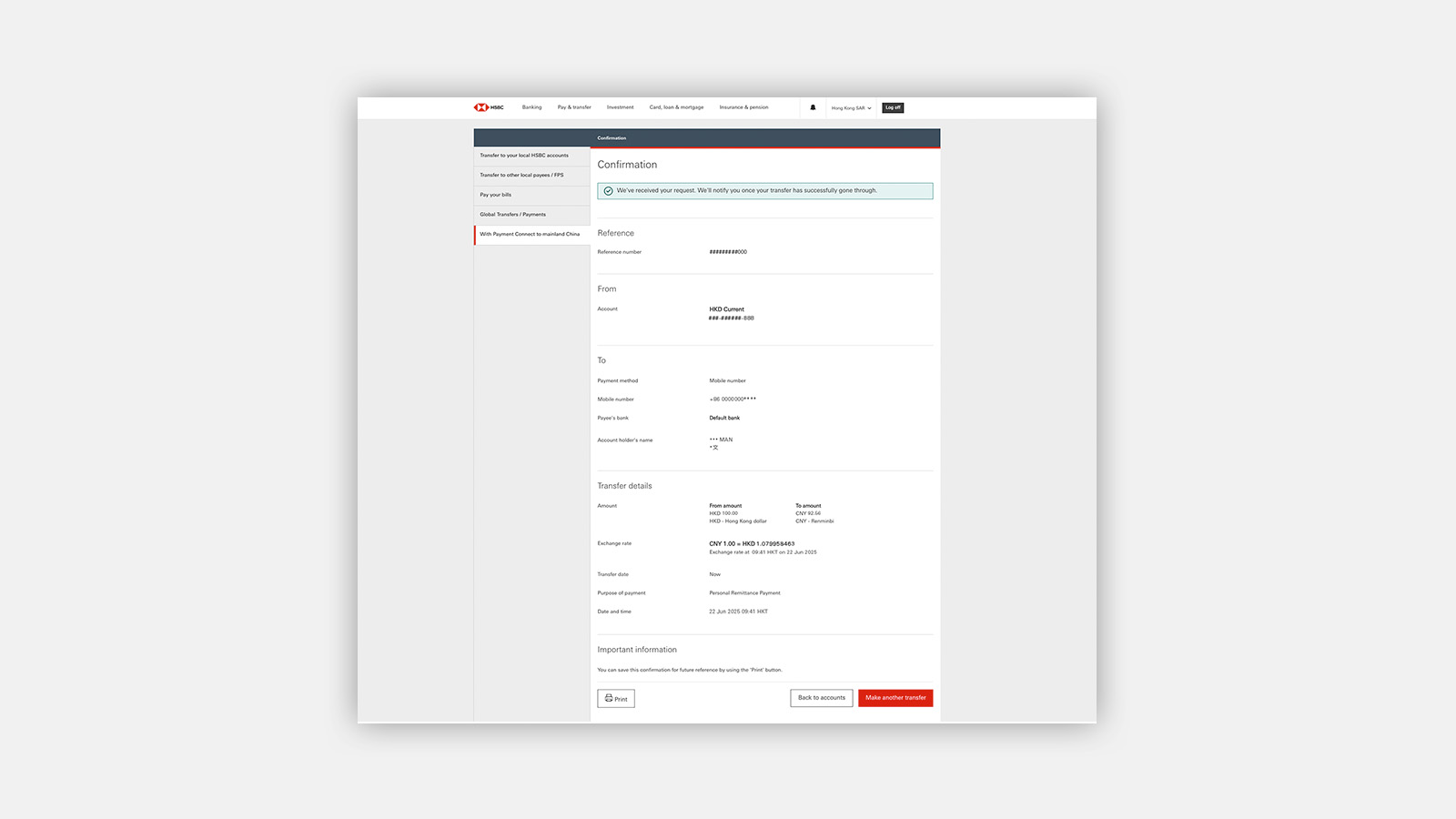

Transfer to mainland China with Payment Connect

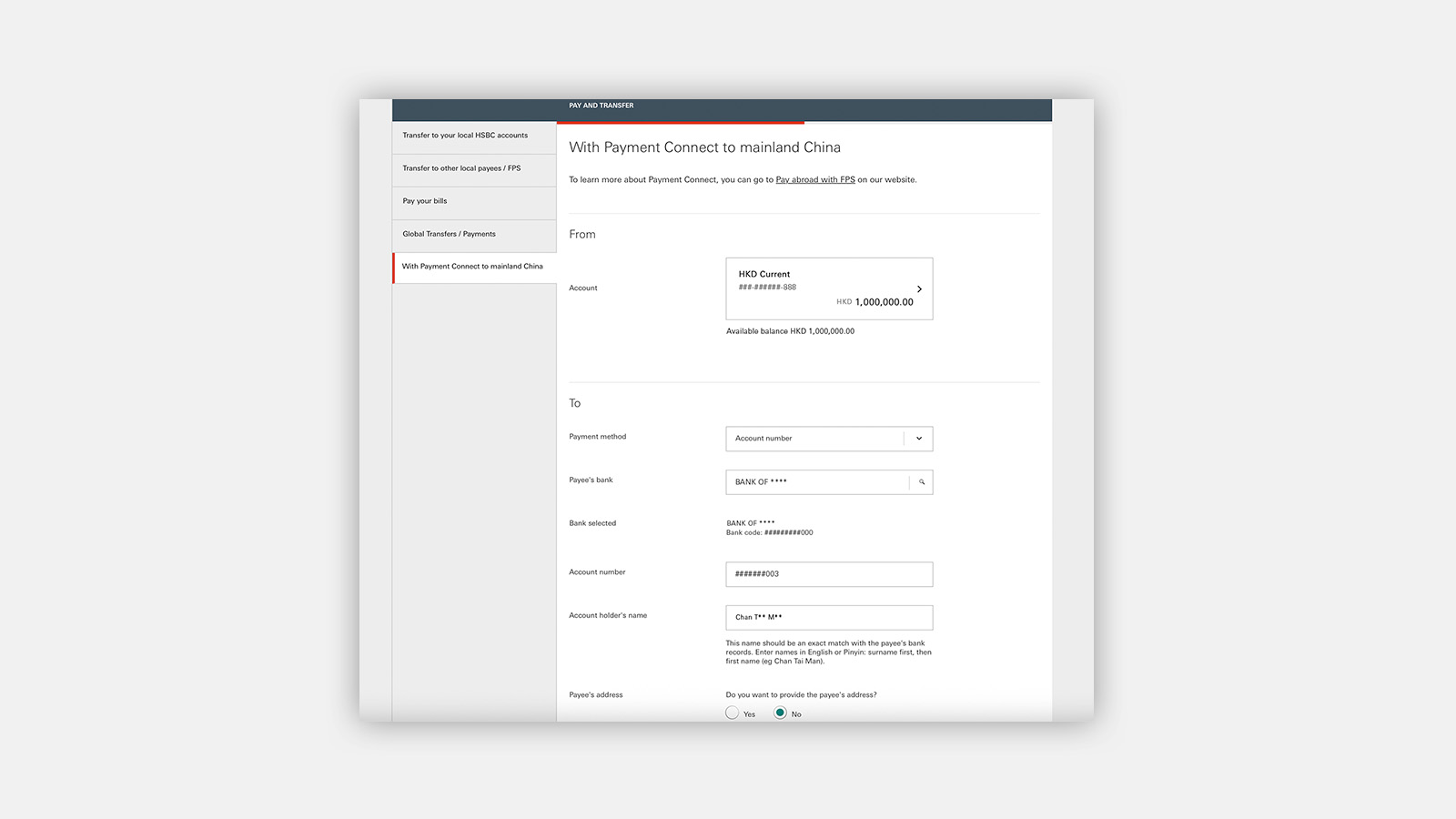

Hong Kong residents can now make an instant RMB payment via FPS from their HKD or RMB bank account by using HSBC HK App or Online Banking.

- Transfer to personal accounts[@transfer-and-payment-fps-to-cn-acct] with designated payee banks in mainland China.

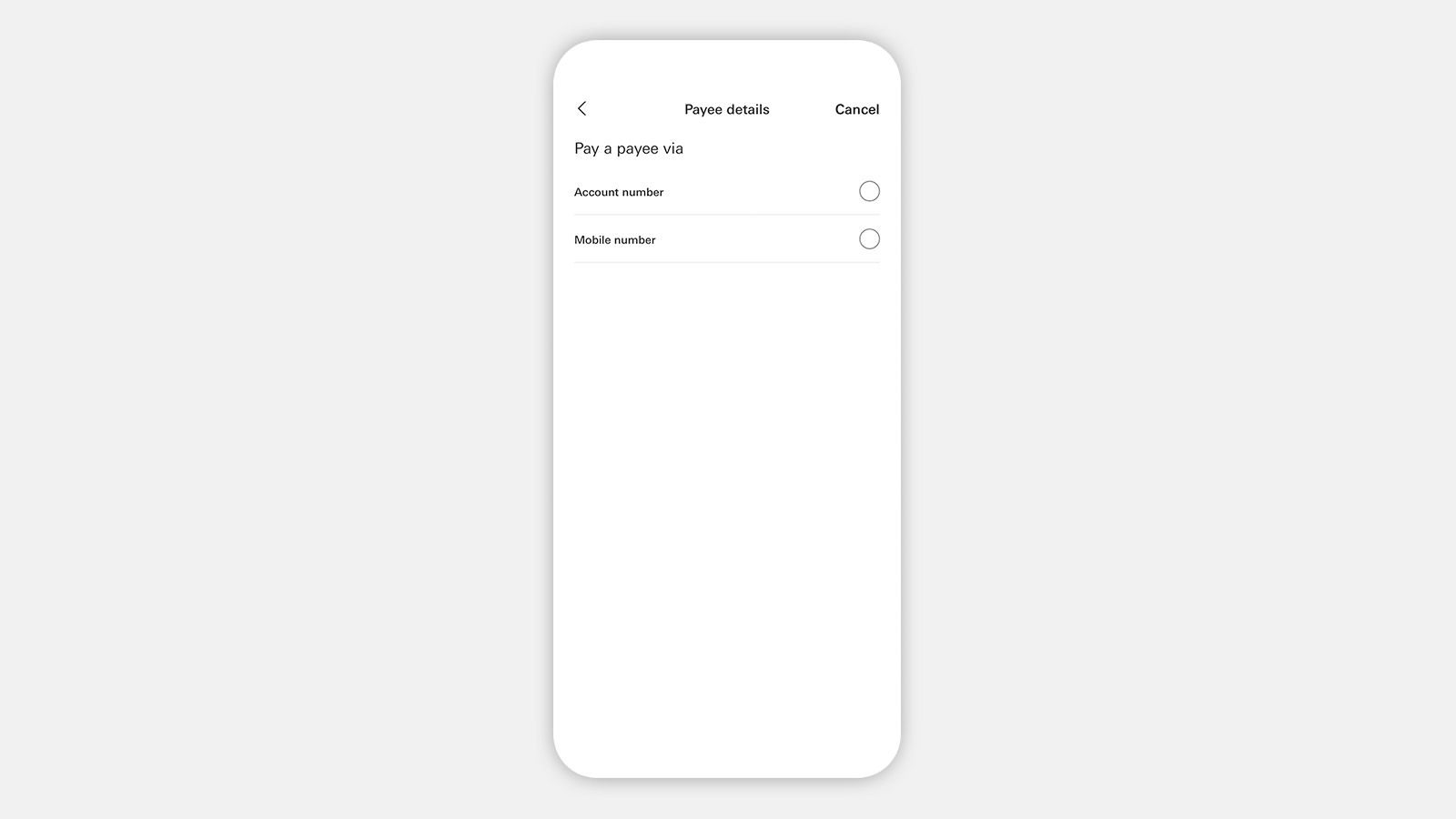

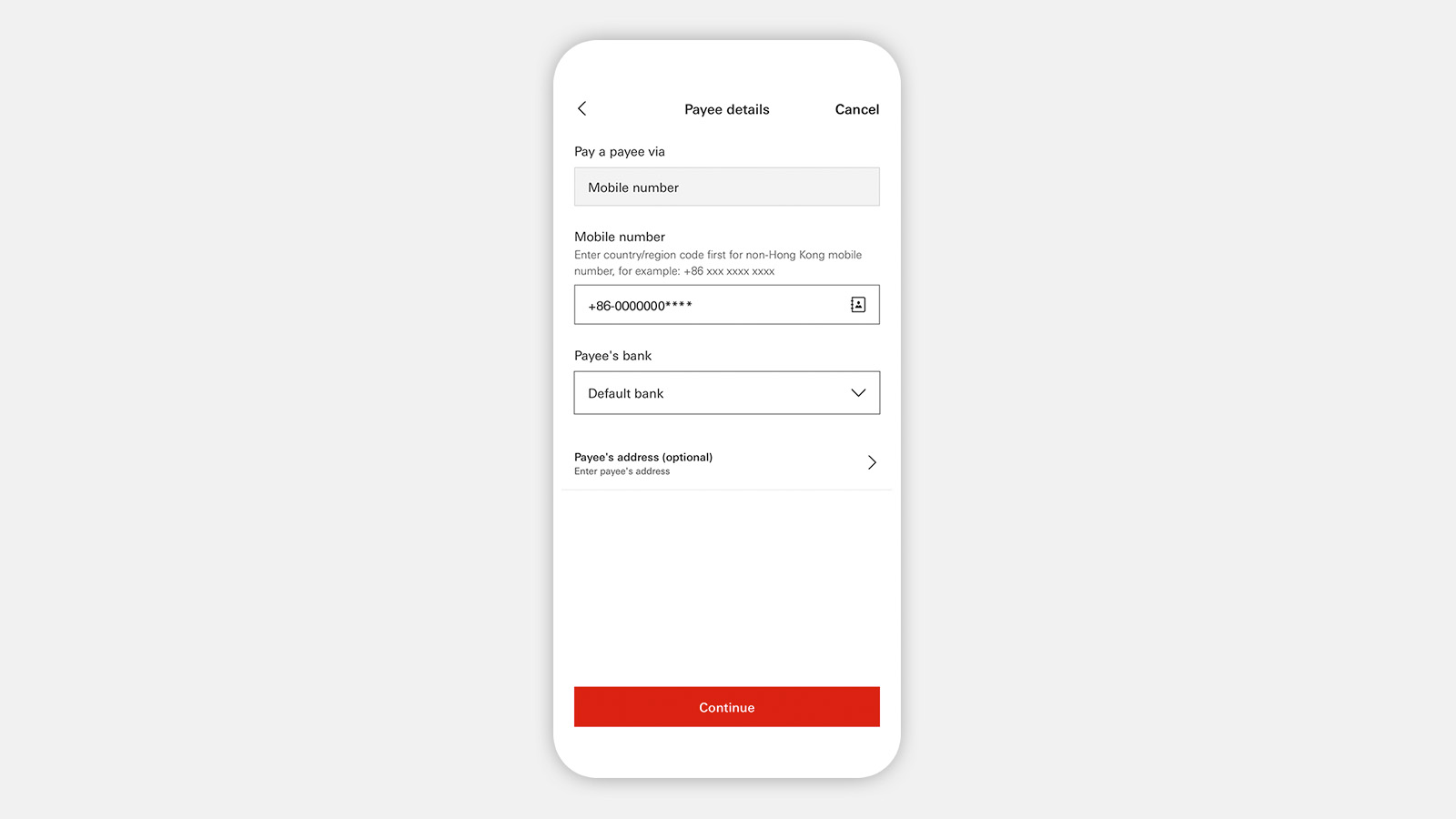

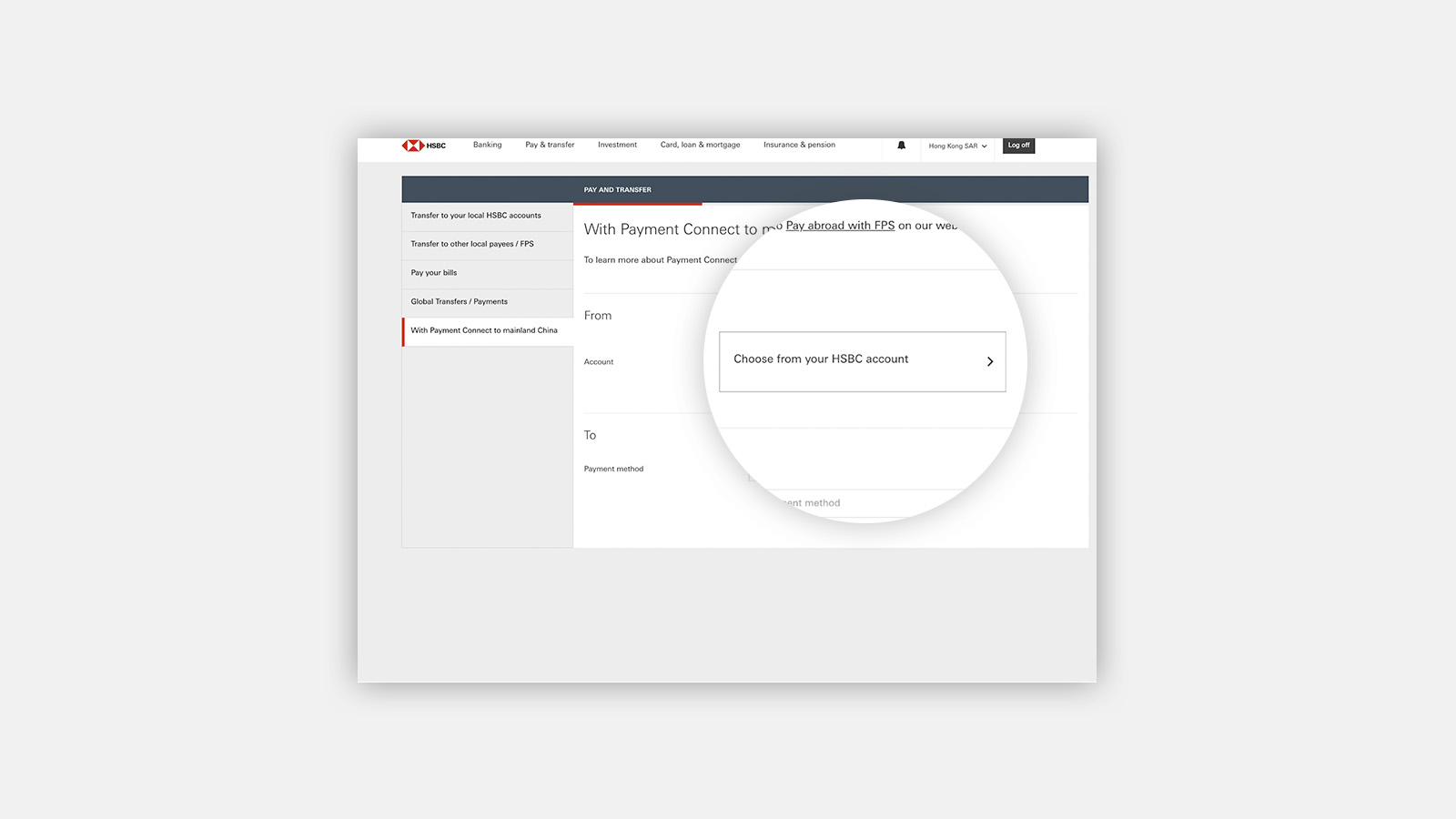

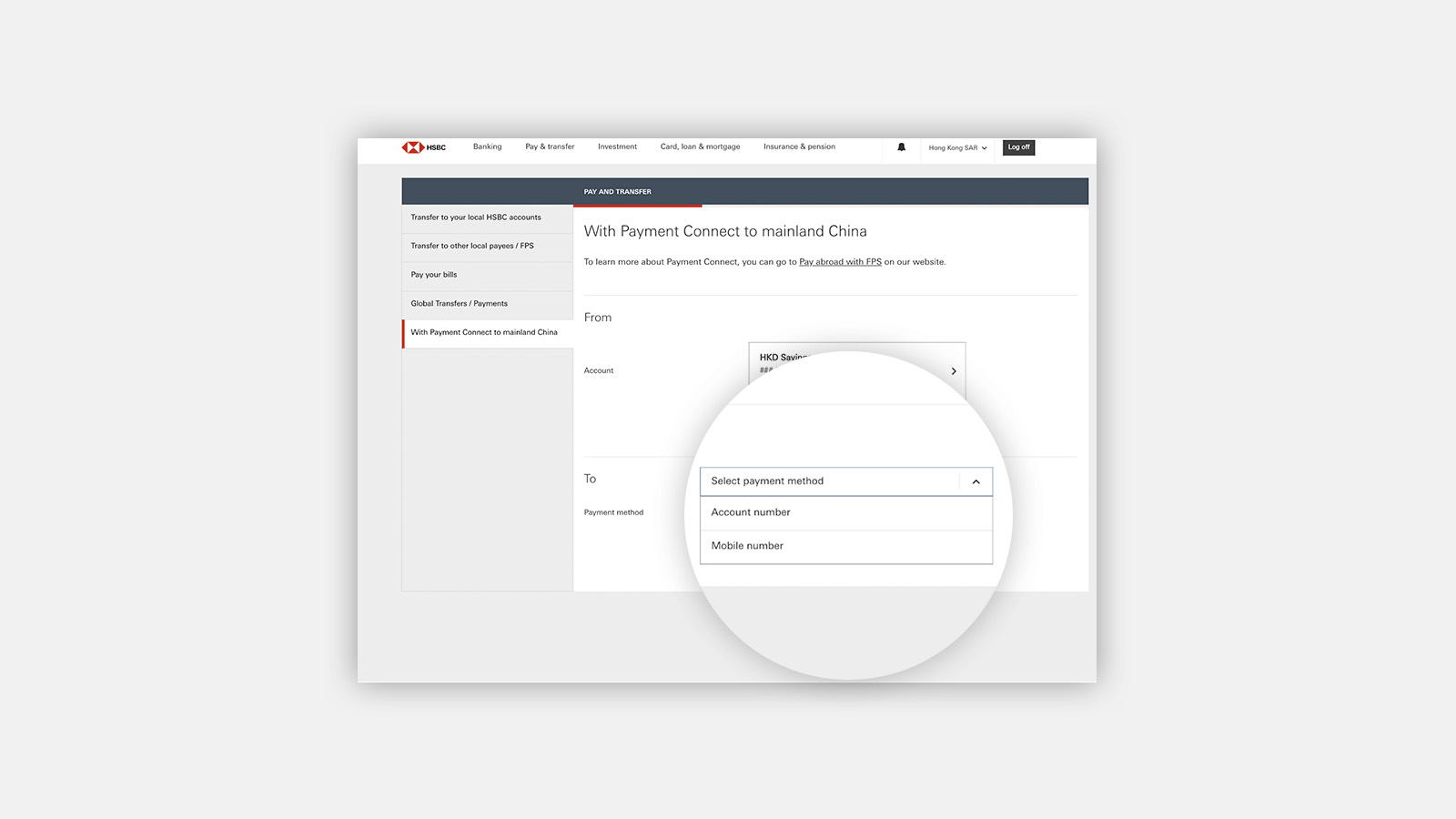

- Simply transfer funds to payee via account number or mobile number.

- You can transfer up to HKD10,000 or equivalent per day.

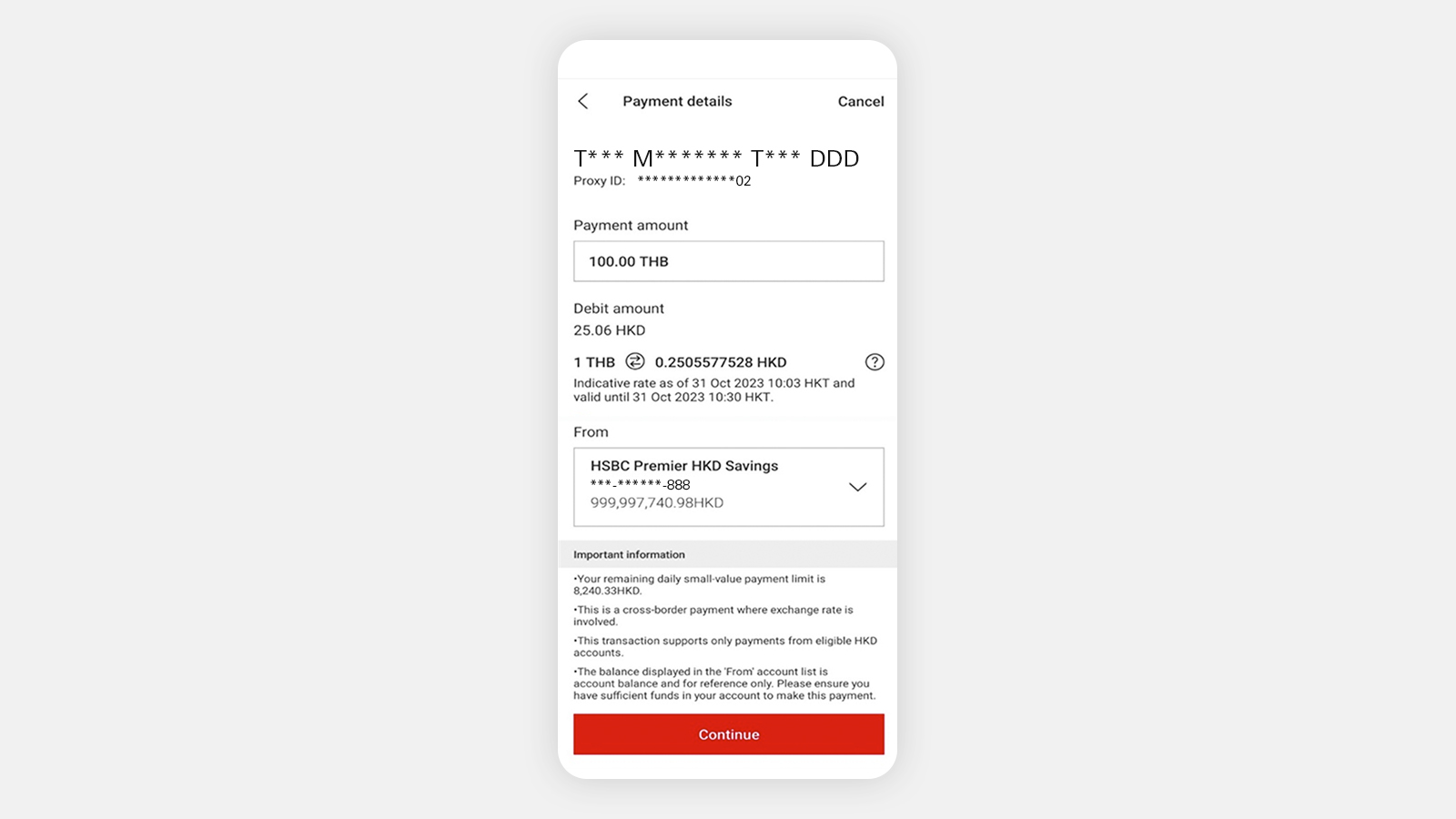

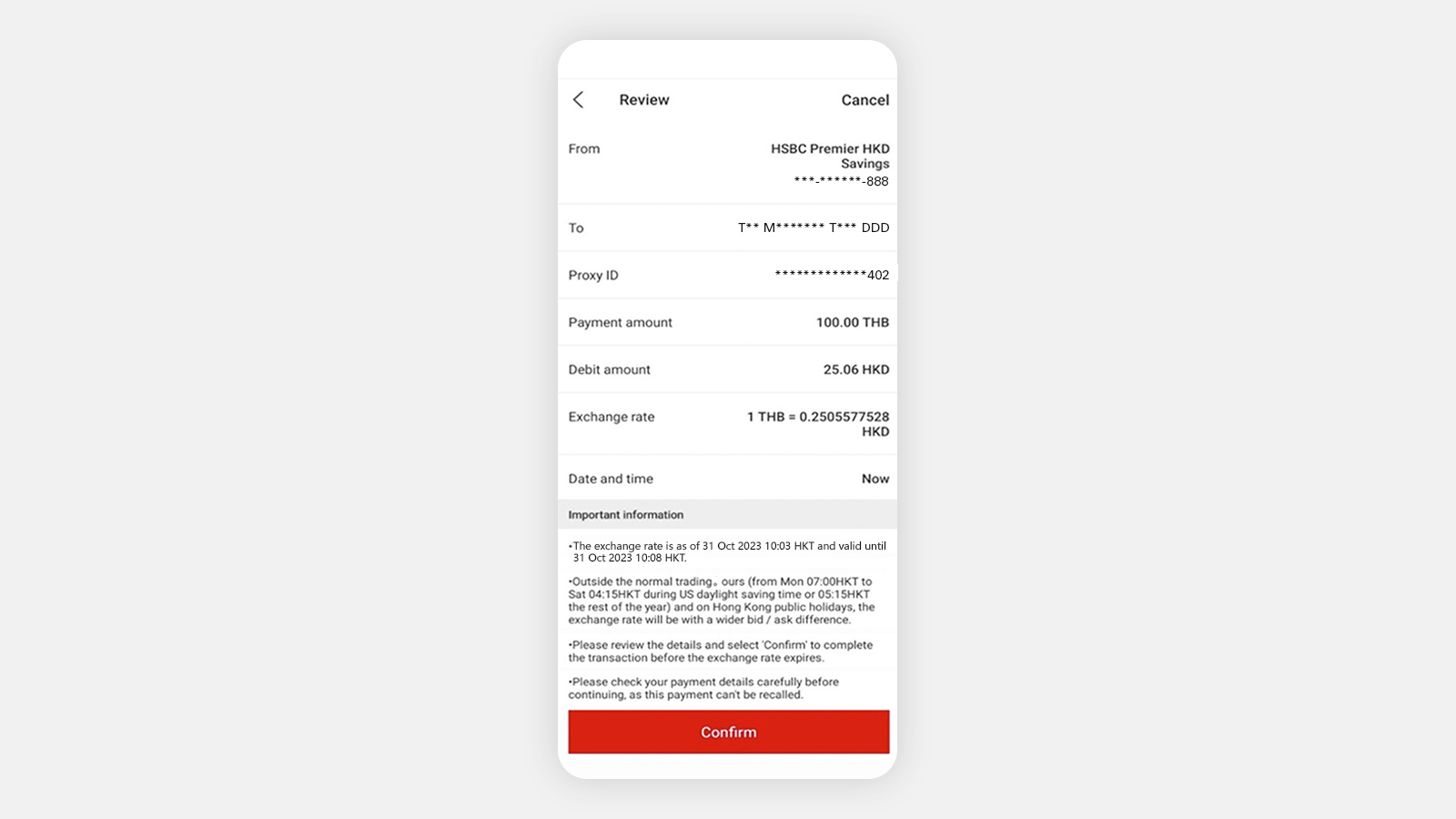

FPS x PromptPay QR payment

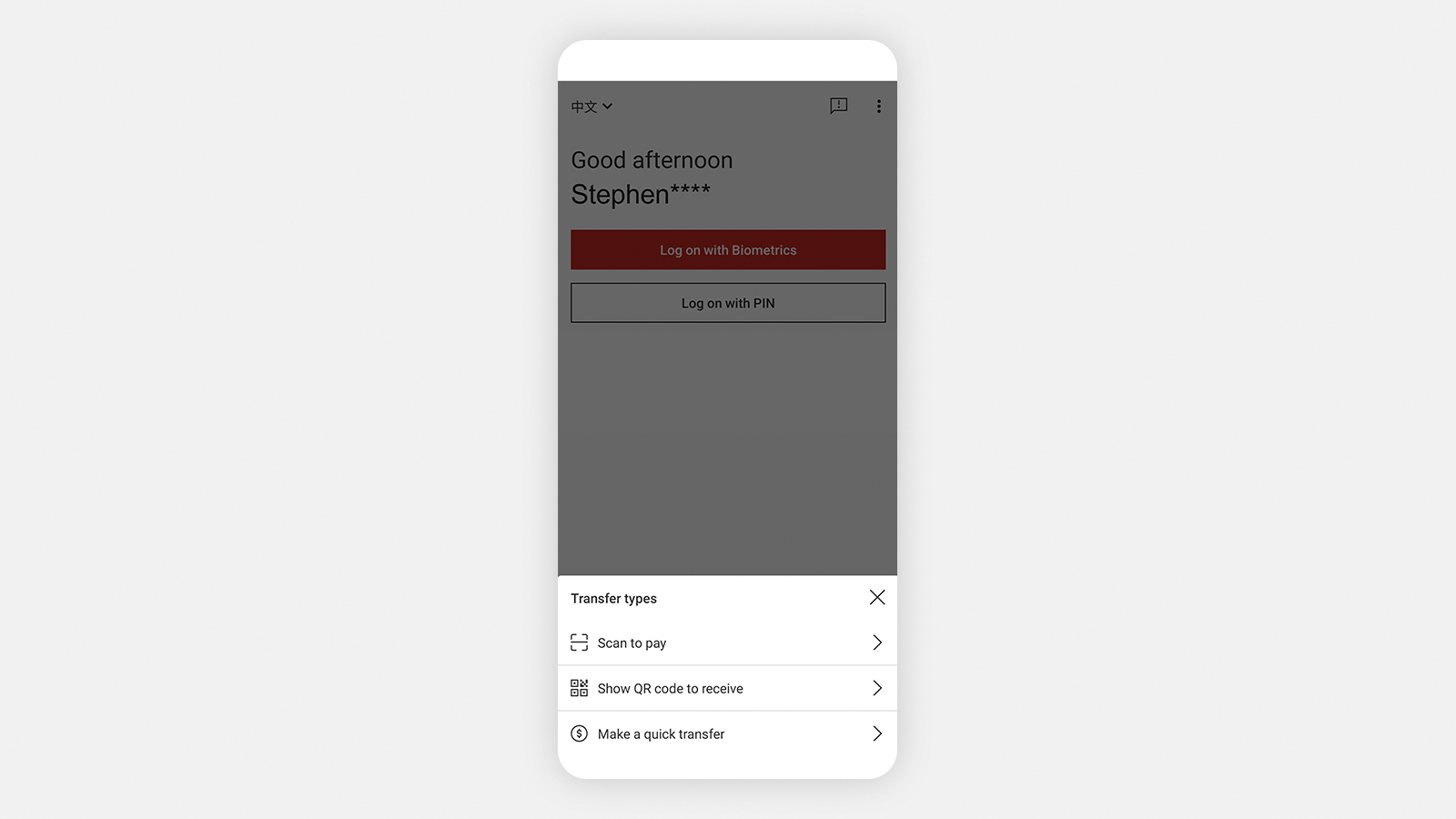

Complete merchant payments instantly with FPS using the HSBC HK App.

- Simply scan 'PromptPay' QR codes of supported merchants in Thailand and pay using your HKD bank account via HSBC HK App.

- You can pay up to HKD10,000 or equivalent per day.

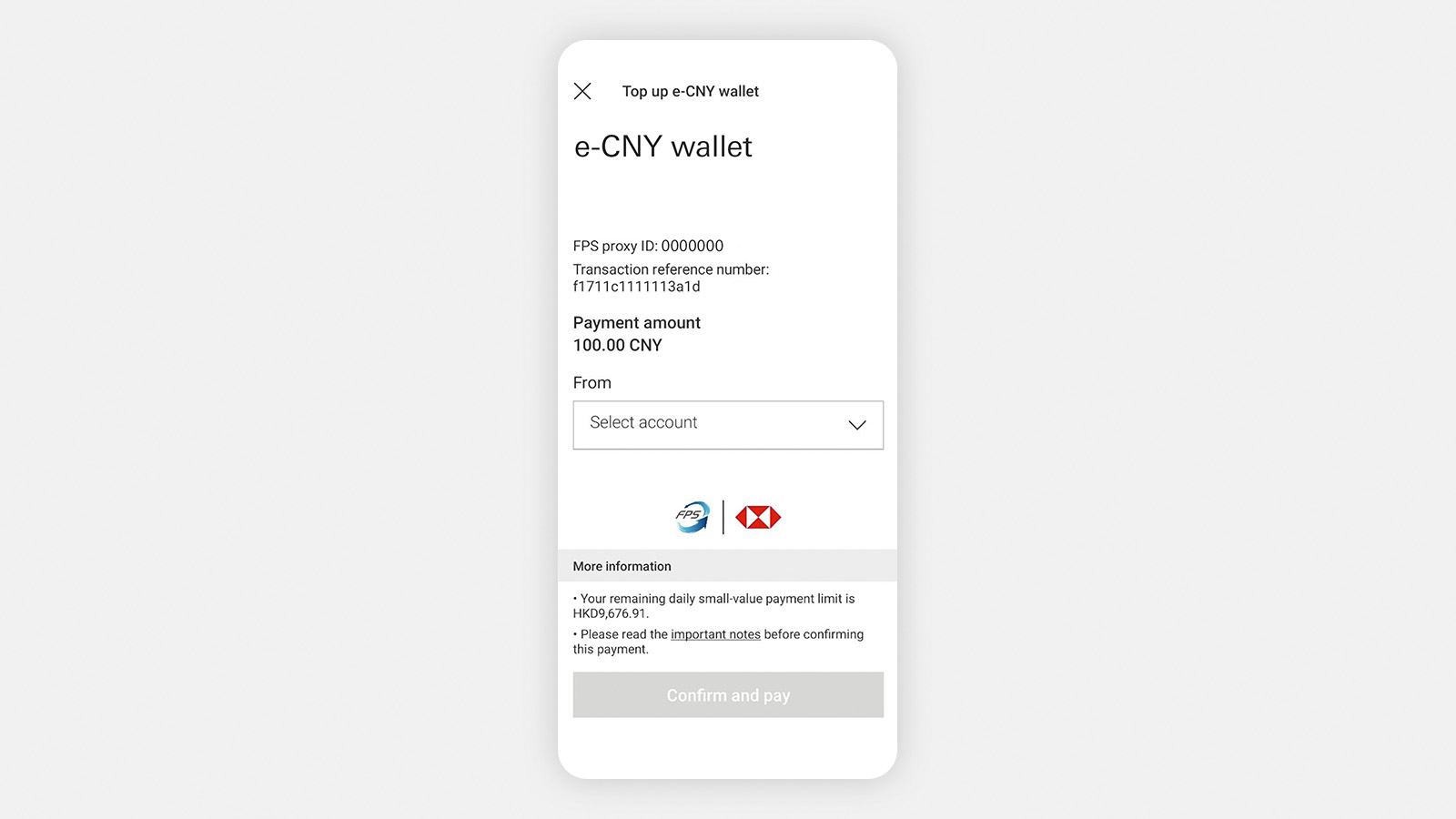

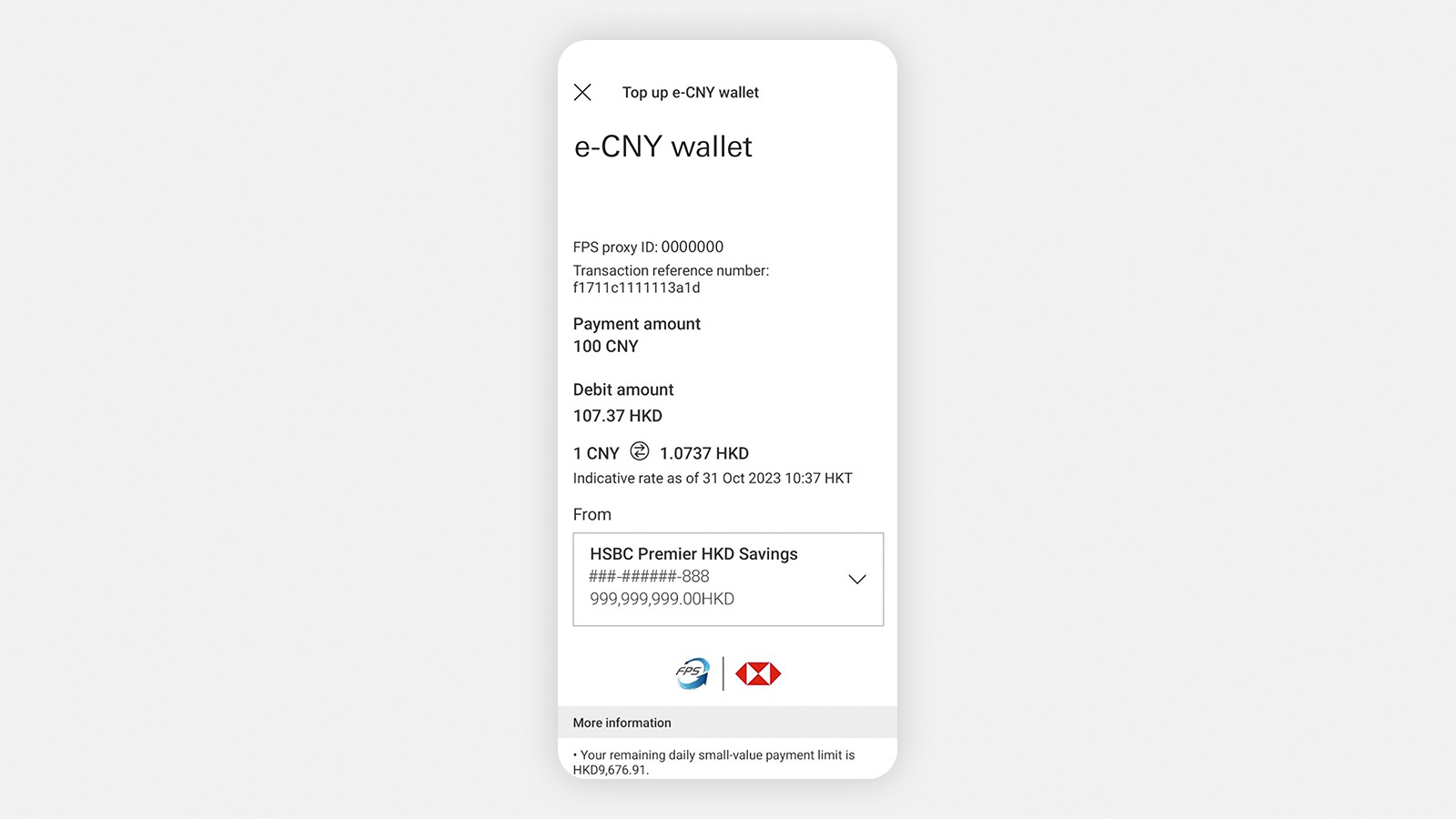

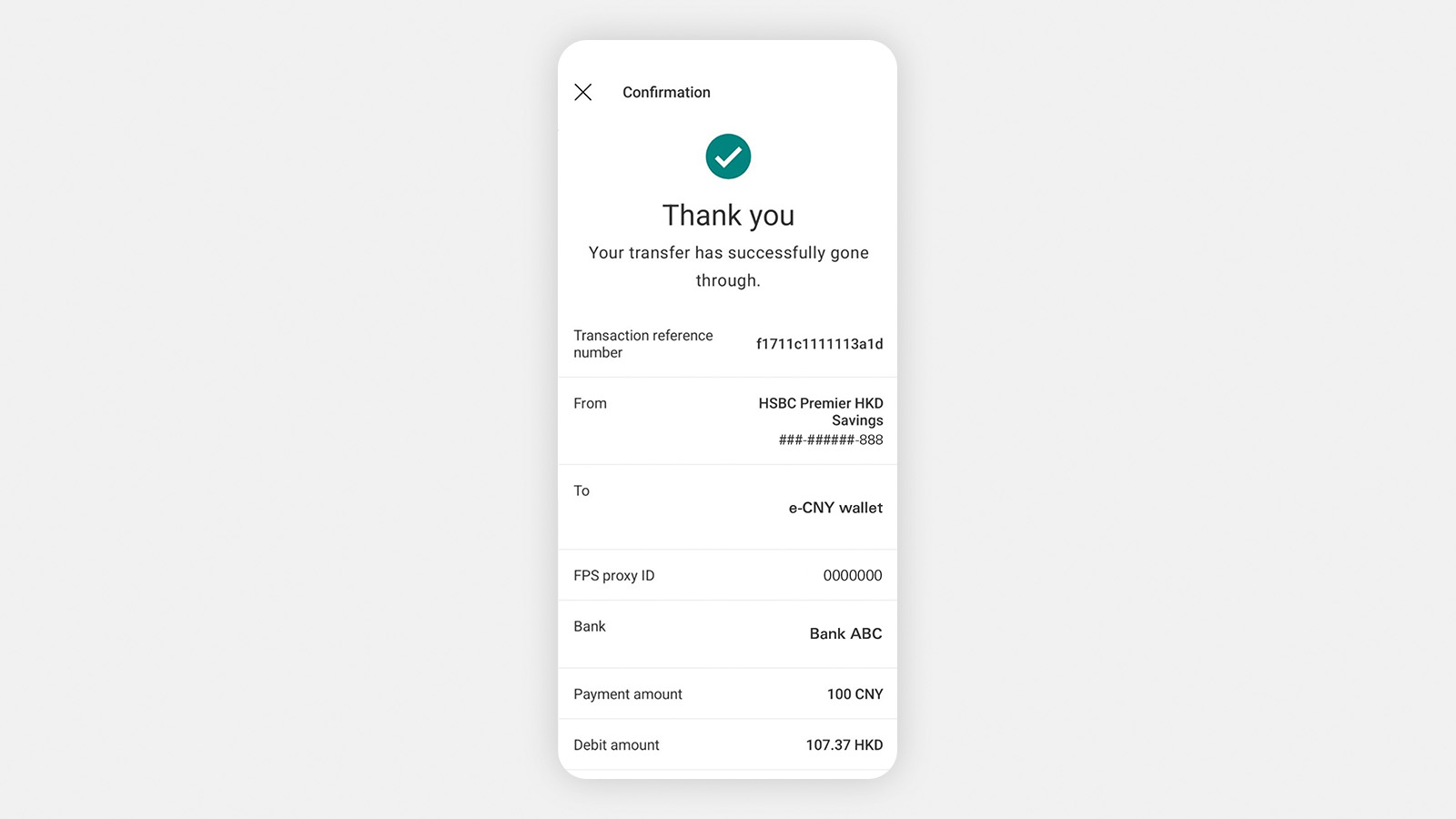

Top up e-CNY wallet via HSBC HK App

With FPS enabled, you can top up your e-CNY wallet by transferring funds directly from your HKD or RMB bank account via HSBC HK App.

- You can transfer up to HKD10,000 or equivalent per day.

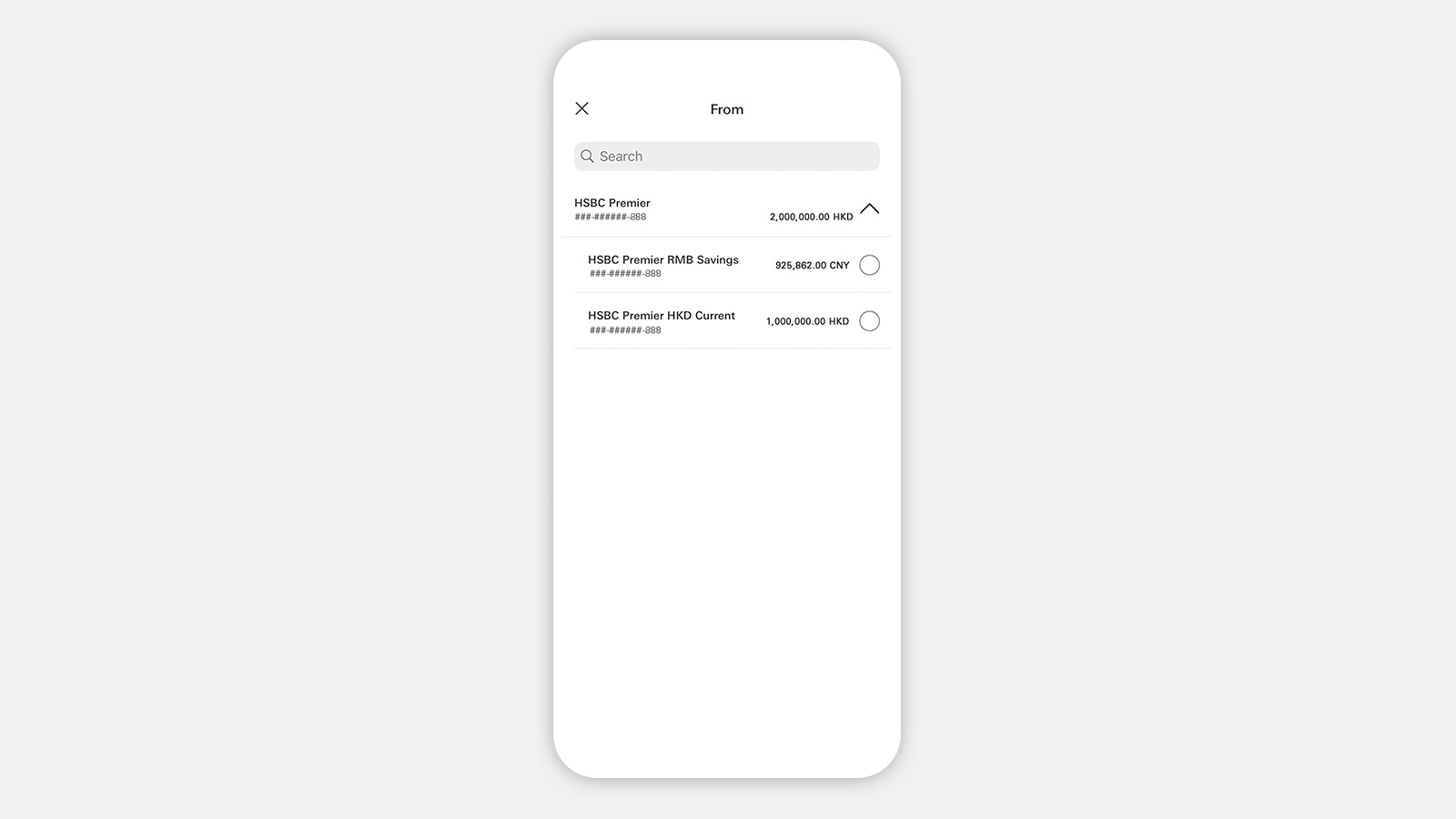

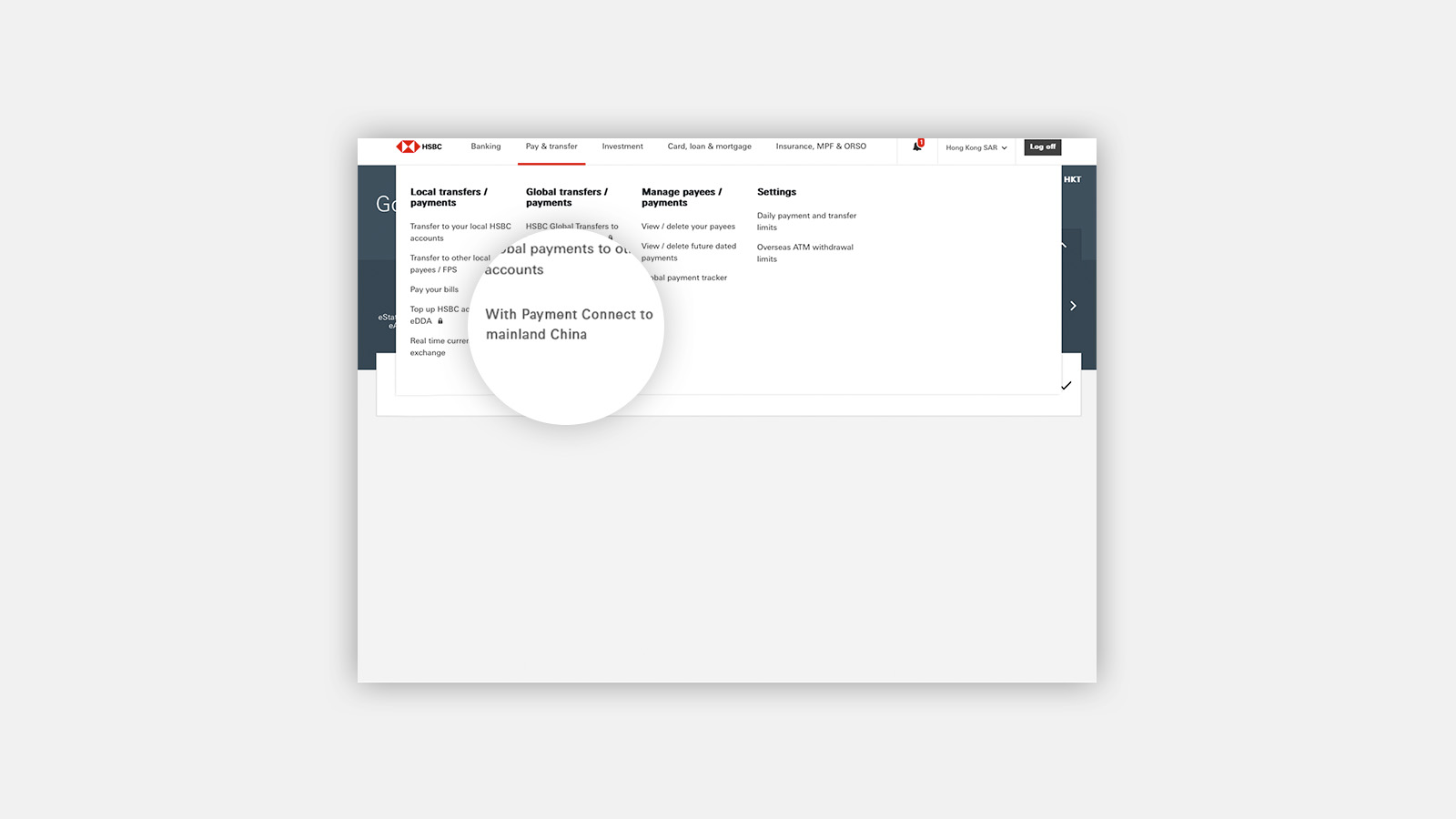

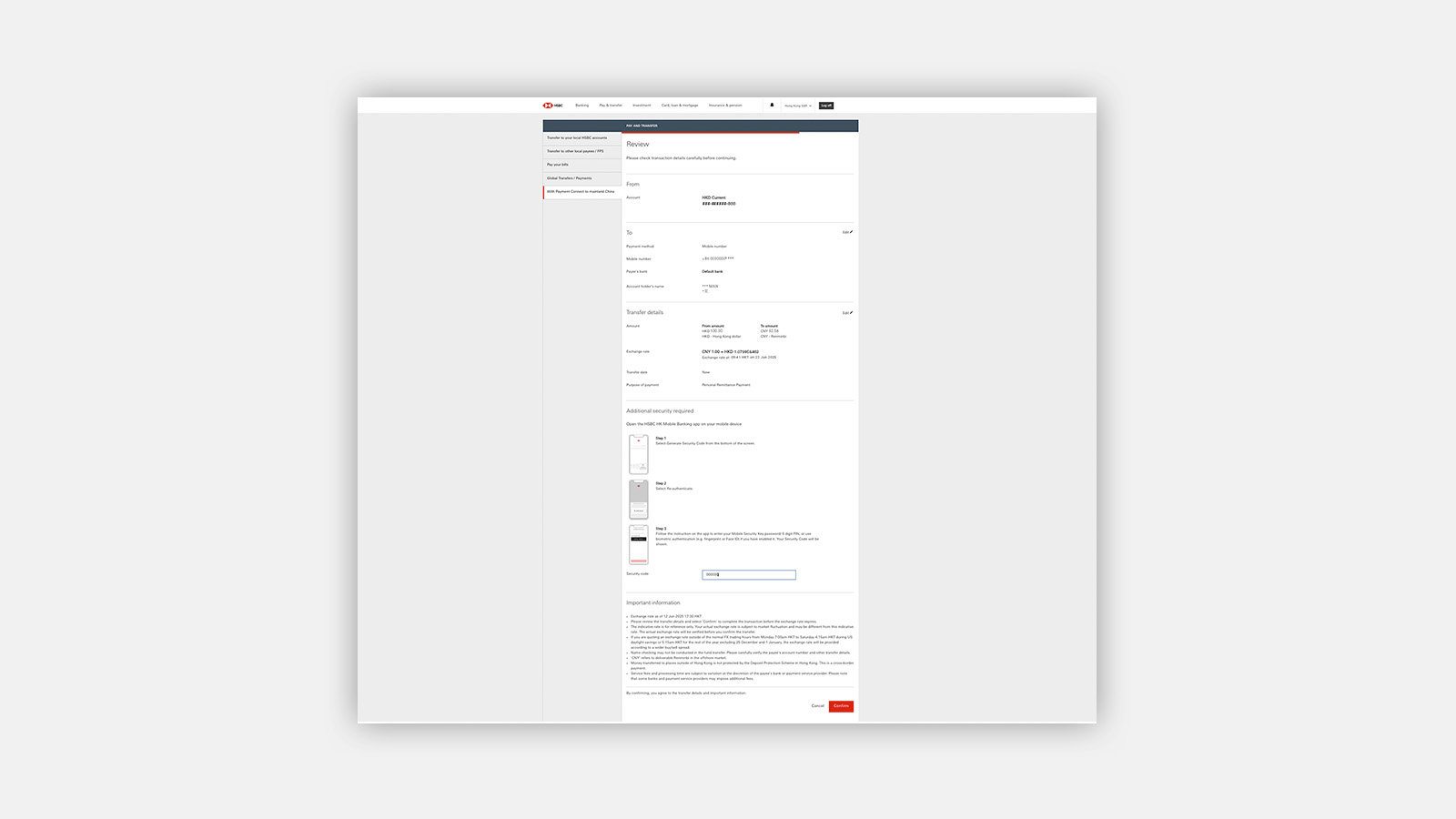

How to transfer to mainland China with Payment Connect

This service is currently available to Hong Kong residents only.

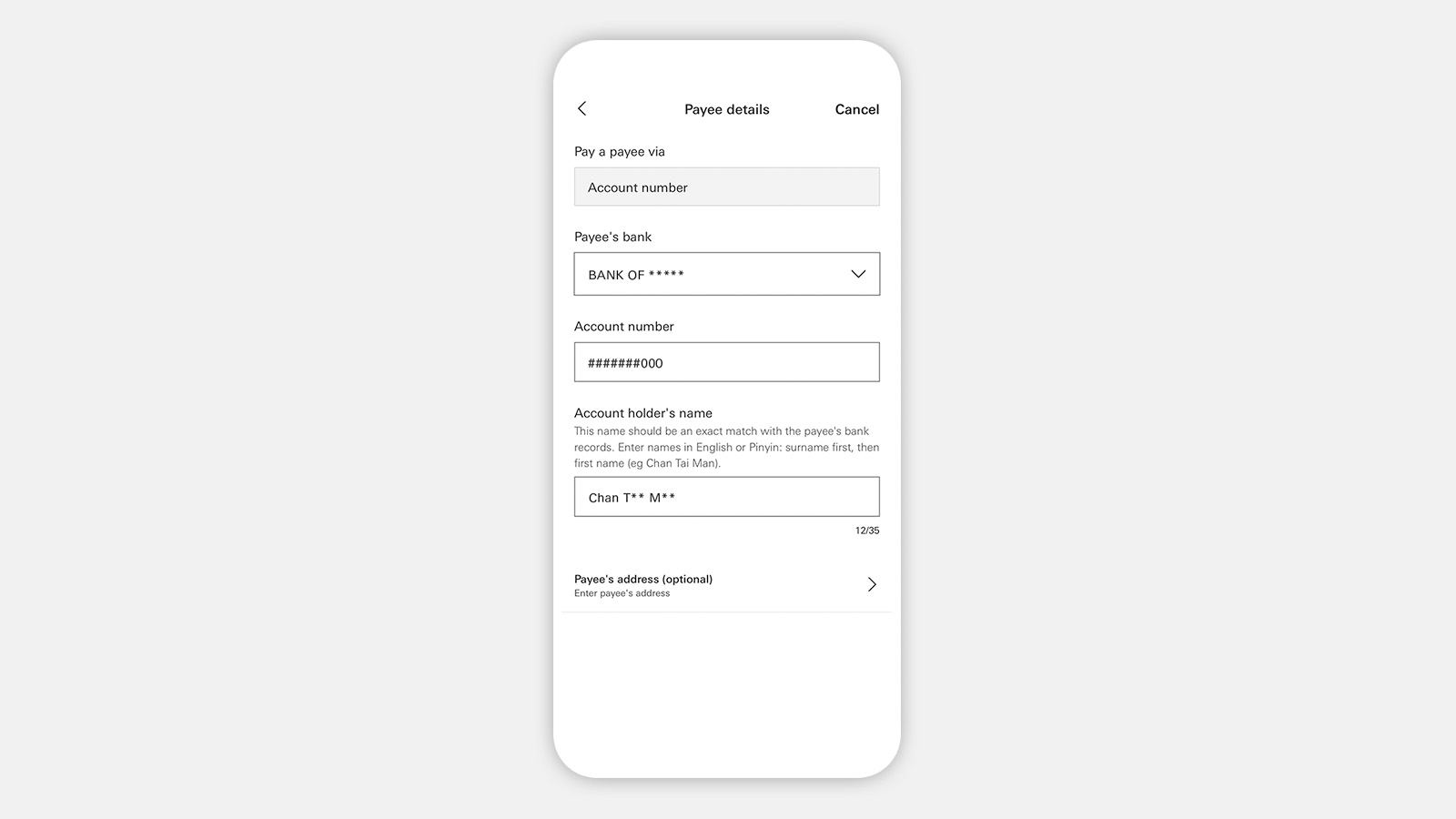

Before you make a transfer to a payee in mainland China, please make sure:

- you enter the 'account holder's name' in English as registered with the payee bank.

- to check the payee's name is as registered with the payee bank, such as whether it is in pinyin or if it includes spaces. Also take note to enter surname first, then the given name.

- the payee's mobile number has been enabled for relevant cross-border transfer services.

How to use FPS x PromptPay QR payment in Thailand

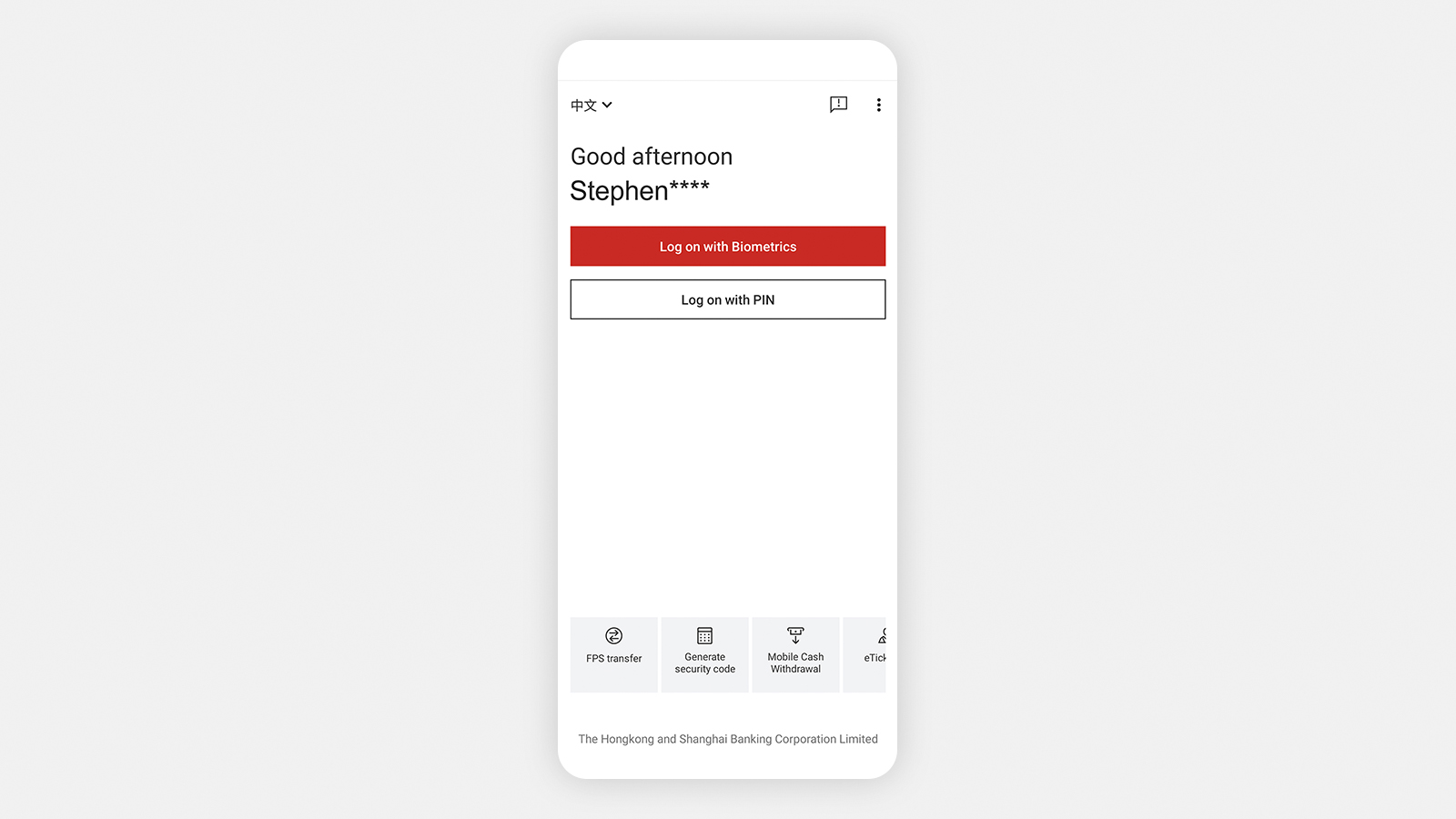

Via the HSBC HK App

Before you can use FPS 'Scan to pay' on HSBC HK App, make sure you've:

- activated your Mobile Security Key

- selected a default debit account

- set up small-value payment limit

If you're an iOS user, make sure you've already enabled your biometric authentication on your device.

Activate your Mobile Security Key or biometric authentication with these easy step-by-step instructions.

Once done, follow the steps below.

How to top up e-CNY wallet

Via the HSBC HK App

Open the e-CNY wallet of your choice to get started.

Download HSBC HK App

One touch and you're in

With the HSBC HK Mobile Banking app (HSBC HK App), you can manage your everyday banking needs anytime, anywhere. Discover a wide range of features and services on the app, and experience an ease of use like never before.