Enrolment to MPF scheme, making contributions and reporting termination and paying the last contributions for casual employees

The HSBC Mandatory Provident Fund - SuperTrust Plus is a master trust scheme. The content on enrolment to MPF scheme, making contributions and reporting termination and paying last contributions for casual employees is explained in the context for the arrangement under master trust scheme. For information on enrolment to industry schemes and its related arrangements for casual employees, please refer to the Mandatory Provident Fund Schemes Authority website at www.mpfa.org.hk.

Table of contents

Enrolment to MPF scheme for casual employees

Casual employees are:

- Aged between 18 and 65

- Engaged in construction or catering industries

- Employed on a day-to-day basis or for a fixed period of less than 60 days

Employers are required to enrol casual employees into an MPF scheme within the 10-day permitted period (first 10 days of employment).

If the last day of the 10-day permitted period falls on a Saturday, public holiday, or gale or black rainstorm signal day, the deadline for enrolment will be extended to the next business day that is not a Saturday, public holiday, or gale or black rainstorm signal day.

Employers who fail to enrol employees into an MPF scheme are liable to a financial penalty and even imprisonment. Visit MPFA's website at www.mpfa.org.hk for details.

Making contributions for casual employees

Employers have to submit contribution details and make contribution payments for casual employees once every payroll cycle (also known as contribution period) in full on or before the relevant contribution day. If casual employees cease employment within 10 days, employers still need to arrange to make contributions for the days worked.

In general, for casual employees who are employed on a day-to-day basis or for a fixed period of less than 60 days, the contributions are to be paid by the employer on or before the 10th day after each contribution period; (or the 10th day after the last day of contribution period in which the 10th day of employment falls if this is a later date).

If the contribution day falls on a Saturday, public holiday, or gale or black rainstorm signal day, the contribution day will be postponed to the next business day which is not a Saturday, public holiday, or gale or black rainstorm signal day.

Employers should be aware that for the purpose of determining the contribution day of the first contributions for new casual employees, the permitted period end date will not be extended even if the last day of the permitted period is a Saturday, public holiday, or gale or black rainstorm signal day.

In calculating the mandatory contributions for casual employees, the amount of mandatory contributions is subject to the minimum and maximum relevant income levels. MPFA reviews the minimum and maximum relevant income levels regularly so please refer to the latest minimum and maximum relevant income levels published on the MPFA website at www.mpfa.org.hk

First contributions for casual employees

Unlike non-casual employees, the contribution holiday is not applicable to casual employees. Both the employers' mandatory contributions and the employees' mandatory contributions shall be payable from the first day of employment. If an employee is working in the same employment for not less than 10 days, the first mandatory contribution should be made on or before the 10th day after the last day of the contribution period in which the permitted period ends.

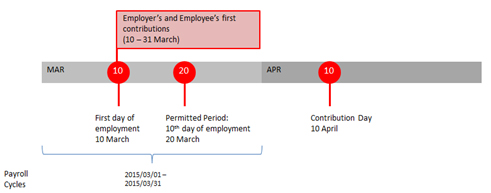

Here's an illustration:

Assumptions 1: Employment exceeds the permitted period

- Payroll cycle is on a monthly basis, starting from the first day to the last day of the month

- A new employee joins on 10 March and the employment period is over the permitted period

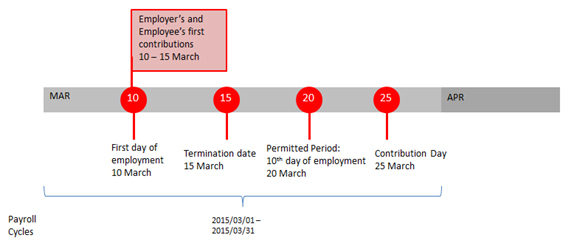

If employees cease employment within the first 10 days, employers still needs to arrange for an enrolment and make contributions for the days worked. The contribution must be made on or before the 10th day after the last day of the first contribution period.

Assumptions 2: Termination within the permitted period

- Payroll cycle is on a monthly basis, starting from the first day to the last day of the month

- A new employee joins on 10 March and ceases employment within the permitted period

Failure to pay mandatory contributions in full and on time to an MPF service provider incurs a 5% surcharge on the outstanding mandatory contributions, along with the possibility of a financial penalty and even imprisonment. Refer to MPFA's website at www.mpfa.org.hk for details.

Reporting termination for casual employees and making last contributions on time

Whenever an employee ceases employment with a company, the employer should report the termination details to the trustee and pay the last contributions on time. For casual employees, employers should notify the trustee within 30 days after the employee's termination.

Besides reporting terminations, employers should make last mandatory contributions on time. Employers and employees are required to make mandatory contributions even if casual employees cease employment within the 'permitted period'. The employers' contribution day for casual employees who cease employment within or after the 'permitted period' may vary. Refer to the below table for an explanation.

| Scenario |

Contribution day (applicable to making the last contributions for casual employees) |

|---|---|

Casual employees who ceased employment within the permitted period |

The 10th day after the end of the relevant contribution period |

Casual employees who ceased employment after the permitted period |

(1) For all contribution periods ending on or before the permitted period (enrolment deadline), the 10th day after the end of the contribution period in which the enrolment deadline falls (2) For all contribution periods ending after the permitted period (enrolment deadline), the 10th day after the end of the relevant contribution period |

If employers plan to set up additional voluntary contributions to employees after enrolling in HSBC MPF scheme, they may submit the 'Additional Voluntary Contribution Application Form'. Please give us at least 1 month notice when specifying the effective date of additional voluntary contributions for us to process your application.