Invest CPI - Capped & Floored Floater Deposit

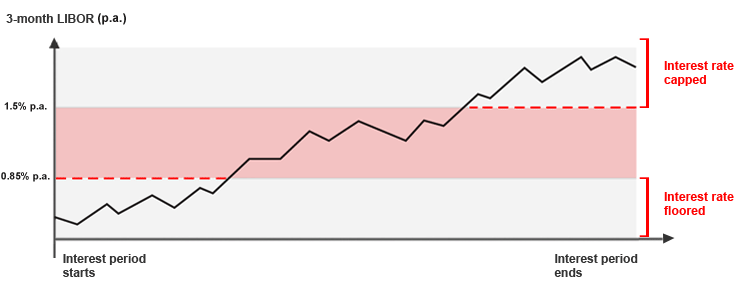

Capital protected investment that offers Periodic interest payment equivalent to the Interest Rate Reference Index, subject to a floor and cap

Features and benefits

If you are looking for:

- Simple and less risky investment

- 100% protection of your capital at maturity while you do not mind to lock up your structured investment deposit for a certain period (e.g. from 2 to 3 years). However, if the Bank becomes insolvent or default on its obligations under this product, you could suffer a total loss of your deposit amount. Please refer to 'Credit risk of the Bank' under Risk for details

- Periodic interest payment linked to an interest rate reference index e.g. HIBOR

Capital Protected Investment Deposit - Capped & Floored Floater Deposit may be your choice.

Product risk level: Low

- Minimal chance of losing a significant portion of your capital over the term of the investment (although this is not guaranteed). Expected to demonstrate minimal price fluctuations over short periods of time.

Trade now

HSBC Personal Internet Banking Users

Don't have an HSBC investment account?

Or visit branch directly to make Structured Product placement.

Need help?

Why Capped & Floored Floater Deposit?

Satisfy your needs

Meet your foreign currency needs such as paying children’s tuition fees, buying a home aboard, or meet your future retirement needs

Capture wealth growth

Offer yield enhancement opportunity to increase your interest

Enhanced potential returns

Offer minimum interest at the interest floor and provide higher potential returns based on the performance of the Interest Rate Reference Index

How to invest/get started with HSBC

Manage your investments online with HSBC

Set up Structured Investment Deposits through HSBC personal Internet Banking

- 24-hour round-the-clock online service to stay up to date with foreign currency market

- Real time market data

How much does it cost?

In general, there are no additional charges on investing Structured Products, all operational, administrative and hedging costs, etc have already been contained and subsumed within the calculation of the return and/or other variables of the Product.